Capital One 2011 Annual Report Download - page 277

Download and view the complete annual report

Please find page 277 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

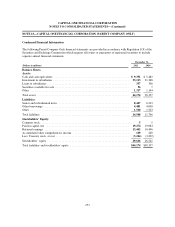

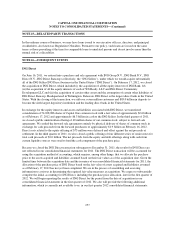

NOTE 25—RELATED PARTY TRANSACTIONS

In the ordinary course of business, we may have loans issued to our executive officers, directors, and principal

stockholders, also known as Regulation O Insiders. Pursuant to our policy, such loans are issued on the same

terms as those prevailing at the time for comparable loans to unrelated persons and do not involve more than the

normal risk of collectability.

NOTE 26—SUBSEQUENT EVENTS

ING Direct

On June 16, 2011, we entered into a purchase and sale agreement with ING Groep N.V., ING Bank N.V., ING

Direct N.V., ING Direct Bancorp (collectively, the “ING Sellers”), under which we would acquire substantially

all of the ING Sellers ING Direct business in the United States (“ING Direct”). On February 17, 2012, we closed

the acquisition of ING Direct, which included (i) the acquisition of all the equity interests of ING Bank, fsb,

(ii) the acquisition of all the equity interests of each of WS Realty, LLC and ING Direct Community

Development LLC and (iii) the acquisition of certain other assets and the assumption of certain other liabilities of

ING Direct Bancorp. Headquartered in Wilmington, Delaware, ING Direct is the largest direct bank in the United

States. With the closing of the transaction, we add over seven million customers and $83.0 billion in deposits to

become the sixth largest depository institution and the leading direct bank in the United States.

In exchange for the equity interests and assets and liabilities associated with ING Direct, we transferred

consideration of 54,028,086 shares of Capital One common stock with a fair value of approximately $2.6 billion

as of February 17, 2012 and approximately $6.3 billion in cash to the ING Sellers. In the third quarter of 2011,

we closed a public underwritten offering of 40 million shares of our common stock, subject to forward sale

agreements. We settled the forward sale agreements entirely by physical delivery of shares of common stock in

exchange for cash proceeds from the forward purchasers of approximately $1.9 billion on February 16, 2012.

Direct costs related to the equity offering of $73 million were deferred and offset against the net proceeds at

settlement. In the third quarter of 2011, we also closed a public offering of four different series of senior notes for

total cash proceeds of $3.0 billion. The net proceeds from the equity and debt offerings along with cash from

current liquidity sources were used to fund the cash component of the purchase price.

Because we closed the ING Direct transaction subsequent to December 31, 2011, the results for ING Direct are

not reflected in our consolidated financial statements for 2011. The ING Direct transaction will be accounted for

using the acquisition method of accounting, which requires, among other things, that we allocate the purchase

price to the assets acquired and liabilities assumed based on their fair values as of the acquisition date. Given the

limited time between the acquisition date and the issuance of our consolidated financial statements for 2011, the

allocation of the purchase price of ING Direct based on the fair value of assets acquired and liabilities assumed

as of February 17, 2012 has not yet been completed. We are in the process of assembling and assessing

information to assist us in determining the required fair value measures at acquisition. We expect to substantially

complete the initial accounting for ING Direct, including the purchase price allocation, later in the first quarter of

2012. We will begin reporting the results of ING Direct for the period from the date of acquisition in our

consolidated financial statements in the first quarter of 2012. We also will provide the following additional

information, which is currently not available to us, in our first quarter 2012 consolidated financial statements:

257