Capital One 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302

|

|

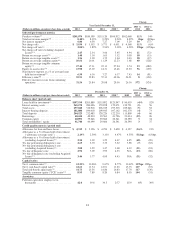

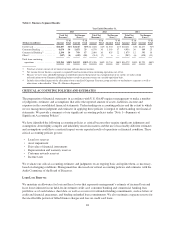

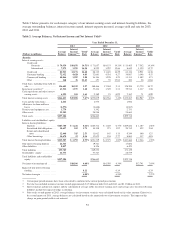

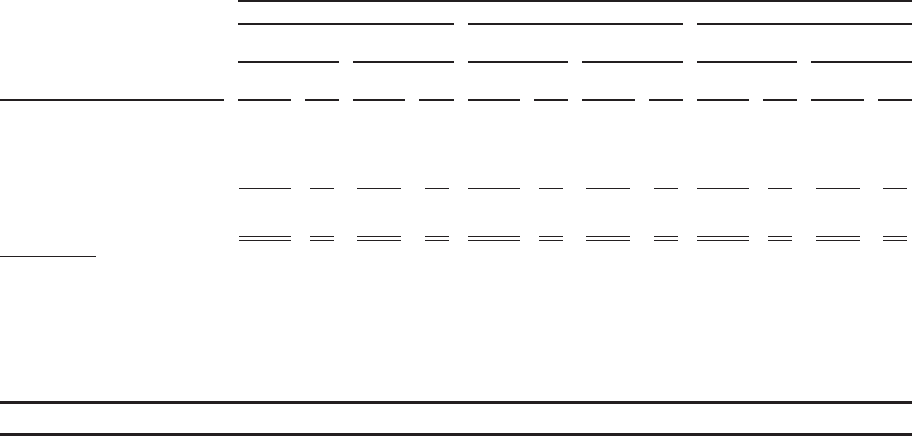

Table 1: Business Segment Results

Year Ended December 31,

2013 2012 2011

Total Net

Revenue(1)

Net Income

(Loss)(2)

Total Net

Revenue(1)

Net Income

(Loss)(2)

Total Net

Revenue(1)

Net Income

(Loss)(2)

(Dollars in millions) Amount

% of

Total Amount

% of

Total Amount

% of

Total Amount

% of

Total Amount

% of

Total Amount

% of

Total

Credit Card .................. $14,287 64% $2,615 60% $13,260 62% $1,530 41% $10,431 64% $2,277 70%

Consumer Banking ............ 6,654 30 1,451 33 6,570 30 1,363 37 4,956 30 809 25

Commercial Banking(3) ......... 2,290 10 769 17 2,080 10 835 22 1,879 12 595 18

Other(4) ..................... (847) (4) (443) (10) (514) (2) 6 — (987) (6) (428) (13)

Total from continuing

operations ................. $22,384 100% $4,392 100% $21,396 100% $3,734 100% $16,279 100% $3,253 100%

(1) Total net revenue consists of net interest income and non-interest income.

(2) Net income for our business segments is reported based on income from continuing operations, net of tax.

(3) Because we have some affordable housing tax-related investments that generate tax-exempt income or tax credits, we make certain

reclassifications to our Commercial Banking business results to present revenues on a taxable-equivalent basis.

(4) Includes the residual impact of the allocation of our centralized Corporate Treasury group activities to our business segments as well as

other items as described in “Note 19—Business Segments”.

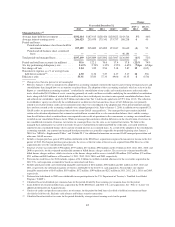

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The preparation of financial statements in accordance with U.S. GAAP requires management to make a number

of judgments, estimates and assumptions that affect the reported amount of assets, liabilities, income and

expenses in the consolidated financial statements. Understanding our accounting policies and the extent to which

we use management judgment and estimates in applying these policies is integral to understanding our financial

statements. We provide a summary of our significant accounting policies under “Note 1—Summary of

Significant Accounting Policies”.

We have identified the following accounting policies as critical because they require significant judgments and

assumptions about highly complex and inherently uncertain matters and the use of reasonably different estimates

and assumptions could have a material impact on our reported results of operations or financial condition. These

critical accounting policies govern:

• Loan loss reserves

• Asset impairment

• Fair value of financial instruments

• Representation and warranty reserves

• Customer rewards reserves

• Income taxes

We evaluate our critical accounting estimates and judgments on an ongoing basis and update them, as necessary,

based on changing conditions. Management has discussed our critical accounting policies and estimates with the

Audit Committee of the Board of Directors.

Loan Loss Reserves

We maintain an allowance for loan and lease losses that represents management’s estimate of incurred loan and

lease losses inherent in our held-for-investment credit card, consumer banking and commercial banking loan

portfolios as of each balance sheet date, as well as a reserve for unfunded lending commitments, such as letters of

credit and financial guarantees, and binding unfunded loan commitments. We also maintain a separate reserve for

the uncollectible portion of billed finance charges and fees on credit card loans.

48