Capital One 2013 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

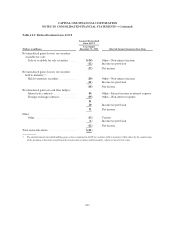

NOTE 10—DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

Use of Derivatives

We manage our asset and liability position and market risk exposure in accordance with prescribed risk

management policies and limits established by our Market and Liquidity Risk Policy which is approved by our

Board of Directors. Our primary market risk stems from the impact on our earnings and economic value of equity

from changes in interest rates, to a lesser extent, changes in foreign exchange rate. We employ several techniques

to manage our interest rate sensitivity, which include changing the duration and re-pricing characteristics of

various assets and liabilities by using interest rate derivatives. Our current asset and liability management policy

also includes the use of derivatives to hedge foreign currency denominated transactions to limit our earnings

exposure to foreign exchange risk. We execute our derivative contracts in both the over-the-counter and

exchange-traded derivative markets. The majority of our derivatives are interest rate swaps. In addition we may

use a variety of other derivative instruments, including caps, floors, options, futures and forward contracts, to

manage our interest rate and foreign exchange risk. We also offer various derivatives to our customers as part of

our commercial banking business but usually offset our exposure through derivative transactions with other

counterparties.

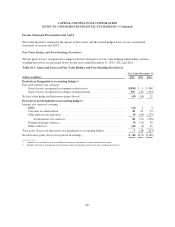

Accounting for Derivatives

Our derivatives are designated as either qualifying accounting hedges or free-standing derivatives. Free-standing

derivatives consist of customer-accommodation derivatives and economic hedges that do not qualify for hedge

accounting. Qualifying accounting hedges are designated as fair value hedges or cash flow hedges.

•Fair Value Hedges: We designate derivatives as fair value hedges to manage our exposure to changes in the

fair value of certain financial assets and liabilities, which fluctuate in value as a result of movements in

interest rates. Changes in the fair value of derivatives designated as fair value hedges are recorded in

earnings together with offsetting changes in the fair value of the hedged item and any resulting

ineffectiveness. Our fair value hedges consist of interest rate swaps that are intended to modify our exposure

to interest rate risk on various fixed rate liabilities.

•Cash Flow Hedges: We designate derivatives as cash flow hedges to manage our exposure to variability in

cash flows related to forecasted transactions. Changes in the fair value of derivatives designated as cash

flow hedges are recorded as a component of AOCI, to the extent that the hedge relationships are effective,

and amounts are reclassified from AOCI to earnings as the forecasted transactions occur. To the extent that

any ineffectiveness exists in the hedge relationships, the amounts are recorded in current period earnings.

Our cash flow hedges consist of interest rate swaps that are intended to hedge the variability in interest

payments on some of our variable rate assets through 2019. These hedges have the effect of converting

some of our variable rate assets to a fixed rate. We also have entered into forward foreign currency

derivative contracts to hedge our exposure to variability in cash flows related to foreign currency

denominated intercompany borrowings.

•Free-Standing Derivatives: We use free-standing derivatives to hedge the risk of changes in the fair value

of residential MSR, mortgage loan origination and purchase commitments and other interests held. We also

categorize our customer-accommodation derivatives and the related offsetting contracts as free-standing

derivatives. Changes in the fair value of free-standing derivatives are recorded in earnings as a component

of other non-interest income.

204