Capital One 2013 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

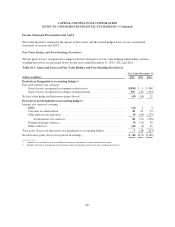

and $109 million as collateral for this exposure in the normal course of business as of December 31, 2013 and

2012, respectively. If our debt credit rating had fallen below investment grade, we would have been required to

post additional variation margin, which represents the impact of daily position mark-to-market calculations, of

less than $1 million and $4 million as of December 31, 2013 and 2012, respectively. In addition, we would have

been required to post independent margin of $58 million and $67 million as of December 31, 2013 and 2012,

respectively, in compliance with the terms of certain of our swap agreements. The fair value of derivative

instruments with credit-risk-related contingent features in a net liability position was less than $1 million and

$7 million as of December 31, 2013 and 2012, respectively.

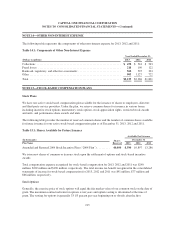

Derivative Counterparty Credit Risk

Derivative instruments contain an element of credit risk that arises from the potential failure of a counterparty to

perform according to the contractual terms of the contract. Our exposure to derivative counterparty credit risk, at

any point in time, is represented by the fair value of derivatives in a gain position, or derivative assets, assuming

no recoveries of underlying collateral. To mitigate the risk of counterparty default, we maintain collateral

agreements with certain derivative counterparties. These agreements typically require both parties to maintain

collateral in the event the fair values of derivative financial instruments exceed established thresholds. We

received cash collateral from derivatives counterparties totaling $397 million and $922 million as of

December 31, 2013 and 2012, respectively. We also received securities from derivatives counterparties totaling

$53 million and $238 million as of December 31, 2013 and 2012, respectively, which we have the ability to

repledge.

We record counterparty credit risk valuation adjustments on our derivative assets to properly reflect the credit

quality of the counterparty. We consider collateral and legally enforceable master netting agreements that

mitigate our credit exposure to each counterparty in determining the counterparty credit risk valuation

adjustment, which may be adjusted in future periods due to changes in the fair value of the derivative contract,

collateral and creditworthiness of the counterparty. The cumulative counterparty credit risk valuation adjustment

recorded on our consolidated balance sheets as a reduction in the derivative asset balance was $7 million and

$9 million as of December 31, 2013 and 2012, respectively. We also adjust the fair value of our derivative

liabilities to reflect the impact of our credit quality. We calculate this adjustment by comparing the spreads on

our credit default swaps to the discount benchmark curve. The cumulative credit risk valuation adjustment related

to our credit quality recorded on our consolidated balance sheets as a reduction in the derivative liability balance

was $6 million and $1 million as of December 31, 2013 and 2012, respectively.

During the second quarter of 2013, it became mandatory for Capital One to clear certain categories of derivative

transactions through a central clearinghouse. We anticipate our cleared derivatives notional and margin amounts

outstanding to grow in the future and expect our bilateral over-the-counter (“OTC”) derivatives portfolio to

shrink as additional categories of derivatives are mandated for clearing by the Commodity Futures Trading

Commission (“CFTC”). As a result, over time, our counterparty credit risk is expected to shift from our bilateral

counterparties and consolidate at central clearinghouses.

209