Capital One 2013 Annual Report Download - page 214

Download and view the complete annual report

Please find page 214 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

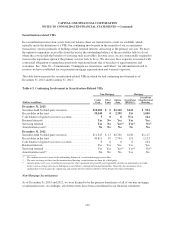

GreenPoint Mortgage Manufactured Housing

We retain the primary obligation for certain provisions of corporate guarantees, recourse sales and clean-up calls

related to the discontinued manufactured housing operations of GreenPoint Credit LLC, which was sold to a third

party in 2004. Although we are the primary obligor, recourse obligations related to aforementioned whole loan

sales, commitments to exercise mandatory clean-up calls on certain securitization transactions and servicing were

transferred to a third party in the sale transaction. We do not consolidate the trusts used for the securitization of

manufactured housing loans because we do not have the power to direct the activities that most significantly

impact the economic performance of the trusts since we no longer service the loans.

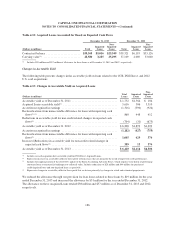

We were required to fund letters of credit in 2004 to cover losses and are obligated to fund future amounts under

swap agreements for certain transactions. We have the right to receive any funds remaining in the letters of credit

after the securities are released. The amount available under the letters of credit was $144 million and

$164 million as of December 31, 2013 and 2012, respectively. The fair value of the expected residual balances on

the funded letters of credit was $43 million and $50 million as of December 31, 2013 and 2012, respectively, and

is included in other assets on the consolidated balance sheets.

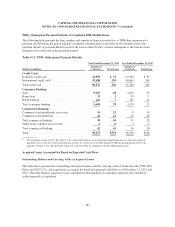

The unpaid principal balance of manufactured housing securitization transactions where we are the residual

interest holder was $1.0 billion and $1.1 billion as of December 31, 2013 and 2012, respectively. In the event the

third party servicer does not fulfill on its obligation to exercise the clean-up calls on certain transactions, the

obligation reverts to us and we would assume approximately $420 million of loans receivable upon our execution

of the clean-up call with the requirement to absorb any losses on the loans receivable.

We monitor the underlying assets for trends in delinquencies and related losses and review the purchaser’s

financial strength as well as servicing performance. These factors are considered in assessing the adequacy of the

liabilities established for these obligations and the valuations of the assets.

Other VIEs

Affordable Housing Entities

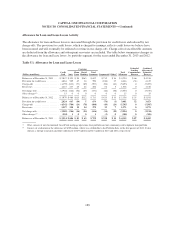

As part of our community reinvestment initiatives, we invest in private investment funds that make equity

investments in multi-family affordable housing properties. We receive affordable housing tax credits for these

investments. The activities of these entities are financed with a combination of invested equity capital and debt.

For those investment funds considered to be VIEs, we are not required to consolidate them if we do not have the

power to direct the activities that most significantly impact the economic performance of those entities. We

record our interests in these unconsolidated VIEs in loans held for investment, other assets and other liabilities on

our consolidated balance sheets. As of December 31, 2013 and 2012 our interests consisted of assets of

approximately $3.1 billion and $2.4 billion, respectively. Our maximum exposure to these entities is limited to

our variable interests in the entities and was $3.1 billion as of December 31, 2013. The creditors of the VIEs have

no recourse to our general credit and we do not provide additional financial or other support during the period

that we were not previously contractually required to provide. The total assets of the unconsolidated investment

funds that were VIEs as of December 31, 2013 and 2012 were approximately $9.9 billion and $7.7 billion,

respectively.

Entities that Provide Capital to Low-Income and Rural Communities

We hold variable interests in entities (“Investor Entities”) that invest in community development entities

(“CDEs”) that provide debt financing to businesses and non-profit entities in low-income and rural communities.

194