Capital One 2013 Annual Report Download - page 78

Download and view the complete annual report

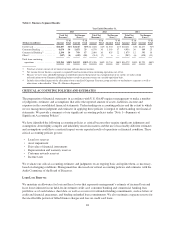

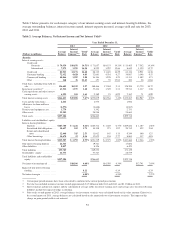

Please find page 78 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net interest income of $18.1 billion in 2013 increased by $1.5 billion, or 9%, from 2012, driven by a 4% increase

in average interest-earning assets and a 5% (30 basis point) increase in net interest margin to 6.80%.

•Average Interest-Earning Assets: The increase in average interest-earning assets in 2013 compared to 2012

reflects the full year impact of loans and investment securities from the ING Direct acquisition and the

addition of loans from the 2012 U.S. card acquisition. Growth in average interest-earning assets was also

driven by continued strong growth in commercial and auto loans, which was partially offset by the

continued run-off of home loans in our Consumer Banking business, the expected run-off of higher-margin,

higher-loss receivables acquired in the 2012 U.S. card acquisition and installment loans in our Credit Card

business, as well as the Portfolio Sale in the third quarter of 2013.

•Net Interest Margin: The increase in our net interest margin in 2013 compared to 2012 was primarily

attributable to a reduction in our cost of funds, which was due in part to the redemption of $3.65 billion of

our trust preferred securities on January 2, 2013, which generally carried a higher coupon than other funding

sources available to us. Our lowered cost of funds also reflects the continued benefit from the shift in the

mix of our funding to lower cost consumer and commercial banking deposits from higher cost wholesale

sources and a decline in deposit interest rates as a result of the continued overall low interest rate

environment.

Net interest income of $16.6 billion in 2012 increased by $3.8 billion, or 30%, from 2011, driven by a 46%

increase in average interest-earning assets, which was partially offset by an 11% (77 basis points) decline in our

net interest margin to 6.50%.

•Average Interest-Earning Assets: The significant increase in average interest-earning assets reflects the

addition of the ING Direct loan portfolio of $40.4 billion in the first quarter of 2012 and the addition of the

$27.8 billion in outstanding receivables acquired in the 2012 U.S. card acquisition and designated as held

for investment in the second quarter of 2012. Growth in average interest-earning assets was also driven by

continued strong growth in commercial and auto loans, which was partially offset by the continued expected

run-off of home loans in our Consumer Banking business, as well as the expected run-off of higher-margin,

higher-loss receivables acquired in the 2012 U.S. card acquisition and installment loans in our Credit Card

business. The run-off of home loans accelerated slightly as a result of the low mortgage interest rate

environment.

•Net Interest Margin: The decrease in our net interest margin in 2012 was attributable to a decline in the

average yield on our interest-earning assets, largely due to the shift in the mix of our interest-earning assets

to a larger proportion of lower yielding assets resulting from the acquired ING Direct home loan and

investment securities portfolios and temporarily higher cash balances from equity and debt offerings. The

ING Direct interest-earning assets generally have lower yields than our legacy loan and investment

securities portfolios. In addition, the establishment of a finance charge and fee reserve of $174 million in the

second quarter of 2012 for the receivables acquired in the 2012 U.S. card acquisition and premium

amortization related to the ING Direct and 2012 U.S. card acquisitions of $391 million in 2012 contributed

to the reduction in the average yield on interest-earning assets. The decrease in the average yield on interest-

earnings assets was partially offset by a reduction in our cost of funds. We have continued to benefit from

the shift in the mix of our funding to lower cost consumer and commercial banking deposits from higher

cost wholesale sources and a decline in deposit interest rates as a result of the continued overall low interest

rate environment.

58