Capital One 2013 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

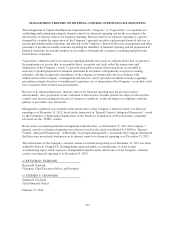

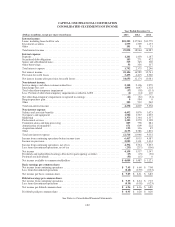

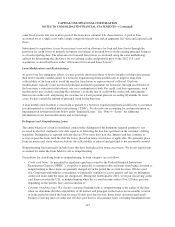

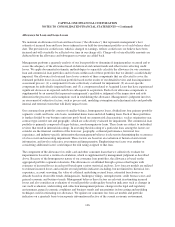

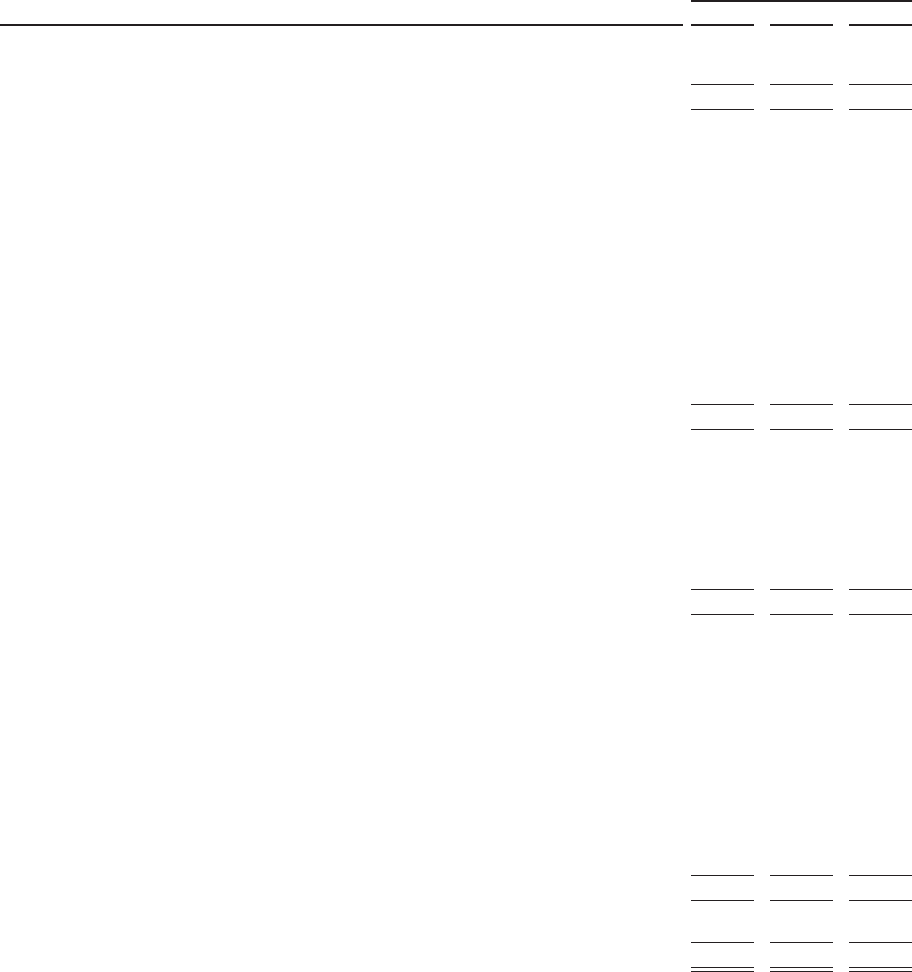

CAPITAL ONE FINANCIAL CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December 31,

(Dollars in millions) 2013 2012 2011

Operating activities:

Income from continuing operations, net of tax ........................................ $ 4,392 $ 3,734 $ 3,253

Loss from discontinued operations, net of tax ......................................... (233) (217) (106)

Net income .................................................................... 4,159 3,517 3,147

Adjustments to reconcile net income to cash provided by operating activities:

Provision for credit losses .................................................... 3,453 4,415 2,360

Depreciation and amortization, net ............................................. 2,065 1,862 579

Net gains on sales of securities available for sale .................................. (7) (45) (259)

Impairment losses on securities available for sale .................................. 41 52 21

Bargain purchase gain ....................................................... 0(594) 0

Loans held for sale: .........................................................

