Capital One 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

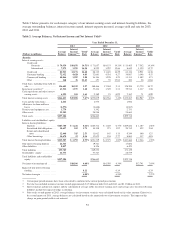

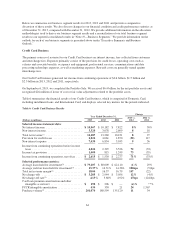

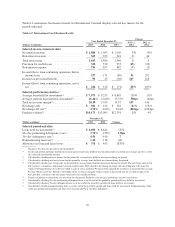

Table 4 displays the components of non-interest income for 2013, 2012 and 2011.

Table 4: Non-Interest Income

Year Ended December 31,

(Dollars in millions) 2013 2012 2011

Service charges and other customer-related fees ........................... $2,118 $2,106 $1,979

Interchange fees, net ................................................. 1,896 1,647 1,318

Bargain purchase gain(1) .............................................. —594 —

Net other-than-temporary impairment ................................... (41) (52) (21)

Other non-interest income:

(Provision) benefit for mortgage representation and warranty(2) ........... 24 (42) (43)

Net gains from the sale of investment securities ....................... 745 259

Net fair value gains (losses) on free-standing derivatives(3)(4) ............. 3(36) (197)

Other(5) ....................................................... 271 545 243

Other non-interest income ............................................ 305 512 262

Total non-interest income ............................................. $4,278 $4,807 $3,538

(1) Represents the amount by which the fair value of the net assets acquired in the ING Direct acquisition, as of the acquisition date

exceeded the consideration transferred.

(2) Represents mortgage representation and warranty provision related to continuing operations. We recorded a total provision for

mortgage representation and warranty losses of $309 million, $349 million and $212 million for 2013, 2012 and 2011, respectively. The

remaining portion of the provision for mortgage representation and warranty losses is included, net of tax, in discontinued operations.

(3) Excludes changes in cumulative credit risk valuation adjustments related to derivatives in a gain position. Credit risk valuation

adjustments for derivative assets totaled $7 million, $9 million and $23 million as of December 31, 2013, 2012 and 2011, respectively.

See “Note 10—Derivative Instruments and Hedging Activities” for additional information.

(4) Includes mark-to-market derivative losses of $78 million and $277 million in 2012 and 2011, respectively, related to interest-rate swaps

we entered into in 2011 to partially hedge the interest rate risk of the net assets associated with the ING Direct acquisition.

(5) Other includes derivative hedge ineffectiveness losses of $43 million and $36 million in 2013 and 2012, respectively, and gains of $15

million in 2011. Other also includes income of $162 million in 2012 related to the sale of Visa stock shares.

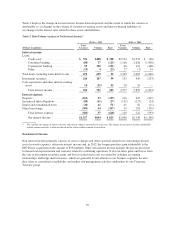

Non-interest income of $4.3 billion in 2013 decreased by $529 million, or 11%, from non-interest income of

$4.8 billion in 2012. The decrease in non-interest income reflected the combined impact of the absence of the

bargain purchase gain of $594 million recognized at acquisition of ING Direct and income of $162 million from

the sale of Visa stock shares, both of which were recorded in 2012. The impact of these items was partially offset

by the favorable impact of increased customer related fees and interchange fees from purchase volume growth,

due in part to the acquisitions, fee based products and services revenue, a reduction in the provision for mortgage

representation and warranty losses and a reduction in fair value losses on free standing derivatives.

Non-interest income of $4.8 billion in 2012 increased by $1.3 billion, or 36%, from non-interest income of

$3.5 billion in 2011. This increase reflected the combined impact of: (i) the bargain purchase gain of $594 million

recorded at acquisition of ING Direct; (ii) increased net interchange and other fees resulting from continued growth

and market share from new account originations, due in part to the ING Direct and the 2012 U.S. card acquisitions;

(iii) income of $162 million from the sale of Visa stock shares in the first quarter of 2012; and (iv) mark-to-market

gains of $85 million recognized on retained interests in mortgage-related securities. The favorable impact of these

items was partially offset by expected customer refunds of approximately $115 million related to cross-sell

activities in our Domestic Card business, approximately $214 million lower net gains from the sale of available for

sale securities recorded in 2012 versus 2011, and a mark-to-market derivative loss of $78 million recognized in the

first quarter of 2012 related to the settlement of interest-rate swaps we entered into in 2011 to partially hedge the

interest rate risk of the net assets associated with the ING Direct acquisition.

60