Capital One 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.determined as the excess of the fair value of the consideration transferred, plus the fair value of any

noncontrolling interests in the acquiree, over the fair value of the net assets acquired and liabilities assumed as of

the acquisition date. We had goodwill of $13.6 billion recorded on our consolidated balance sheets as of

December 31, 2011 and 2010, respectively. Other intangible assets consist primarily of core deposit intangibles.

Other intangible assets, which we report on our consolidated balance sheets as a component of other assets,

totaled $610 million and $733 million as of December 31, 2011 and 2010, respectively. Goodwill and other

intangible assets together represented 7% of our total assets as of December 31, 2011 and 2010.

Goodwill is not amortized but must be allocated to reporting units and tested for impairment on an annual basis

or in interim periods if events or circumstances indicate potential impairment. A reporting unit is a business

segment or one level below. Our reporting units for purposes of goodwill impairment testing are Domestic Card,

International Card, Auto Finance, other Consumer Banking and Commercial Banking. We perform our annual

goodwill impairment test for all reporting units as of October 1 each year using a two-step process. First, we

compare the fair value of each reporting unit to its current carrying amount, including goodwill. If the fair value

of the reporting unit is in excess of the carrying value, the related goodwill is considered not to be impaired and

no further analysis is necessary. If, however, the carrying value of the reporting unit exceeds the fair value, there

is an indication of potential impairment and a second step of testing is performed to measure the amount of

impairment, if any, for that reporting unit.

Estimating the fair value of reporting units and the assets, liabilities and intangible assets of a reporting unit is a

subjective process that involves the use of estimates and judgments, particularly related to cash flows, the

appropriate discount rates and an applicable control premium. Management judgment is required to assess

whether the carrying value of the reporting unit can be supported by the fair value of the individual reporting

unit. There are widely accepted valuation methodologies, such as the market approach (earnings multiples and/or

transaction multiples) and/or discounted cash flow methods, that are used to estimate the fair value of reporting

units. In applying these methodologies, we utilize a number of factors, including actual operating results, future

business plans, economic projections, and market data. We also may engage an independent valuation specialist

to assist in our valuation process.

In estimating the fair value of the reporting units in step one of the goodwill impairment analyses, fair values can

be sensitive to changes in the projected cash flows and assumptions. In some instances, minor changes in the

assumptions could impact whether the fair value of a reporting unit is greater than its carrying amount.

Furthermore, a prolonged decrease or increase in a particular assumption could eventually lead to the fair value

of a reporting unit being less than its carrying amount. Also, to the extent step two of the goodwill analyses is

required, changes in the estimated fair values of individual assets and liabilities may impact other estimates of

fair value for assets or liabilities and result in a different amount of implied goodwill, and ultimately the amount

of goodwill impairment, if any.

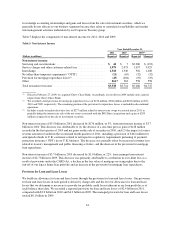

In conducting our goodwill impairment test for 2011, we determined the fair value of our reporting units using a

discounted cash flow analysis, a form of the income approach. Our discounted cash flow analysis required

management to make judgments about future loan and deposit growth, revenue growth, credit losses, and capital

rates. We relied on each reporting unit’s internal cash flow forecast and calculated a terminal value using a

growth rate that reflected the nominal growth rate of the economy as a whole and appropriate discount rates for

the respective reporting units. We adjusted cash flows as necessary to maintain each reporting unit’s equity

capital requirements. The cash flows were discounted to present value using reporting unit specific discount rates

that were largely based on our external cost of equity, adjusted for risks inherent in each reporting unit. We

corroborated the key inputs used in our discounted cash flow analysis with market data, where available, to

validate that our assumptions were within a reasonable range of observable market data.

Based on the results of step one of our 2011 goodwill impairment test, we determined that the fair value of each

of our reporting units, including goodwill, significantly exceeded the carrying value for each reporting unit. Fair

value as a percentage of carrying value for our five reporting units ranged from 118% to 243%, with the

51