Originations and purchases ............................................... (2,276) (1,699) (1,031)

Gain (losses) on sales .................................................... (32) (58) (28)

Proceeds from sales and paydowns ......................................... 2,469 2,692 1,086

Stock plan compensation expense .............................................. 240 199 189

Changes in operating assets and liabilities, net of effects of acquisitions: ...............

(Increase) decrease in interest receivable ..................................... 276 (495) 41

(Increase) decrease in other assets .......................................... (245) (1,033) (126)

Increase (decrease) in interest payable ....................................... (143) (47) (22)

Increase in other liabilities ................................................ 239 798 1,403

Net cash (used in) provided by discontinued operations ............................. (255) (40) 95

Net cash provided by operating activities ........................................ 9,984 9,524 7,455

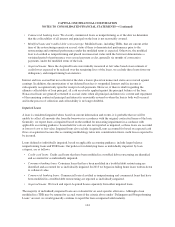

Investing activities:

Purchases of securities ........................................................... (16,062) (29,257) (16,060)

Proceeds from paydowns and maturities of securities ................................... 13,930 17,779 9,710

Proceeds from sales of securities ................................................... 2,539 16,894 9,169

Net increase in loans held for investment ............................................ 2,291 (7,605) (13,777)

Principal recoveries of loans previously charged off .................................... 1,589 1,538 1,543

Additions of premises and equipment ............................................... (818) (560) (315)

Net cash paid for acquisitions ..................................................... (204) (17,603) (1,444)

Net cash provided by other investing activities ........................................ 456 00

Net cash used in investing activities ............................................ 3,721 (18,814) (11,174)

Financing activities:

(Decrease) increase in restricted cash for securitization investors .......................... (446) 363 811

Net increase (decrease) in deposits ................................................. (7,972) (156) 6,010

Issuance of securitized debt obligations .............................................. 2,200 00

Maturities and paydowns of securitized debt obligations ................................ (3,309) (5,129) (10,388)

Issuance of senior and subordinated notes and junior subordinated debt .................... 2,063 2,248 2,992

Redemption of junior subordinated debentures ........................................ (3,641) 00

Maturities and redemptions of senior and subordinate notes .............................. (777) (632) (855)

Net increase (decrease) in other borrowings .......................................... (5,144) 13,819 5,774

Net proceeds from issuances of common stock ........................................ 81 3,233 40

Net proceeds from issuances of preferred stock ....................................... 0853 0

Proceeds from share-based payment activities ........................................ 114 80 57

Dividends paid on common stock .................................................. (555) (111) (91)

Dividends paid on preferred stock .................................................. (53) (15) 0

Purchases of treasury stock ....................................................... (1,033) (43) (42)

Net cash provided by (used in) financing activities ................................. (18,472) 14,510 4,308

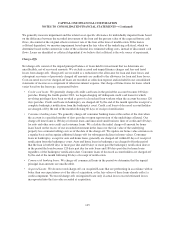

Increase (decrease) in cash and cash equivalents ....................................... (4,767) 5,220 589

Cash and cash equivalents at beginning of the period ................................... 11,058 5,838 5,249

Cash and cash equivalents at end of the period ........................................ $ 6,291 $ 11,058 $ 5,838

Supplemental cash flow information:

Non-cash items:

Fair value of common stock issued in business acquisition ........................... $0$ 2,638 $ 0

Net transfers of loans held for investment to loans held for sale ....................... 6,846 94 0

Transfer from securities available for sale to securities held to maturity ................ 18,275 00

Redemption of senior and subordinated notes ..................................... (1,969) 00

Issuance of senior and subordinated notes ........................................ 1,968 00

Interest paid ................................................................... (1,936) (2,391) (2,267)

Income tax paid ................................................................ (1,721) (1,621) (923)

See Notes to Consolidated Financial Statements.

136