Capital One 2013 Annual Report Download - page 267

Download and view the complete annual report

Please find page 267 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

NOTE 20—COMMITMENTS, CONTINGENCIES, GUARANTEES, AND OTHERS

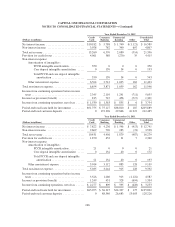

Contingent Payments Related to Acquisitions and Partnership Agreements

Certain of our acquisition and partnership agreements include contingent payment provisions in which we agree

to provide future payments, up to a maximum amount, based on certain performance criteria. Our contingent

payment arrangements are generally based on the difference between the expected credit performance of

specified loan portfolios as of the date of the applicable agreement and the actual future performance. To the

extent that actual losses associated with these portfolios are less than the expected level, we agree to share a

portion of the benefit with the seller. In 2013 we settled all of our existing contingent payment arrangements for

$165 million and as of December 31, 2013, we had no liability for contingent payments related to these

arrangements. Our liability for contingent payments related to these arrangements was $165 million as of

December 31, 2012.

Guarantees

We have credit exposure on agreements that we entered into to absorb a portion of the risk of loss on certain

manufactured housing securitizations issued by GreenPoint Credit LLC in 2000. Our maximum credit exposure

related to these agreements totaled $16 million and $19 million as of December 31, 2013 and 2012, respectively.

These agreements are recorded in our consolidated balance sheets as a component of other liabilities. The value

of our obligations under these agreements was $15 million and $17 million as of December 31, 2013 and 2012,

respectively.

See “Note 6—Variable Interest Entities and Securitizations” for additional information about our manufactured

housing securitization transactions.

Letters of Credit and Loss Sharing Agreements

We issue letters of credit (financial standby, performance standby and commercial) to meet the financing needs

of our customers. Standby letters of credit are conditional commitments issued by us to guarantee the

performance of a customer to a third party in a borrowing arrangement. Commercial letters of credit are

short-term commitments issued primarily to facilitate trade finance activities for customers and are generally

collateralized by the goods being shipped to the client. Collateral requirements are similar to those for funded

transactions and are established based on management’s credit assessment of the customer. Management

conducts regular reviews of all outstanding letters of credit and customer acceptances, and the results of these

reviews are considered in assessing the adequacy of our allowance for loan and lease losses.

On November 1, 2013, we acquired Beech Street Capital, a privately-held, delegated underwriting and servicing

lender (“DUS”) that originates multi-family commercial loans with the intent to sell to a government-sponsored

enterprise (“GSE”). We enter into loss sharing agreements with Fannie Mae upon the sale of the DUS

commercial loans. Under these agreements, losses on the covered loans are shared on a pari passu basis over the

life of the loans. At inception, we record a liability representing the fair value of our obligation which is

subsequently amortized as we are released from risk of payment under the loss sharing agreement. If payment

under the loss sharing agreement becomes probable and estimable, an additional liability may be recorded in the

consolidated balance sheets and a non-interest expense may be recognized in the consolidated statements of

income. The associated MSRs will also be reviewed for impairment annually.

We had standby letters of credit and commercial letters of credit with contractual amounts of $2.0 billion and

$1.9 billion as of December 31, 2013 and 2012, respectively. The carrying value of outstanding letters of credit,

247