Capital One 2013 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

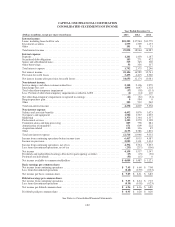

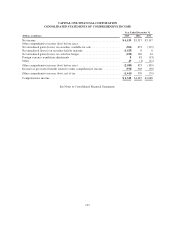

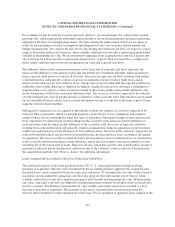

CAPITAL ONE FINANCIAL CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

Year Ended December 31,

(Dollars in millions, except per share-related data) 2013 2012 2011

Interest income:

Loans, including loans held for sale .............................................. $18,222 $17,544 $13,779

Investment securities .......................................................... 1,575 1,329 1,137

Other ...................................................................... 101 91 71

Total interest income .......................................................... 19,898 18,964 14,987

Interest expense:

Deposits .................................................................... 1,241 1,403 1,187

Securitized debt obligations .................................................... 183 271 422

Senior and subordinated notes ................................................... 315 345 300

Other borrowings ............................................................. 53 356 337

Total interest expense ......................................................... 1,792 2,375 2,246

Net interest income ........................................................... 18,106 16,589 12,741

Provision for credit losses ...................................................... 3,453 4,415 2,360

Net interest income after provision for credit losses .................................. 14,653 12,174 10,381

Non-interest income:

Service charges and other customer-related fees .................................... 2,118 2,106 1,979

Interchange fees, net .......................................................... 1,896 1,647 1,318

Total other-than-temporary impairment ........................................... (37) (38) (131)

Less: Portion of other-than-temporary impairment recorded in AOCI .................... (4) (14) 110

Net other-than-temporary impairment recognized in earnings .......................... (41) (52) (21)

Bargain purchase gain ......................................................... 0594 0

Other ...................................................................... 305 512 262

Total non-interest income ...................................................... 4,278 4,807 3,538

Non-interest expense:

Salaries and associate benefits .................................................. 4,432 3,876 3,023

Occupancy and equipment ..................................................... 1,504 1,327 1,025

Marketing .................................................................. 1,373 1,364 1,337

Professional services .......................................................... 1,303 1,270 1,198

Communications and data processing ............................................. 885 778 681

Amortization of intangibles ..................................................... 671 609 222

Acquisition-related ........................................................... 193 336 45

Other ...................................................................... 2,153 2,386 1,801

Total non-interest expense ..................................................... 12,514 11,946 9,332

Income from continuing operations before income taxes .............................. 6,417 5,035 4,587

Income tax provision .......................................................... 2,025 1,301 1,334

Income from continuing operations, net of tax ...................................... 4,392 3,734 3,253

Loss from discontinued operations, net of tax ...................................... (233) (217) (106)

Net income ................................................................. 4,159 3,517 3,147

Dividends and undistributed earnings allocated to participating securities ................ (17) (15) (26)

Preferred stock dividends ...................................................... (53) (15) 0

Net income available to common stockholders ...................................... $ 4,089 $ 3,487 $ 3,121

Basic earnings per common share:

Net income from continuing operations ........................................... $ 7.45 $ 6.60 $ 7.08

Loss from discontinued operations ............................................... (0.40) (0.39) (0.23)

Net income per basic common share .............................................. $ 7.05 $ 6.21 $ 6.85

Diluted earnings per common share:

Net income from continuing operations ........................................... $ 7.35 $ 6.54 $ 7.03

Loss from discontinued operations ............................................... (0.39) (0.38) (0.23)

Net income per diluted common share ............................................ $ 6.96 $ 6.16 $ 6.80

Dividends paid per common share ............................................... $ 0.95 $ 0.20 $ 0.20

See Notes to Consolidated Financial Statements.

132