Capital One 2013 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

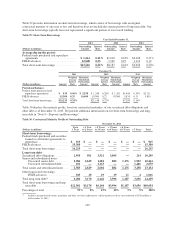

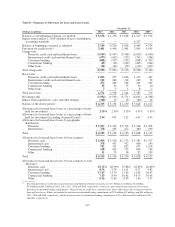

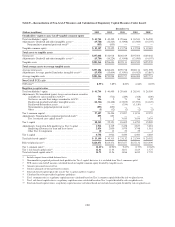

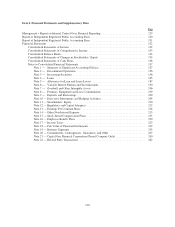

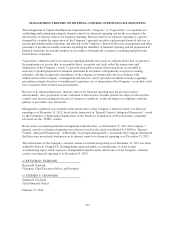

Table E—Summary of Allowance for Loan and Lease Losses

December 31,

(Dollars in millions) 2013 2012 2011 2010 2009

Balance as of beginning of period, as reported. ........... $ 5,156 $ 4,250 $ 5,628 $ 4,127 $ 4,524

Impact from January 1, 2010 adoption of new consolidation

accounting standards .............................. —— — 4,317 —

Balance at beginning of period, as adjusted .............. 5,156 4,250 5,628 8,444 4,524

Provision for credit losses(1) .......................... 3,401 4,446 2,401 3,895 4,145

Charge-offs:

Domestic credit card and installment loans .......... (3,969) (3,507) (3,558) (6,020) (3,050)

International credit card and installment loans ........ (573) (652) (752) (761) (284)

Consumer banking .............................. (888) (797) (732) (898) (1,357)

Commercial banking ............................ (49) (94) (214) (445) (444)

Other loans ................................... (26) (43) (59) (114) (207)

Total charge-offs ................................... (5,505) (5,093) (5,315) (8,238) (5,342)

Recoveries:

Domestic credit card and installment loans .......... 1,065 975 1,036 1,113 447

International credit card and installment loans ........ 192 240 218 169 52

Consumer banking .............................. 272 266 248 243 263

Commercial banking ............................ 35 52 37 54 10

Other loans ................................... 75582

Total recoveries. ................................... 1,571 1,538 1,544 1,587 774

Net charge-offs .................................... (3,934) (3,555) (3,771) (6,651) (4,568)

Impact from acquisitions, sales and other changes ......... (308) 15 (8) (60) 26

Balance at the end of period .......................... $ 4,315 $ 5,156 $ 4,250 $ 5,628 $ 4,127

Allowance for loan and lease losses as a percentage of loans

held for investment ............................... 2.19% 2.50% 3.13% 4.47% 4.55%

Allowance for loan and lease losses as a percentage of loans

held for investment (excluding Acquired Loans) ........ 2.54 3.02 3.22 4.67 4.95

Allowance for loan and lease losses by geographic

distribution:

Domestic ..................................... $ 3,937 $ 4,703 $ 3,778 $ 5,168 $ 3,928

International. .................................. 378 453 472 460 199

Total ............................................ $ 4,315 $ 5,156 $ 4,250 $ 5,628 $ 4,127

Allowance for loan and lease losses by loan category:

Domestic card ................................. $ 2,836 $ 3,526 $ 2,375 $ 3,581 $ 1,927

International card ............................... 378 453 472 460 199

Consumer banking .............................. 752 711 652 675 1,076

Commercial banking ............................ 338 433 715 830 786

Other ........................................ 11 33 36 82 139

Total ............................................ $ 4,315 $ 5,156 $ 4,250 $ 5,628 $ 4,127

Allowance for loan and lease losses by loan category to total

allowance:

Domestic card ................................. 65.72% 68.39% 55.88% 63.63% 46.69%

International card ............................... 8.76 8.78 11.11 8.17 4.82

Consumer banking .............................. 17.43 13.79 15.34 11.99 26.07

Commercial banking ............................ 7.83 8.40 16.82 14.75 19.05

Other ........................................ 0.26 0.64 0.85 1.46 3.37

(1) The total provision for credit losses reported in our consolidated statements of income are $3.5 billion, $4.4 billion, $2.4 billion,

$3.9 billion and $4.2 billion in 2013, 2012, 2011, 2010 and 2009, respectively, consists of a provision for loan and lease losses and a

provision for unfunded lending commitments. The provision for credit losses reported in the above table relates only to the provision for

loan and lease losses. It does not include the provision for unfunded lending commitments of $52 million, $12 million, and $85 million in

2013, 2010 and 2009, respectively, and the provision release for unfunded lending commitments of $31 million and $41 million in 2012

and 2011, respectively.

119