Capital One 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The market risk positions of our banking entities and our total company are calculated separately and in total and

are reported in comparison to pre-established limits to the Asset Liability Committee monthly and to the Risk

Committee of the Board of Directors no less than quarterly. Management is authorized to utilize financial

instruments as outlined in our policy to actively manage market risk exposure.

Operational Risk Management

We recognize the criticality of managing operational risk on a day-to-day basis and have expanded our approach

to operational risk management based on the growth and complexity of the company. We have appropriate

operational risk management policy, standards, processes and tools to enable the delivery of high quality and

consistent customer and client experiences. The Operational Risk Management Program establishes requirements

and control processes that assure certain consistent practices in the management of operational risk and provides

transparency to the corporate operational risk profile. Operational risk practices are currently being aligned with

Basel II AMA (“Advanced Measurement Approach”) requirements.

Reputation Risk Management

We recognize that reputation risk is of particular concern for financial institutions as a result of the aftermath of

the financial crisis and economic downturn, which has resulted in increased scrutiny and widespread regulatory

changes. We manage both strategic and tactical reputation issues and build our relationships with the

government, media, consumer advocates, and other constituencies to help strengthen the reputations of both our

company and industry. Our actions include implementing pro-consumer practices in our business and taking

public positions in support of better consumer practices in our industry. Day to day activities are controlled by

the frameworks set forth in the Reputation Risk Management Policy and other risk management policies.

Strategic Risk Management

We recognize that maintaining a strong capital position is essential to our business strategy and competitive

position. We also recognize that regulatory and market expectations for the amount and quality of capital are

rising. Understanding and managing risks to our capital position is an underlying objective of all our risk

programs. The Chief Executive Officer develops an overall corporate strategy and leads alignment of our entire

organization with this strategy through the definition of strategic imperatives and top-down communication. The

Chief Executive Officer and other senior executives spend significant time throughout our entire company

sharing our corporate strategy and related business strategies and connecting them to day-to-day associate

activities to enable effective execution.

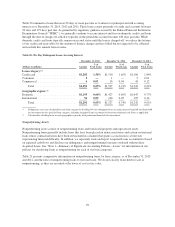

CREDIT RISK PROFILE

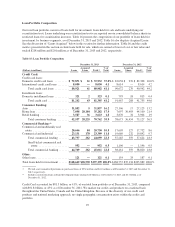

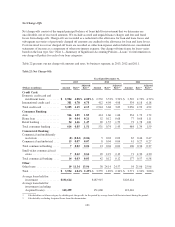

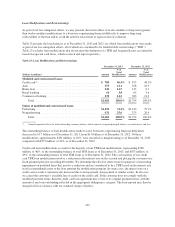

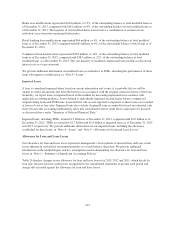

Our loan portfolio accounts for the substantial majority of our credit risk exposure. These activities are also

governed under our credit policy and are subject to independent review and approval. Below we provide

information about the composition of our loan portfolio, key concentrations and credit performance metrics.

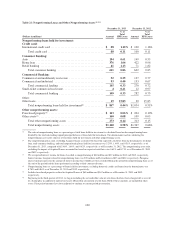

We also engage in certain non-lending activities that may give rise to credit and counterparty settlement risk,

including the purchase of securities for our investment securities portfolio, entering into derivative transactions to

manage our market risk exposure and to accommodate customers, foreign exchange transactions, and customer

overdrafts. We provide additional information on credit risk related to our investment securities portfolio under

“Consolidated Balance Sheets Analysis—Investment Securities” and credit risk related to derivative transactions

in “Note 10—Derivative Instruments and Hedging Activities.”

93