Capital One 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

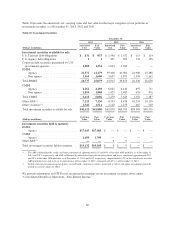

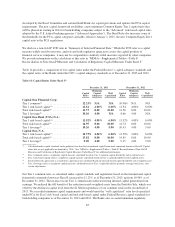

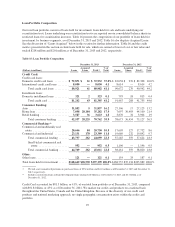

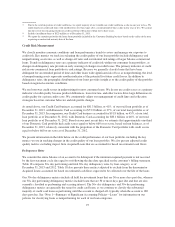

Table 15: Estimated Common Equity Tier 1 Capital Ratio Under Basel III Standardized

December 31, 2013

(Dollars in millions, except ratio) 2014 Phase-In 2015 Phase-In Full Phase-In

Tier 1 common capital under Basel I rules .................... $ 27,487 $ 27,487 $ 27,487

Adjustments related to AOCI for securities available for sale and

defined benefit pension plans(1) ......................... (175) (350) (875)

Adjustments related to PCCR intangible(1) .................. (134) (402) (1,207)

Other adjustments(1)(2) ................................... 305 230 5

Estimated Common Equity Tier 1 capital under Basel III

Standardized ........................................... $ 27,483 $ 26,965 $ 25,410

Risk-weighted assets under Basel I rules ...................... $224,671 $224,671 $224,671

Adjustments for Basel III Standardized(3) ................... 210 7,979 7,805

Estimated risk-weighted assets adjusted for Basel III

Standardized ........................................... $224,881 $232,650 $232,476

Estimated Common Equity Tier 1 capital ratio under Basel III

Standardized(4) ......................................... 12.2% 11.6% 10.9%

(1) Adjustments are phased in at 20% for 2014, at 40% for 2015, and at 100% for 2018 and beyond.

(2) Other adjustments are related to disallowed deferred tax assets from net operating losses and tax credit carry forwards, mortgage

servicing rights and other intangibles net of associated deferred tax liabilities.

(3) Adjustments to Basel I risk weighted assets include higher risk weights for 90 days or more past due exposures, high volatility

commercial real estate, securitization exposures and corresponding adjustments to PCCR intangibles, deferred tax assets and certain

other assets in the calculation of Common Equity Tier 1 capital under Basel III Standardized.

(4) Calculated by dividing Estimated Common Equity Tier 1 capital under Basel III Standardized by estimated risk-weighted assets

adjusted for Basel III Standardized.

With respect to the Basel III Advanced Approaches, we expect to enter the parallel run phase no earlier than

January 1, 2015. We currently anticipate a multi-year parallel run consistent with the experience of other U.S.

banks. By rule, this phase must last at least four consecutive quarters.

Under the Final Rule, when we complete our parallel run for the Advanced Approaches, our minimum risk-based

capital requirement will be the greater requirement of the Basel III Standardized and the Basel III Advanced

Approaches. We anticipate that we will need to hold more regulatory capital under the Basel III Advanced

Approaches than under Basel I or Basel III Standardized to meet our minimum required capital ratios.

Capital Planning and Regulatory Stress Testing

In November 2011, the Federal Reserve finalized capital planning rules applicable to large bank holding

companies like us (commonly referred to as “Comprehensive Capital Analysis and Review” or “CCAR”). Under

the rules, bank holding companies with consolidated assets of $50 billion or more must submit capital plans to

the Federal Reserve on an annual basis and must obtain approval from the Federal Reserve before making most

capital distributions. The purpose of the rules is to ensure that large bank holding companies have robust,

forward-looking capital planning processes that account for their unique risks and capital needs to continue

operations through times of economic and financial stress.

On September 24, 2013, the Federal Reserve released an interim final rule that stated, for the first time, that the

2014 CCAR cycle will require us to meet Basel III Standardized capital requirements, with appropriate phase-in

provisions applicable to Advanced Approaches institutions during the CCAR planning horizon, under the

supervisory severely adverse stress scenario in addition to the capital plan rule’s Tier 1 common ratio using Basel

I definitions. See “Recent Developments in Capital Requirements” above for more information regarding Basel

87