Capital One 2013 Annual Report Download - page 277

Download and view the complete annual report

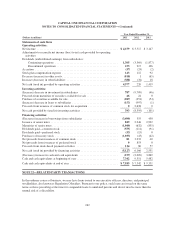

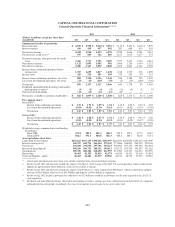

Please find page 277 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(the “FHLB of Boston Litigation”). Capital One Financial Corporation and CONA are named in the complaint as

alleged successors in interest to CCB, which allegedly marketed some of the mortgage-backed securities at issue

in the litigation. The FHLB of Boston seeks rescission, unspecified damages, attorneys’ fees, and other

unspecified relief. The case was removed to the United States District Court for the District of Massachusetts in

May 2011. FHLB of Boston filed an Amended Complaint in June 2012, and the Company’s motion to dismiss

was denied in September 2013.

Checking Account Overdraft Litigation

In May 2010, Capital One Financial Corporation and COBNA were named as defendants in a putative class

action named Steen v. Capital One Financial Corporation, et al., filed in the U.S. District Court for the Eastern

District of Louisiana. Plaintiff challenges practices relating to fees for overdraft and non-sufficient funds fees on

consumer checking accounts. Plaintiff alleges that our methodology for posting transactions to customer accounts

is designed to maximize the generation of overdraft fees, supporting claims for breach of contract, breach of the

covenant of good faith and fair dealing, unconscionability, conversion, unjust enrichment and violations of state

unfair trade practices laws. Plaintiff seeks a range of remedies, including restitution, disgorgement, injunctive

relief, punitive damages and attorneys’ fees. In May 2010, the case was transferred to the Southern District of

Florida for coordinated pre-trial proceedings as part of a multi-district litigation (MDL) involving numerous

defendant banks, captioned In re Checking Account Overdraft Litigation. In January 2011, plaintiffs filed a

second amended complaint against CONA in the MDL court. In February 2011, CONA filed a motion to dismiss

the second amended complaint. In March 2011, the MDL court granted CONA’s motion to dismiss claims of

breach of the covenant of good faith and fair dealing under Texas law, but denied the motion to dismiss in all

other respects. In June 2012, the MDL court granted plaintiff’s motion for class certification. The modified

scheduling order entered by the MDL court contemplates the conclusion of discovery in the second quarter of

2014 and we anticipate a remand to the Eastern District of Louisiana in the third quarter of 2014.

Hawaii, Mississippi, Missouri and New Mexico State Attorney General Payment Protection Matters

In April 2012, the Attorney General of Hawaii filed a lawsuit in First Circuit Court in Hawaii against Capital One

Bank (USA) N.A., and Capital One Services, LLC. The case is one of several similar lawsuits filed by the

Attorney General of Hawaii against various banks challenging the marketing and sale of payment protection and

credit monitoring products. In June 2012, the Attorney General of Mississippi filed substantially similar suits

against Capital One and several other banks. In April 2013, the Attorney General of New Mexico also filed

substantially similar suits against Capital One and several other banks. All three state attorney general complaints

allege that Capital One enrolls customers in such programs without their consent and that Capital One enrolls

customers in such programs in circumstances in which the customer is not eligible to receive benefits for the

product in question. All suits allege unjust enrichment and violation of Unfair and Deceptive Practices Act

statutes. The remedies sought in the lawsuits include an injunction prohibiting the Company from engaging in the

alleged violations, restitution for all persons allegedly injured by the complained of practices, civil penalties and

costs.

In May 2012, Capital One removed the Hawaii AG case to U.S. District Court, District of Hawaii. In November

2012, the court denied the Hawaii AG’s motion to remand. The Hawaii AG petitioned to appeal the District

Court’s decision to the Ninth Circuit Court of Appeals, which was granted by the Ninth Circuit in April 2013.

The District Court case is now stayed pending the appeal.

In August 2012, Capital One removed the Mississippi AG case to the U.S. District Court, Southern District of

Mississippi. In July 2013, the court denied the Mississippi AG’s motion to remand. The Fifth Circuit overturned

the District Court’s denial of the AG’s motion to remand in December 2013, and the case will proceed in state

court.

257