Capital One 2013 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

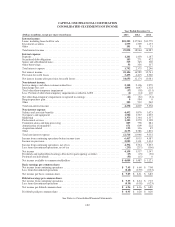

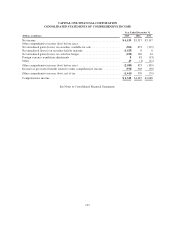

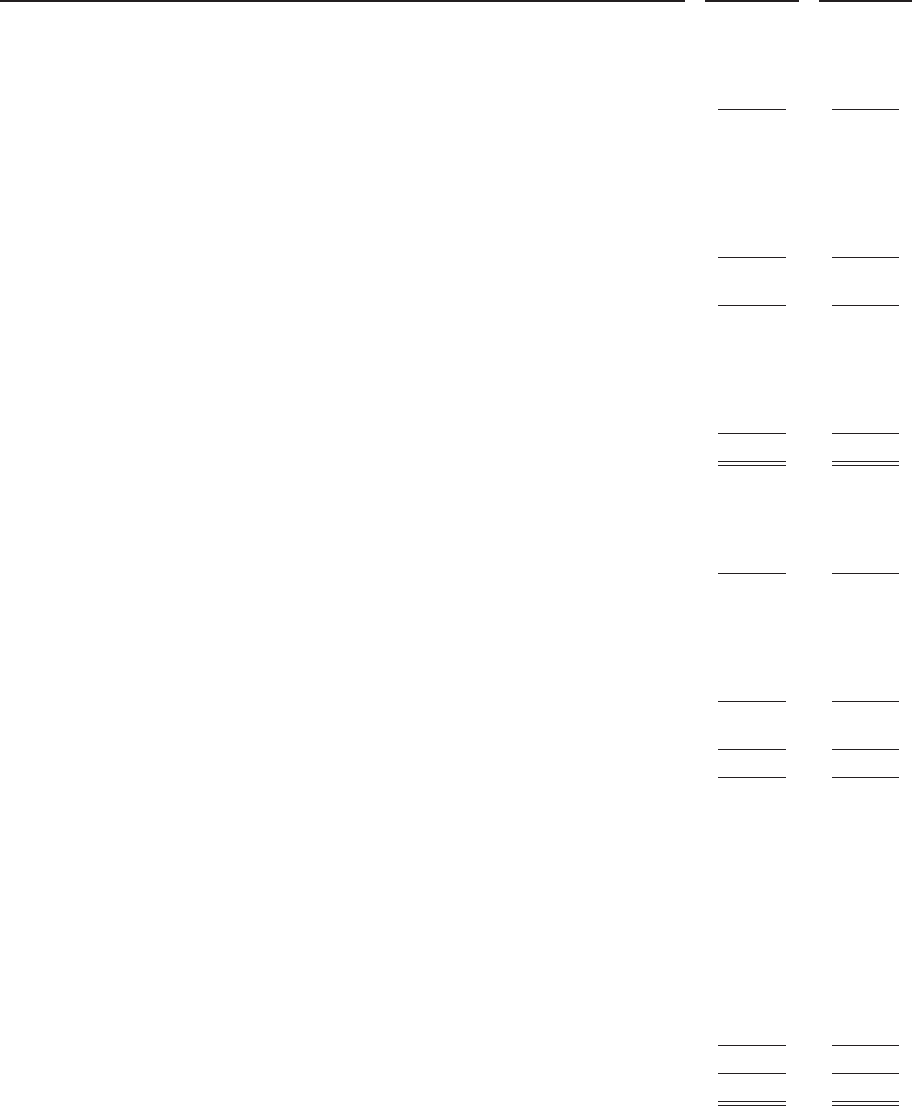

CAPITAL ONE FINANCIAL CORPORATION

CONSOLIDATED BALANCE SHEETS

(Dollars in millions, except per share data)

December 31,

2013

December 31,

2012

Assets:

Cash and cash equivalents:

Cash and due from banks ..................................................... $ 2,821 $ 3,440

Interest-bearing deposits with banks ............................................. 3,131 7,617

Federal funds sold and securities purchased under agreements to resell ................. 339 1

Total cash and cash equivalents .................................................. 6,291 11,058

Restricted cash for securitization investors .......................................... 874 428

Securities available for sale, at fair value ........................................... 41,800 63,979

Securities held to maturity, at carrying value ........................................ 19,132 9

Loans held for investment:

Unsecuritized loans held for investment .......................................... 157,651 162,059

Restricted loans for securitization investors ....................................... 39,548 43,830

Total loans held for investment ................................................... 197,199 205,889

Less: Allowance for loan and lease losses ........................................ (4,315) (5,156)

Net loans held for investment .................................................... 192,884 200,733

Loans held for sale, at lower of cost or fair value ..................................... 218 201

Premises and equipment, net ..................................................... 3,839 3,587

Interest receivable ............................................................. 1,418 1,694

Goodwill .................................................................... 13,978 13,904

Other ....................................................................... 16,614 17,325

Total assets .................................................................. $297,048 $312,918

Liabilities:

Interest payable ............................................................... $ 307 $ 450

Customer deposits:

Non-interest bearing deposits .................................................. 22,643 22,467

Interest bearing deposits ...................................................... 181,880 190,018

Total customer deposits ......................................................... 204,523 212,485

Securitized debt obligations ..................................................... 10,289 11,398

Other debt:

Federal funds purchased and securities loaned or sold under agreements to repurchase ..... 915 1,248

Senior and subordinated notes ................................................. 13,134 12,686

Other borrowings ........................................................... 16,316 24,578

Total other debt ............................................................... 30,365 38,512

Other liabilities ............................................................... 9,820 9,574

Total liabilities ............................................................... 255,304 272,419

Commitments, contingencies and guarantees (see Note 14)

Stockholders’ equity:

Preferred stock, par value $.01 per share; 50,000,000 shares authorized; 875,000 shares issued

and outstanding as of December 31, 2013 and 2012, respectively ...................... 00

Common stock, par value $.01 per share; 1,000,000,000 shares authorized; 637,151,800 and

631,806,585 shares issued as of December 31, 2013 and 2012, respectively, and

572,675,375 and 582,207,133 shares outstanding as of December 31, 2013 and 2012,

respectively ................................................................ 66

Additional paid-in capital, net .................................................... 26,526 26,188

Retained earnings ............................................................. 20,404 16,853

Accumulated other comprehensive income (loss) .................................... (872) 739

Less: Treasury stock, at cost; par value $.01 per share; 64,476,425 and 49,599,452 shares as of

December 31, 2013 and 2012, respectively ....................................... (4,320) (3,287)

Total stockholders’ equity ..................................................... 41,744 40,499

Total liabilities and stockholders’ equity ......................................... $297,048 $312,918

See Notes to Consolidated Financial Statements.

134