Capital One 2013 Annual Report Download - page 233

Download and view the complete annual report

Please find page 233 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

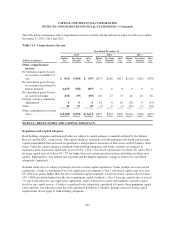

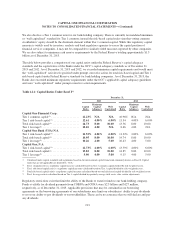

We also disclose a Tier 1 common ratio for our bank holding company. There is currently no mandated minimum

or “well capitalized” standard for Tier 1 common; instead the risk-based capital rules state that voting common

stockholders’ equity should be the dominant element within Tier 1 common capital. While this regulatory capital

measure is widely used by investors, analysts and bank regulatory agencies to assess the capital position of

financial services companies, it may not be comparable to similarly titled measures reported by other companies.

We are also subject to minimum cash reserve requirements by the Federal Reserve totaling approximately $1.5

billion as of December 31, 2013.

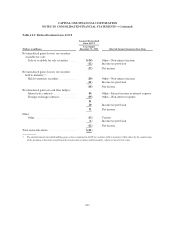

The table below provides a comparison of our capital ratios under the Federal Reserve’s capital adequacy

standards and the capital ratios of the Banks under the OCC’s capital adequacy standards as of December 31,

2013 and 2012. As of December 31, 2013 and 2012, we exceeded minimum capital requirements and would meet

the “well-capitalized” ratio levels specified under prompt corrective action for total risk-based capital and Tier 1

risk-based capital under Federal Reserve standards for bank holding companies. As of December 31, 2013, the

Banks also exceeded minimum regulatory requirements under the OCC’s applicable capital adequacy guidelines

and were “well-capitalized” under prompt corrective action requirements.

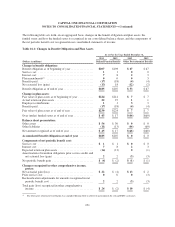

Table 12.1: Capital Ratios Under Basel I(1)

December 31,

2013 2012

Capital

Ratio

Minimum

Capital

Adequacy

Well

Capitalized

Capital

Ratio

Minimum

Capital

Adequacy

Well

Capitalized

Capital One Financial Corp:

Tier 1 common capital(2) .................... 12.23% N/A N/A 10.96% N/A N/A

Tier 1 risk-based capital(3) .................. 12.61 4.00% 6.00% 11.34 4.00% 6.00%

Total risk-based capital(4) ................... 14.73 8.00 10.00 13.56 8.00 10.00

Tier 1 leverage(5) .......................... 10.10 4.00 N/A 8.66 4.00 N/A

Capital One Bank (USA) N.A.

Tier 1 risk-based capital(3) .................. 11.52% 4.00% 6.00% 11.32% 4.00% 6.00%

Total risk-based capital(4) ................... 14.95 8.00 10.00 14.74 8.00 10.00

Tier 1 leverage(5) .......................... 10.26 4.00 5.00 10.43 4.00 5.00

Capital One, N.A.

Tier 1 risk-based capital(3) .................. 12.73% 4.00% 6.00% 13.59% 4.00% 6.00%

Total risk-based capital(4) ................... 13.82 8.00 10.00 14.85 8.00 10.00

Tier 1 leverage(5) .......................... 9.00 4.00 5.00 9.15 4.00 5.00

(1) Calculated under capital standards and regulations based on the international capital framework commonly known as Basel I. Capital

ratios that are not applicable are denoted by “N/A.”

(2) Tier 1 common ratio is a regulatory capital measure calculated based on Tier 1 common capital divided by risk-weighted assets.

(3) Tier 1 risk-based capital ratio is a regulatory capital measure calculated based on Tier 1 capital divided by risk-weighted assets.

(4) Total risk-based capital ratio is a regulatory capital measure calculated based on total risk-based capital divided by risk-weighted assets.

(5) Tier 1 leverage ratio is calculated based on Tier 1 capital divided by quarterly average total assets, after certain adjustments.

Regulatory restrictions exist that limit the ability of the Banks to transfer funds to our bank holding company.

Funds available for dividend payments from COBNA and CONA were $2.3 billion and $127 million,

respectively, as of December 31, 2013. Applicable provisions that may be contained in our borrowing

agreements or the borrowing agreements of our subsidiaries may limit our subsidiaries’ ability to pay dividends

to us or our ability to pay dividends to our stockholders. There can be no assurance that we will declare and pay

any dividends.

213