Capital One 2011 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298

|

|

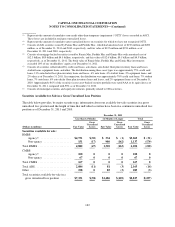

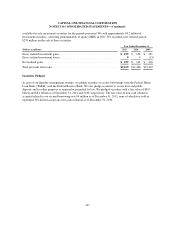

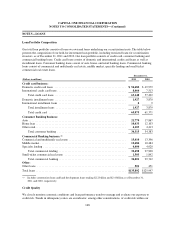

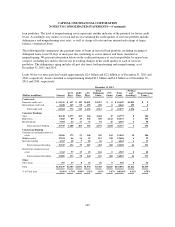

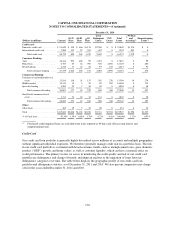

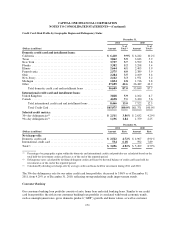

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

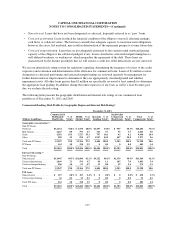

December 31, 2010

(Dollars in millions) Current

30-59

Days

60-89

Days

> 90

Days

Total

Delinquent

Loans

PCI

Loans

Total

Loans

> 90 Days

and

Accruing(1)

Nonperforming

Loans(1)

Credit card:

Domestic credit card ............ $ 51,649 $ 558 $ 466 $1,176 $2,200 $ 0 $ 53,849 $1,176 $ 0

International credit card .......... 7,090 132 97 203 432 0 7,522 203 0

Total credit card ............ 58,739 690 563 1,379 2,632 0 61,371 1,379 0

Consumer Banking:

Auto ......................... 16,414 952 402 99 1,453 0 17,867 0 99

Home loan .................... 6,707 65 44 395 504 4,892 12,103 0 486

Retail banking ................. 4,218 31 22 40 93 102 4,413 5 91

Total consumer banking ...... 27,339 1,048 468 534 2,050 4,994 34,383 5 676

Commercial Banking:

Commercial and multifamily real

estate ....................... 12,816 118 31 153 302 278 13,396 14 276

Middle market ................. 10,113 34 5 50 89 282 10,484 0 133

Specialty lending ............... 3,962 25 7 26 58 0 4,020 0 48

Total commercial lending .... 26,891 177 43 229 449 560 27,900 14 457

Small-ticket commercial real

estate ....................... 1,711 74 24 33 131 0 1,842 0 38

Total commercial banking .... 28,602 251 67 262 580 560 29,742 14 495

Other:

Other loans .................... 382 19 5 45 69 0 451 0 54

Total ......................... $115,062 $2,008 $1,103 $2,220 $5,331 $5,554 $125,947 $1,398 $1,225

% of Total loans ................ 91.36% 1.59% 0.88% 1.76% 4.23% 4.41% 100.00% 1.11% 0.97%

(1) Purchased credit-impaired loans are excluded from loans reported as 90 days and still accruing interest and

nonperforming loans.

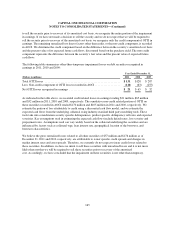

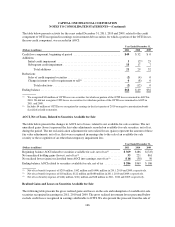

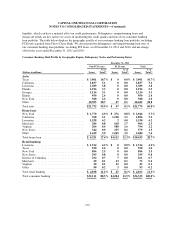

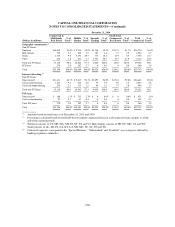

Credit Card

Our credit card loan portfolio is generally highly diversified across millions of accounts and multiple geographies

without significant individual exposures. We therefore generally manage credit risk on a portfolio basis. The risk

in our credit card portfolio is correlated with broad economic trends, such as unemployment rates, gross domestic

product (“GDP”) growth, and home values, as well as customer liquidity, which can have a material effect on

credit performance. The primary factors we assess in monitoring the credit quality and risk of our credit card

portfolio are delinquency and charge-off trends, including an analysis of the migration of loans between

delinquency categories over time. The table below displays the geographic profile of our credit card loan

portfolio and delinquency statistics as of December 31, 2011 and 2010. We also present comparative net-charge

offs for the years ended December 31, 2011 and 2010.

170