Capital One 2013 Annual Report Download - page 72

Download and view the complete annual report

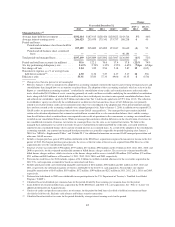

Please find page 72 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Mortgage Servicing Rights

Mortgage servicing rights (“MSR”) are initially recorded at fair value when mortgage loans are sold or

securitized in the secondary market and the right to service these loans is retained for a fee. Subsequently, our

consumer related MSRs are carried at fair value on our consolidated balance sheets with changes in fair value

recognized in non-interest income. Our commercial mortgage related MSRs are subsequently measured under the

amortization method and are periodically evaluated for impairment, which is recognized as a reduction in non-

interest income. See “Note 7—Goodwill and Other Intangible Assets” and “Note 18—Fair Value of Financial

Instruments” for additional information.

Fair Value

Fair value is defined as the price that would be received for an asset or paid to transfer a liability in an orderly

transaction between market participants on the measurement date (also referred to as an exit price). The fair value

accounting guidance provides a three-level fair value hierarchy for classifying financial instruments. This

hierarchy is based on whether the inputs to the valuation techniques used to measure fair value are observable or

unobservable. Fair value measurement of a financial asset or liability is assigned to a level based on the lowest

level of any input that is significant to the fair value measurement in its entirety. The three levels of the fair value

hierarchy are described below:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities

Level 2: Observable market-based inputs, other than quoted prices in active markets for identical assets or

liabilities

Level 3: Unobservable inputs

The degree of management judgment involved in determining the fair value of a financial instrument is

dependent upon the availability of quoted prices in active markets or observable market parameters. When

quoted prices and observable data in active markets are not fully available, management judgment is necessary to

estimate fair value. Changes in market conditions, such as reduced liquidity in the capital markets or changes in

secondary market activities, may reduce the availability and reliability of quoted prices or observable data used

to determine fair value.

We have developed policies and procedures to determine when markets for our financial assets and liabilities are

inactive if the level and volume of activity has declined significantly relative to normal conditions. If markets are

determined to be inactive, it may be appropriate to adjust price quotes received. When significant adjustments are

required to price quotes or inputs, it may be appropriate to utilize an estimate based primarily on unobservable

inputs.

Significant judgment may be required to determine whether certain financial instruments measured at fair value

are included in Level 2 or Level 3. In making this determination, we consider all available information that

market participants use to measure the fair value of the financial instrument, including observable market data,

indications of market liquidity and orderliness, and our understanding of the valuation techniques and significant

inputs used. Based upon the specific facts and circumstances of each instrument or instrument category,

judgments are made regarding the significance of the Level 3 inputs to the instruments’ fair value measurement

in its entirety. If Level 3 inputs are considered significant, the instrument is classified as Level 3. The process for

determining fair value using unobservable inputs is generally more subjective and involves a high degree of

management judgment and assumptions.

Our financial instruments recorded at fair value on a recurring basis represented approximately 14% and 21% of

our total assets as of December 31, 2013 and December 31, 2012, respectively. Financial assets for which the fair

value was determined using significant Level 3 inputs represented approximately 8% and 5% of these financial

instruments as of December 31, 2013 and 2012, respectively.

52