Capital One 2013 Annual Report Download - page 94

Download and view the complete annual report

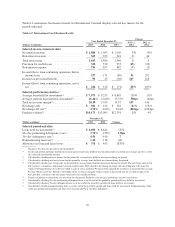

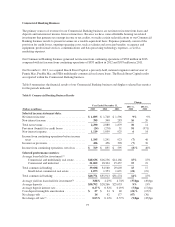

Please find page 94 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.•Loans Held for Investment: Period-end loans held for investment in our Consumer Banking business

declined by $4.4 billion, or 6%, in 2013, to $70.8 billion as of December 31, 2013, due to the continued

expected run-off of acquired home loans, partially offset by higher period-end auto loan balances due to the

continued high volume of auto loan originations.

•Deposits: Period-end deposits in our Consumer Banking business declined by $4.7 billion, or 3%, in 2013 to

$167.7 billion as of December 31, 2013, primarily due to the expected run-off of our legacy National Direct

Bank deposits.

•Charge-off and Delinquency Statistics: The reported net charge-off rate increased to 0.85% in 2013, from

0.74% in 2012. The 30+ day delinquency rate increased to 3.89% as of December 31, 2013, from 3.34% as

of December 31, 2012. The increase in the net charge-off rates reflect moderately higher auto loan charge-

offs, partially offset by improved home loan performance. The overall delinquency rates increased

moderately largely due to the run-off of the acquired home loans, which were included in the denominator

in calculating the delinquency rates.

Key factors affecting the results of our Consumer Banking business for 2012, compared with 2011, and changes

in financial condition and credit performance between December 31, 2012 and December 31, 2011 include the

following:

•Net Interest Income: Net interest income increased by $1.6 billion, or 37%, in 2012. The increase was

primarily attributable to the addition of home loans from the ING Direct acquisition, continued growth and

strong margin performance in our auto loan portfolio and the addition of low-rate deposits from the ING

Direct acquisition. With the addition of deposits from ING Direct, average deposits increased to $162.6

billion in 2012, from $86.9 billion in 2011, while the average deposit interest rate fell to 0.70% in 2012,

from 0.96% in 2011. The favorable impact from these items was modestly offset by the expected run-off of

acquired home loans.

•Non-Interest Income: Non-interest income increased by $62 million, or 9%, in 2012. The increase was

primarily attributable to mark-to-market gains on retained interests in interest-only strips and negative

amortization mortgage securities recognized in the third quarter of 2012.

•Provision for Credit Losses: The provision for credit losses increased by $137 million in 2012 to

$589 million. The increase was largely due to higher auto loan balances, which more than offset the benefit

from lower net charge-off rates and continued credit performance improvement. We recorded an allowance

build of $59 million in 2012, compared with an allowance release of $23 million in 2011.

•Non-Interest Expense: Non-interest expense increased by $627 million, or 19%, in 2012. The increase was

largely attributable to operating expenses related to ING Direct, merger-related expenses associated with the

acquisition and higher infrastructure expenditures resulting from continued investments in the home loan

business and growth in auto loan balances as a result of increased auto loan originations.

•Loans Held for Investment: Period-end loans in the Consumer Banking business increased by $38.8 billion,

or 107%, in 2012 to $75.1 billion as of December 31, 2012, primarily due to the acquisition of $40.4 billion

of ING Direct home loans and growth in auto loan originations, which were partially offset by the expected

continued run-off of our acquired home loan portfolios.

•Deposits: Period-end deposits in the Consumer Banking business increased by $83.9 billion, or 95%, in

2012 to $172.4 billion as of December 31, 2012, primarily due to the addition of ING Direct deposits of

$84.4 billion.

•Charge-off and Delinquency Statistics: The net charge-off rate decreased to 0.74% in 2012, from 1.39% in

2011. The 30+ day delinquency rate decreased to 3.34% as of December 31, 2012, from 5.99% as of

December 31, 2011. The improvement in our reported net charge-off and delinquency rates for our

Consumer Banking business reflects the impact of the addition of the ING Direct home loan portfolio. The

overall improvement in credit quality metrics, excluding Acquired Loans, reflects improved credit

performance in our legacy consumer loan portfolios.

74