Capital One 2013 Annual Report Download - page 86

Download and view the complete annual report

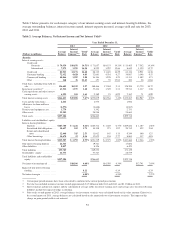

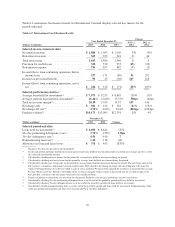

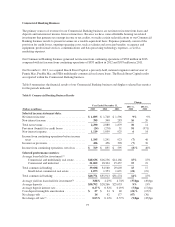

Please find page 86 of the 2013 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.loans held for investment, (ii) the increase in interest and non interest income in 2013 due to the full year

impact of 2012 U.S. card acquisition, and (iii) the absence of the charge recorded in the second quarter of

2012 to establish the finance charge and fee reserve for the loans acquired in the 2012 U.S card acquisition.

The higher average yield on loans held for investment was driven largely by the transfer of the Best Buy

loan portfolio to the loans held for sale category in the first quarter of 2013. This was partially offset by a

decrease in average loans held for investment due to the Portfolio Sale and expected continued run-off of

our installment loan portfolio and other credit card loans acquired in the 2012 U.S. card acquisition.

•Non-Interest Income: Non-interest income increased by $242 million, or 8% in 2013 to $3.3 billion from

$3.1 billion in 2012. The increase was primarily driven by higher net interchange fees from growth in

purchase volume due in part to the 2012 U.S. card acquisition. Purchase volume increased by $20.5 billion,

or 11%, in 2013. Other factors include increased customer-related fees from the addition of acquired credit

card accounts and the absence of charges incurred in the first and second quarters of 2012 for expected

refunds to customers affected by certain cross-sell sales practices in our Domestic Card business.

•Provision for Credit Losses: The provision for credit losses related to our Credit Card business decreased by

$1.3 billion to $2.8 billion in 2013, from $4.1 billion in 2012. The decrease was primarily driven by the

absence of the provision for credit losses of $1.2 billion recorded in the second quarter of 2012 to establish

an allowance for credit card loans acquired in the 2012 U.S. card acquisition.

•Non-Interest Expense: Non-interest expense increased by $585 million, or 9%, in 2013 to $7.4 billion from

$6.9 billion in 2012. The increase was largely due to higher operating expenses resulting from the 2012 U.S.

card acquisition. This includes PCCR intangible amortization expense of $434 million in 2013, compared

with $350 million in 2012.

•Loans Held for Investment: Period-end loans held for investment in our Credit Card business decreased by

$10.5 billion, or 11% as of December 31, 2013. The decrease was due in part to the Portfolio Sale in 2013,

as well as the expected continued run-off of our installment loan portfolio and certain other credit card loans

acquired in the 2012 U.S. card acquisition partially offset by growth in certain other credit card segments.

•Charge-off and Delinquency Statistics: Our reported net charge-off rate increased to 4.15% in 2013, from

3.68% in 2012. The 30+ day delinquency rate decreased to 3.54% as of December 31, 2013, from 3.69% as

of December 31, 2012. The increase in reported net charge-off rates in 2013 were largely due to the impact

of charge-offs from the 2012 U.S. card acquisition which was recorded at fair value. Charges offs are

recorded on Acquired Loans when the nonaccretable difference on the loans are reduced to zero. Charge

offs related to the 2012 U.S. card acquisition were included in the numerator in calculating our net charge-

off rates in 2013.

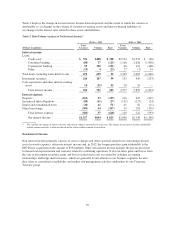

Key factors affecting the results of our Credit Card business for 2012, compared with 2011, and changes in

financial condition and credit performance between December 31, 2012 and December 31, 2011 include the

following:

•Net Interest Income: Net interest income increased by $2.4 billion, or 30%, in 2012, primarily attributable to

the substantial increase in average loans held for investment resulting from the 2012 U.S. card acquisition in

the second quarter of 2012, which was partially offset by a modest reduction in average loan yields due to

the establishment of a finance charge and fee reserve for the loans acquired in the 2012 U.S. card acquisition

and net premium amortization related to these loans.

•Non-InterestIncome: Non-interest income increased by $469 million, or 18%, in 2012. The increase was

primarily driven by higher net interchange fees generated from purchase volume growth and customer-

related fees resulting from the addition of customer accounts associated with the 2012 U.S. card acquisition

in the second quarter of 2012. This increase was partially offset by charges of approximately $115 million

expected refunds to customers affected by certain cross-sell activities in our Domestic Card business and the

discontinuance of revenue recognition for billings to customers affected by the cross-sell activities.

66