Capital One 2011 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

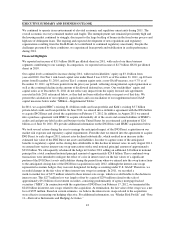

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of financial statements in accordance with U.S. GAAP requires management to make a number

of judgments, estimates and assumptions that affect the reported amount of assets, liabilities, income and

expenses in the consolidated financial statements. Understanding our accounting policies and the extent to which

we use management judgment and estimates in applying these policies is integral to understanding our financial

statements. We provide a summary of our significant accounting policies in “Note 1—Summary of Significant

Accounting Policies.”

We have identified the following accounting policies as critical because they require significant judgments and

assumptions about highly complex and inherently uncertain matters and the use of reasonably different estimates

and assumptions could have a material impact on our reported results of operations or financial condition. These

critical accounting policies govern:

• Loan loss reserves

• Representation and warranty reserve

• Asset impairment

• Fair value

• Derivative and hedge accounting

• Income taxes

We evaluate our critical accounting estimates and judgments on an ongoing basis and update them as necessary

based on changing conditions. Management has reviewed and approved these critical accounting policies and has

discussed these policies with the Audit and Risk Committee of the Board of Directors.

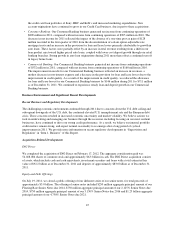

Loan Loss Reserves

We maintain an allowance for loan and lease losses that represents management’s estimate of incurred credit

losses inherent in our held-for investment loan portfolio as of each balance sheet date. We maintain a separate

reserve for the uncollectible portion of billed finance charges and fees on credit card loans.

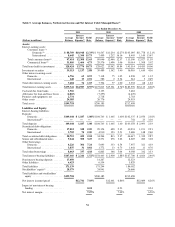

Allowance for Loan and Lease Losses

We have an established process, using analytical tools, benchmarks and management judgment, to determine our

allowance for loan and lease losses. We calculate the allowance for loan and lease losses by estimating incurred

losses for segments of our loan portfolio with similar risk characteristics. The allowance totaled $4.3 billion as of

December 31, 2011, compared with $5.6 billion as of December 31, 2010.

We generally review and assess our allowance methodologies and adequacy of the allowance for loan and lease

losses on a quarterly basis. Our assessment involves evaluating many factors including, but not limited to,

historical loss and recovery experience, recent trends in delinquencies and charge-offs, risk ratings, the impact of

bankruptcy filings, the value of collateral underlying secured loans, account seasoning, changes in our credit

evaluation, underwriting and collection management policies, seasonality, general economic conditions, changes

in the legal and regulatory environment and uncertainties in forecasting and modeling techniques used in

estimating our allowance for loan and lease losses. Key factors that have a significant impact on our allowance

for loan and lease losses include assumptions about unemployment rates, home prices, and the valuation of

commercial properties, consumer real estate, and autos.

Although we examine a variety of externally available data, as well as our internal loan performance data, to

determine our allowance for loan and lease losses, our estimation process is subject to risks and uncertainties,

including a reliance on historical loss and trend information that may not be representative of current conditions

and indicative of future performance. Accordingly, our actual credit loss experience may not be in line with our

expectations. For example, as a result of improving credit performance trends during 2011 and 2010, charge-offs

48