Capital One 2013 Annual Report Download - page 269

Download and view the complete annual report

Please find page 269 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

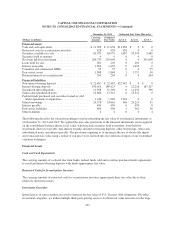

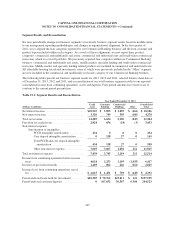

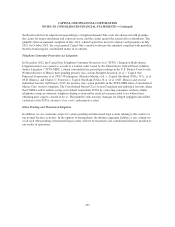

The following table presents the original principal balance of mortgage loan originations, by vintage for 2005

through 2008, for the three general categories of purchasers of mortgage loans and the estimated outstanding

principal balance as of December 31, 2013 and 2012:

Table 20.1: Unpaid Principal Balance of Mortgage Loans Originated and Sold to Third Parties Based on

Category of Purchaser (estimated)

Unpaid Principal Balance

December 31, December 31, Original Unpaid Principal Balance

(Dollars in billions) 2013 2012 Total 2008 2007 2006 2005

Government sponsored enterprises (“GSEs”)(1) .... $3 $4 $11 $1 $4 $3 $3

Insured Securitizations ....................... 55 20 0 2 8 10

Uninsured Securitizations and Other ............ 18 23 80 3 15 30 32

Total ..................................... $26 $32 $111 $4 $21 $41 $45

(1) GSEs include Fannie Mae and Freddie Mac.

Between 2005 and 2008, our subsidiaries sold an aggregate amount of $11 billion in original principal balance

mortgage loans to the GSEs.

Of the $20 billion in original principal balance of mortgage loans sold directly by our subsidiaries to private-label

purchasers who placed the loans into securitizations supported by bond insurance (“Insured Securitizations”),

approximately 48% of the original principal balance was covered by the bond insurance. Further, approximately

$16 billion original principal balance was placed in securitizations as to which the monoline bond insurers have

made repurchase requests or loan file requests to one of our subsidiaries (“Active Insured Securitizations”) and

the remaining approximately $4 billion original principal balance was placed in securitizations as to which the

monoline bond insurers have not made repurchase requests or loan file requests to one of our subsidiaries

(“Inactive Insured Securitizations”). Insured Securitizations often allow the monoline bond insurer to act

independently of the investors. Bond insurers typically have indemnity agreements directly with both the

mortgage originators and the securitizers, and they often have super-majority rights within the trust

documentation that allow them to direct trustees to pursue mortgage repurchase requests without coordination

with other investors.

Because we do not service most of the loans our subsidiaries sold to others, we do not have complete information

about the current ownership of a portion of the $80 billion in original principal balance of mortgage loans not

sold directly to GSEs or placed in Insured Securitizations. We have determined based on information obtained

from third-party databases that about $48 billion original principal balance of these mortgage loans are currently

held by private-label publicly issued securitizations not supported by bond insurance (“Uninsured

Securitizations”). An additional approximately $22 billion original principal balance of mortgage loans were

initially sold to private investors as whole loans. Various known and unknown investors purchased the remaining

$10 billion original principal balance of mortgage loans.

With respect to the $111 billion in original principal balance of mortgage loans originated and sold to others

between 2005 and 2008, we estimate that approximately $26 billion in unpaid principal balance remains

outstanding as of December 31, 2013, of which approximately $6 billion in unpaid principal balance is at least 90

days delinquent. Approximately $20 billion in losses have been realized by third parties. Because we do not

service most of the loans we sold to others, we do not have complete information about the underlying credit

performance levels for some of these mortgage loans. These amounts reflect our best estimates, including

extrapolations of underlying credit performance where necessary. These estimates could change as we get

additional data or refine our analysis.

249