Capital One 2013 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Potential Mortgage Representation & Warranty Liabilities

We acquired three subsidiaries that originated residential mortgage loans and sold them to various purchasers,

including purchasers who created securitization trusts. These subsidiaries are Capital One Home Loans, which

was acquired in February 2005; GreenPoint, which was acquired in December 2006 as part of the North Fork

acquisition; and CCB, which was acquired in February 2009 and subsequently merged into CONA.

We have established representation and warranty reserves for losses associated with the mortgage loans sold by

each subsidiary that we consider to be both probable and reasonably estimable, including both litigation and non-

litigation liabilities. These reserves are reported in our consolidated balance sheets as a component of other

liabilities. The reserve setting process relies heavily on estimates, which are inherently uncertain, and requires the

application of judgment. We evaluate these estimates on a quarterly basis. We build our representation and

warranty reserves through the provision for mortgage representation and warranty losses, which we report in our

consolidated statements of income as a component of non-interest income for loans originated and sold by CCB

and Capital One Home Loans and as a component of discontinued operations for loans originated and sold by

GreenPoint. In establishing the representation and warranty reserves, we consider a variety of factors depending

on the category of purchaser.

The aggregate reserves for all three subsidiaries totaled $1.2 billion as of December 31, 2013, compared with

$899 million as of December 31, 2012.

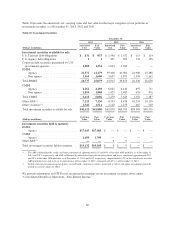

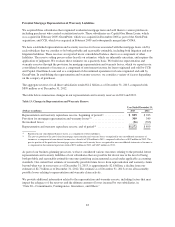

The table below summarizes changes in our representation and warranty reserves in 2013 and 2012.

Table 13: Changes in Representation and Warranty Reserve

Year Ended December 31,

(Dollars in millions) 2013 2012

Representation and warranty repurchase reserve, beginning of period(1) .............. $ 899 $ 943

Provision for mortgage representation and warranty losses(2) ...................... 309 349

Net realized losses ........................................................ (36) (393)

Representation and warranty repurchase reserve, end of period(1) ................... $1,172 $ 899

(1) Reported in our consolidated balance sheets as a component of other liabilities.

(2) The pre-tax portion of the provision for mortgage representation and warranty losses recognized in our consolidated statements of

income as a component of non-interest income was a benefit of $24 million in 2013, compared with a loss of $42 million in 2012. The

pre-tax portion of the provision for mortgage representation and warranty losses recognized in our consolidated statements of income as

a component of discontinued operations totaled $333 million in 2013 and $307 million in 2012.

As part of our business planning processes, we have considered various outcomes relating to the potential future

representation and warranty liabilities of our subsidiaries that are possible but do not rise to the level of being

both probable and reasonably estimable outcomes justifying an incremental accrual under applicable accounting

standards. Our current best estimate of reasonably possible future losses from representation and warranty claims

beyond what was in our reserve as of December 31, 2013, is approximately $2.6 billion, a decline from our

estimate of $2.7 billion as of December 31, 2012. The estimate as of December 31, 2013 covers all reasonably

possible losses relating to representation and warranty claim activity.

We provide additional information related to the representation and warranty reserve, including factors that may

impact the adequacy of the reserves and the ultimate amount of losses incurred by our subsidiaries, in

“Note 20—Commitments, Contingencies, Guarantees, and Others.”

83