Capital One 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.underwriting, using what we deem to be conservative assumptions. In unsecured consumer loan underwriting, we

generally assume that loans will be subject to an environment in which losses are significantly higher than those

prevailing at the time of underwriting. In commercial underwriting, we generally require strong cash flow,

collateral and covenants and guarantees. In addition to sound underwriting, we continually monitor our portfolio

and take steps to collect or work out distressed loans.

Third, we recognize that compliance is becoming more complex and that regulatory and consumer expectations

are rising. In the aftermath of the financial crisis, new rules and regulations were and continue to be promulgated

and a new agency was created, the Consumer Financial Protection Bureau, to increase focus on consumer

protection. In response, we have been and will continue to expand the scope and intensity of our compliance

activities including developing requirements, approving new products, establishing procedures and controls,

training staff and testing the effectiveness of business controls and the overall program.

Fourth, we recognize that reputational risk is of particular concern for financial institutions as a result of the

aftermath of the recent financial crisis and economic downturn, which has resulted in increased regulation and

widespread regulatory changes. Consequently, our Chief Executive Officer and executive team manage both

tactical and strategic reputation issues and build our relationships with the government, media and other

constituencies to help strengthen the reputations of both our company and industry. Our actions include taking

public positions in support of better consumer practices in our industry and, where possible, unilaterally

implementing those practices in our business.

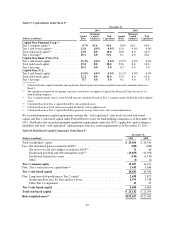

Finally, we recognize that maintaining a strong capital position is essential to our business strategy and

competitive position. We also recognize that regulatory and market expectations for the amount and quality of

capital are rising. Understanding and managing risks to our capital position is an underlying objective of all our

risk programs. Stress testing and economic capital measurement, both of which incorporate inputs from across

the risk spectrum, are key tools for evaluating our capital position and risk adjusted returns. We also consider

risks to our reputation and to our ability to access capital markets as part of our process for evaluating our capital

plans. See “MD&A—Capital Management” for additional information on our capital adequacy and strength.

Risk Management Roles and Responsibilities

The Board of Directors is responsible for establishing our overall risk framework, approving and overseeing

execution of the Enterprise Risk Management Policy and key risk category policies, establishing our risk

appetite, and regularly reviewing our risk profile.

The Chief Risk Officer, who reports to the Chief Executive Officer, is responsible for overseeing our risk

management program and driving appropriate action to resolve any weaknesses. The risk management program

begins with a set of policies and risk appetites approved by the Board that are implemented through a system of

risk committees and senior executive risk stewards. We have established risk committees at both the corporate

and divisional level to identify and manage risk. In addition, we have assigned a senior executive expert to each

of eight risk categories. We refer to these experts as risk stewards. These executive risk stewards work with the

Chief Risk Officer and the risk committees to identify and report risks, develop mitigation plans and controls and

remediate issues. The Chief Risk Officer aggregates the results of these processes to assemble a view of our risk

profile. Both management and the Board of Directors regularly review the risk profile.

Risk Management Framework

We use a consistent risk management framework to manage risk. This framework applies at all levels, from the

development of the Enterprise Risk Management Program itself to the tactical operations of the front-line

business team. Our risk management framework, which is built around governance, processes and people,

consists of the following six key elements:

91