Capital One 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 85

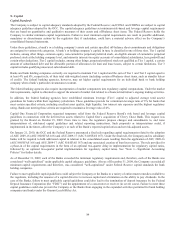

Prompt Corrective Action

In general, the Federal Deposit Insurance Corporation Improvement Act of 1991 (“FDICIA”) subjects banks to significantly increased

regulation and supervision. Among other things, FDICIA requires federal banking agencies to take “prompt corrective action” in

respect of banks that do not meet minimum capital requirements. FDICIA establishes five capital ratio levels: well-capitalized,

adequately capitalized, undercapitalized, significantly undercapitalized, and critically undercapitalized. Under applicable regulations, a

bank is considered to be well-capitalized if it maintains a total risk-based capital ratio of at least 10%, a Tier 1 risk-based capital ratio

of at least 6%, a Tier 1 leverage capital ratio of at least 5% and is not subject to any supervisory agreement, order, or directive to meet

and maintain a specific capital level for any capital reserve. A bank is considered to be adequately capitalized if it maintains a total

risk-based capital ratio of at least 8%, a Tier 1 risk-based capital ratio of at least 4%, a Tier 1 leverage capital ratio of at least 4% (3%

for certain highly rated institutions), and does not otherwise meet the well-capitalized definition. The three undercapitalized categories

are based upon the amount by which a bank falls below the ratios applicable to adequately capitalized institutions. The capital

categories are determined solely for purposes of applying FDICIA’s prompt corrective action provisions, and such capital categories

may not constitute an accurate representation of the Banks’ overall financial condition or prospects. As of December 31, 2009, each of

the Banks met the requirements for a “well capitalized” institution.

As an additional means to identify problems in the financial management of depository institutions, FDICIA requires regulators to

establish certain non-capital safety and soundness standards. The standards relate generally to operations and management, asset

quality, interest rate exposure and executive compensation. The agencies are authorized to take action against institutions that fail to

meet such standards.

Dividend Policy

The declaration and payment of dividends to the Company’s stockholders, as well as the amount thereof, are subject to the discretion

of the Board of Directors of the Company and will depend upon our results of operations, financial condition, cash requirements,

future prospects and other factors deemed relevant by the Board of Directors. As a holding company, our ability to pay dividends is

largely dependent upon the receipt of dividends or other payments from our subsidiaries. Regulatory restrictions exist that limit the

ability of the Banks to transfer funds to the Company. As of December 31, 2009, funds available for dividend payments from COBNA

and CONA were $798.0 million and zero, respectively. The funds of COBNA are available for payment as dividends to the

Corporation without prior approval of the OCC while a dividend payment by CONA would require prior approval of the OCC.

Additionally, applicable provisions that may be contained in our borrowing agreements or the borrowing agreements of our

subsidiaries may limit our subsidiaries’ ability to pay dividends to us or our ability to pay dividends to our stockholders. There can be

no assurance that the Company will declare and pay any dividends.