Capital One 2011 Annual Report Download - page 267

Download and view the complete annual report

Please find page 267 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

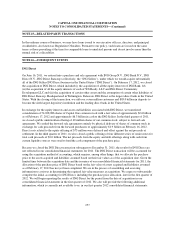

Interchange Lawsuits. As a result, in the first quarter of 2008, we reduced our Visa-related indemnification

liabilities of $91 million recorded in other liabilities with a corresponding reduction of other non-interest

expense. We made an election in accordance with the accounting guidance for fair value option for financial

assets and liabilities on the indemnification guarantee to Visa, and the fair value of the guarantee at

December 31, 2011 and 2010 was zero. In January 2011, we entered into a MasterCard Settlement and Judgment

Sharing Agreement, along with other defendant banks, which apportions between MasterCard and its member

banks any costs and liabilities of any judgment or settlement arising from the Interchange Lawsuits.

In March 2011, a furniture store owner, on behalf of himself and other merchants who accept Visa and

MasterCard branded credit cards, filed a class action in the Supreme Court of British Columbia (Vancouver

Registry) against the Visa and MasterCard membership associations related to credit card interchange fees. In

May 2011, another merchant, on behalf of himself and other merchants who accept Visa and MasterCard branded

credit cards, filed a class action in the Ontario Superior Court of Justice (Toronto Region) asserting the same

alleged violations of law related to credit card interchange fees and network rules. Both class actions name Visa

and MasterCard and a number of member banks, including Capital One Financial Corporation, which only issues

MasterCard branded credit cards in Canada. The class action complaints allege that the associations and member

banks are liable for civil conspiracy, unjust enrichment, constructive trust and unlawful interference with

economic interests and violated Canadian anti-competition laws by (a) conspiring to fix supra-competitive

interchange fees and merchant discounts, and (b) requiring participation in the respective networks and

adherence to Visa and MasterCard Rules to acceptance of payment guarantee services.

Late Fees Litigation

In 2007, a number of individual plaintiffs, each purporting to represent a class of cardholders, filed antitrust

lawsuits in the U.S. District Court for the Northern District of California against several issuing banks, including

us. These lawsuits allege, among other things, that the defendants conspired to fix the level of late fees and over-

limit fees charged to cardholders, and that these fees are excessive. In May 2007, the cases were consolidated for

all purposes, and a consolidated amended complaint was filed alleging violations of federal statutes and state law.

The amended complaint requests civil monetary damages, which could be trebled, and injunctive relief. In

November 2007, the court dismissed the amended complaint. Plaintiffs appealed that order to the Ninth Circuit

Court of Appeals. The plaintiffs’ appeal challenges the dismissal of their claims under the National Bank Act, the

Depository Institutions Deregulation Act of 1980 and the California Unfair Competition Law (the “UCL”), but

not their antitrust conspiracy claims. In June 2009, the Ninth Circuit Court of Appeals stayed the matter pending

the bankruptcy proceedings of one of the defendant financial institutions. On January 4, 2012, the Ninth Circuit

Court of Appeals entered an additional order continuing the stay of the matter pending the bankruptcy

proceedings.

Credit Card Interest Rate Litigation

In July 2010, the U.S. Court of Appeals for the Ninth Circuit reversed a dismissal entered in favor of COBNA in

Rubio v. Capital One Bank, which was filed in the U.S. District Court for the Central District of California in

2007. The plaintiff in Rubio alleges in a putative class action that COBNA breached its contractual obligations

and violated the Truth In Lending Act (the “TILA”) and the UCL when it raised interest rates on certain credit

card accounts. The plaintiff seeks damages, restitution, attorney’s fees and an injunction against future rate

increases. The District Court granted COBNA’s motion to dismiss all claims as a matter of law prior to any

discovery. On appeal, the Ninth Circuit reversed the District Court’s dismissal with respect to the TILA and UCL

claims, remanding the case back to the District Court for further proceedings. The Ninth Circuit upheld the

dismissal of the plaintiff’s breach of contract claim, finding that COBNA was contractually allowed to increase

interest rates. In September 2010, the Ninth Circuit denied COBNA’s Petition for Panel Rehearing and Rehearing

247