Capital One 2013 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302

|

|

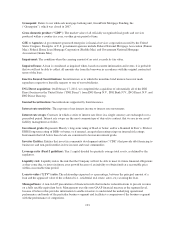

Greenpoint: Refers to our wholesale mortgage banking unit, GreenPoint Mortgage Funding, Inc.

(“Greenpoint”), which was closed in 2007.

Gross domestic product (“GDP”): The market value of all officially recognized final goods and services

produced within a country in a year, or other given period of time.

GSE or Agencies: A government sponsored enterprise is financial services corporation created by the United

States Congress. Examples of U.S. government agencies include Federal National Mortgage Association (Fannie

Mae), Federal Home Loan Mortgage Corporation (Freddie Mac) and Government National Mortgage

Association (Ginnie Mae).

Impairment: The condition when the carrying amount of an asset exceeds its fair value.

Impaired loans: A loan is considered as impaired when, based on current information and events, it is probable

that we will not be able to collect all amounts due from the borrower in accordance with the original contractual

terms of the loan.

Inactive Insured Securitizations: Securitizations as to which the monoline bond insurers have not made

repurchase requests or loan file requests to one of our subsidiaries.

ING Direct acquisition: On February 17, 2012, we completed the acquisition of substantially all of the ING

Direct business in the United States (“ING Direct”) from ING Groep N.V., ING Bank N.V., ING Direct N.V. and

ING Direct Bancorp.

Insured Securitizations: Securitizations supported by bond insurance.

Interest rate sensitivity: The exposure of net interest income to interest rate movements.

Interest rate swaps: Contracts in which a series of interest rate flows in a single currency are exchanged over a

prescribed period. Interest rate swaps are the most common type of derivative contract that we use in our asset/

liability management activities.

Investment grade: Represents Moody’s long-term rating of Baa3 or better; and/or a Standard & Poor’s, Fitch or

DBRS long-term rating of BBB- or better; or if unrated, an equivalent rating using our internal risk ratings.

Instruments that fall below these levels are considered to be non-investment grade.

Investor Entities: Entities that invest in community development entities (“CDE”) that provide debt financing to

businesses and non-profit entities in low-income and rural communities.

Leverage ratio (Basel I guideline): Tier 1 capital divided by quarterly average total assets, as defined by the

regulators.

Liquidity risk: Liquidity risk is the risk that the Company will not be able to meet its future financial obligations

as they come due, or invest in future asset growth because of an inability to obtain funds at a reasonable price

within a reasonable time period

Loan-to-value (“LTV”) ratio: The relationship expressed as a percentage, between the principal amount of a

loan and the appraised value of the collateral (i.e., residential real estate, autos, etc) securing the loan.

Managed basis: A non-GAAP presentation of financial results that includes reclassifications to present revenue

on a fully taxable-equivalent basis. Management uses this non-GAAP financial measure at the segment level,

because it believes this provides information to enable investors to understand the underlying operational

performance and trends of the particular business segment and facilitates a comparison of the business segment

with the performance of competitors.

123