Capital One 2011 Annual Report Download - page 65

Download and view the complete annual report

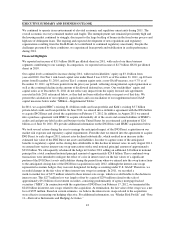

Please find page 65 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the credit card loan portfolios of Sony, HBC and Kohl’s and increased marketing expenditures. New

account originations have continued to grow in our Credit Card business, due in part to these acquisitions.

•Consumer Banking: Our Consumer Banking business generated net income from continuing operations of

$809 million in 2011, compared with net income from continuing operations of $905 million in 2010. The

decrease in net income for 2011 reflected the impact of the absence of a one-time pre-tax gain of $128

million recorded in the first quarter of 2010 from the deconsolidation of certain option-adjustable rate

mortgage trusts and an increase in the provision for loan and lease losses primarily attributable to growth in

auto loans. These factors were partially offset by an increase in total revenue resulting from a shift in our

loan product mix toward higher priced auto loans, coupled with lower cost deposit growth through our retail

banking branches. Strong growth in auto loan originations during 2011 more than offset a continued run-off

in legacy home loans.

•Commercial Banking: Our Commercial Banking business generated net income from continuing operations

of $532 million in 2011, compared with net income from continuing operations of $160 million in 2010.

The improvement in results for our Commercial Banking business reflected an increase in revenues, a

modest decrease in non-interest expense and a decrease in the provision for loan and lease losses due to the

improvement in credit quality. As a result of the improvement in credit quality, we reduced the allowance

for loan and lease losses for our Commercial Banking business by $146 million during 2011 to $711 million

as of December 31, 2011. We continued to experience steady loan and deposit growth in our Commercial

Banking business.

Business Environment and Significant Recent Developments

Recent Business and Regulatory Developments

The challenging economic environment continued through 2011 due to concerns about the U.S. debt ceiling and

subsequent downgrade of the U.S. debt, the continued elevated U.S. unemployment rate and the European debt

crisis. These concerns resulted in increased economic uncertainty and market volatility. We believe actions we

took in underwriting and managing our business through the recession, including focusing on our most resilient

businesses, have continued to drive our strong credit performance. As a result, we believe our internal portfolio

credit metrics remain strong, and expect normal seasonality to re-emerge after a long period of cyclical

improvement in 2011. We provide more information on recent regulatory developments in “Supervision and

Regulation” in “Item 1. Business” of this Report.

Acquisition-Related Developments

ING Direct

We completed the acquisition of ING Direct on February 17, 2012. The aggregate consideration paid was

54,028,086 shares of common stock and approximately $6.3 billion in cash. The ING Direct acquisition consists

of assets, which include cash and cash equivalents, investment securities and loans with a total estimated fair

value of $92.2 billion as of December 31, 2011 and deposits of approximately $83.0 billion as of December 31,

2011.

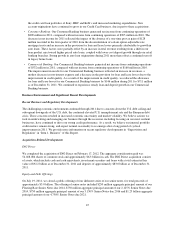

Equity and Debt Offerings

On July 19, 2011, we closed a public offering of four different series of our senior notes, for total proceeds of

approximately $3.0 billion. The offering of senior notes included $250 million aggregate principal amount of our

Floating Rate Senior Notes due 2014, $750 million aggregate principal amount of our 2.125% Senior Notes due

2014, $750 million aggregate principal amount of our 3.150% Senior Notes due 2016 and $1.25 billion aggregate

principal amount of our 4.750% Senior Notes due 2021.

45