Capital One 2011 Annual Report Download - page 269

Download and view the complete annual report

Please find page 269 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

of loans in the portfolio, or, alternatively, the repurchase of specific mortgage loans to which the alleged breaches

of representations and warranties relate. On March 3, 2010, the Court granted GreenPoint’s motion to dismiss

with respect to plaintiffs Syncora and CIFG and denied the motion with respect to U.S. Bank. In March 2010,

GreenPoint answered the complaint with respect to U.S. Bank, denying the allegations, and filed a counterclaim

against U.S. Bank alleging breach of covenant of good faith and fair dealing. In April 2010, plaintiffs U.S. Bank,

Syncora, and CIFG filed an amended complaint seeking, among other things, the repurchase remedies described

above and indemnification for losses suffered by Syncora and CIFG. GreenPoint filed a motion to dismiss the

amended complaint. In January 2011, the Court instructed plaintiffs to seek leave of court to file an amended

complaint supported by an evidentiary showing of merit. Plaintiffs filed their motion for leave in June 2011,

GreenPoint opposed the motion, and the court heard arguments on the motion in January 2012. As noted above,

GreenPoint has established reserves with respect to its probable and reasonably estimable legal liability from the

U.S. Bank Lawsuit, which reserves are included within the overall representation and warranty reserve. Also as

noted above, GreenPoint has exposure to loss in excess of the amount established within the overall

representation and warranty reserve because GreenPoint has not established reserves with respect to the

portfolio-wide repurchase claim on the basis that the claim is not considered probable and reasonably estimable.

In the event GreenPoint is obligated to repurchase all 30,000 mortgage loans under the portfolio-wide repurchase

claim, GreenPoint would incur the current and future economic losses inherent in the portfolio. With respect to

the mortgage loan portfolio at issue in the U.S. Bank Litigation, we believe approximately $849 million of losses

have been realized and approximately $297 million in mortgage loans are still outstanding, of which

approximately $37 million are more than 90 days delinquent, including foreclosures and REO.

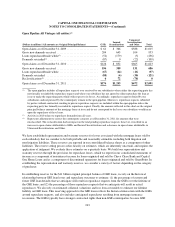

In September 2010, DB Structured Products, Inc. (“DBSP”) named GreenPoint in a third-party complaint, filed

in the New York County Supreme Court, alleging breach of contract and seeking indemnification (the “DBSP

Litigation”). In the underlying suit, Assured Guaranty Municipal Corp. (“AGM”) sued DBSP for alleged

breaches of representations and warranties made by DBSP with respect to certain residential mortgage loans that

collateralize a securitization insured by AGM and sponsored by DBSP (the “Underlying Lawsuit”). DBSP

purchased the HELOC loans from GreenPoint in 2006. The entire securitization is comprised of about 6,200

mortgage loans with an aggregate original principal balance of approximately $353 million. DBSP asserts that

any liability it faces lies with GreenPoint, alleging that DBSP’s representations and warranties to AGM are

substantially similar to the representations and warranties made by GreenPoint to DBSP. GreenPoint filed a

motion to dismiss the complaint in October 2010, which the court denied on July 25, 2011. The parties are

currently engaged in discovery. As noted above, GreenPoint has established reserves with respect to its estimated

probable and reasonable estimable legal liability from the DBSP Litigation, which reserves are included within

the overall representation and warranty reserve. Also as noted above, GreenPoint has not established a reserve

with respect to any portfolio-wide repurchase claim, but in the event GreenPoint is obligated to indemnify DBSP

for the repurchase of all 6,200 mortgage loans, GreenPoint would incur the current and future economic losses

inherent in the securitization. With respect to these loans, we believe approximately $148 million of losses have

been realized and approximately $47 million in mortgage loans are still outstanding, of which approximately $3

million are more than 90 days delinquent, including foreclosures and REO.

SEC Investigation

Since July 2009, we have been providing documents and information in response to an inquiry by the Staff of the

SEC. In the first quarter of 2010, the SEC issued a formal order of investigation with respect to this inquiry.

Although the order, as is generally customary, authorizes a broader inquiry by the Staff, we believe that the

investigation is focused largely on our method of determining the loan loss reserves for our auto finance business

for certain quarterly periods in 2007. We are cooperating fully with the Staff’s investigation.

249