Capital One 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

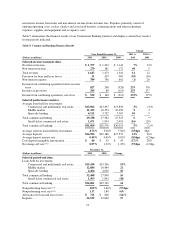

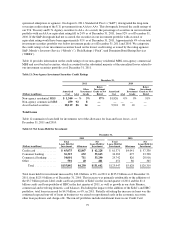

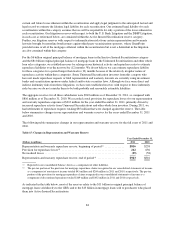

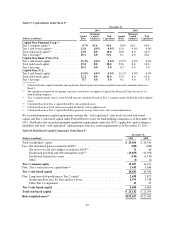

(1) The open pipeline includes all repurchase requests ever received by our subsidiaries where either the requesting party has

not formally rescinded the repurchase request and where our subsidiary has not agreed to either repurchase the loan at

issue or make the requesting party whole with respect to its losses. Accordingly, repurchase requests denied by our

subsidiaries and not pursued by the counterparty remain in the open pipeline. Moreover, repurchase requests submitted

by parties without contractual standing to pursue repurchase requests are included within the open pipeline unless the

requesting party has formally rescinded its repurchase request. Finally, the amounts reflected in this chart are the original

principal balance amounts of the mortgage loans at issue and do not correspond to the losses our subsidiary would incur

upon the repurchase of these loans.

(2) Activity in 2010 relates to repurchase demands from all years.

(3) Represents adjustments to correct the counterparty category as of December 31, 2011 for amounts that were

misclassified. The reclassification had no impact on the total pending repurchase requests; however, it resulted in an

increase in open claims attributable to GSEs and Insured Securitizations and a decrease in open claims attributable to

Uninsured Securitizations and Other.

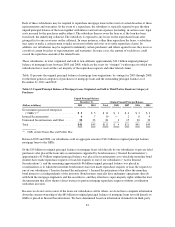

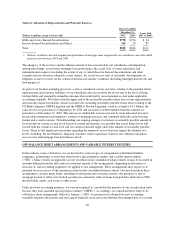

We have established representation and warranty reserves for losses associated with the mortgage loans sold by

each subsidiary that we consider to be both probable and reasonably estimable, including both litigation and

non-litigation liabilities. These reserves are reported in our consolidated balance sheets as a component of other

liabilities. The reserve setting process relies heavily on estimates, which are inherently uncertain, and requires the

application of judgment. We evaluate these estimates on a quarterly basis. We build our representation and

warranty reserves through the provision for repurchase losses, which we report in our consolidated statements of

income as a component of non-interest income for loans originated and sold by Chevy Chase Bank and Capital

One Home Loans and as a component of discontinued operations for loans originated and sold by GreenPoint. In

establishing the representation and warranty reserves, we consider a variety of factors depending on the category

of purchaser.

In establishing reserves for the $11 billion original principal balance of GSE loans, we rely on the historical

relationship between GSE loan losses and repurchase outcomes to estimate: (1) the percentage of current and

future GSE loan defaults that we anticipate will result in repurchase requests from the GSEs over the lifetime of

the GSE loans; and (2) the percentage of those repurchase requests that we anticipate will result in actual

repurchases. We also rely on estimated collateral valuations and loss forecast models to estimate our lifetime

liability on GSE loans. This reserving approach to the GSE loans reflects the historical interaction with the GSEs

around repurchase requests, and also includes anticipated repurchases resulting from mortgage insurance

rescissions. The GSEs typically have stronger contractual rights than non-GSE counterparties because GSE

contracts typically do not contain prompt notice requirements for repurchase requests or materiality

qualifications to the representations and warranties. Moreover, although we often disagree with the GSEs about

the validity of their repurchase requests, we have established a negotiation pattern whereby the GSEs and our

subsidiaries continually negotiate around individual repurchase requests, leading to the GSEs rescinding some

repurchase requests and our subsidiaries agreeing in some cases to repurchase some loans or make the GSEs

whole with respect to losses. Our lifetime representation and warranty reserves with respect to GSE loans are

grounded in this history.

For the $13 billion original principal balance in Active Insured Securitizations, our reserving approach also

reflects our historical interaction with monoline bond insurers around repurchase requests. Typically, monoline

bond insurers allege a very high repurchase rate with respect to the mortgage loans in the Active Insured

Securitization category. In response to these repurchase requests, our subsidiaries typically request information

from the monoline bond insurers demonstrating that the contractual requirements around a valid repurchase

request have been satisfied. In response to these requests for supporting documentation, monoline bond insurers

typically initiate litigation. Accordingly, our reserves within the Active Insured Securitization are not based upon

the historical repurchase rate with monoline bond insurers, but rather upon the expected resolution of litigation

with the monoline bond insurers. Every bond insurer within this category is pursuing a substantially similar

litigation strategy either through active or probable litigation. Accordingly, our representation and warranty

reserves for this category are litigation reserves. In establishing litigation reserves for this category, we consider

83