Capital One 2009 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132

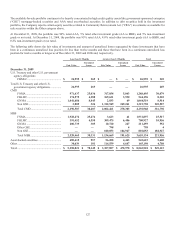

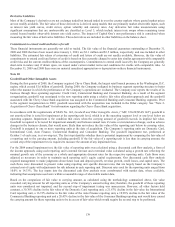

The Company’s acquired loans from the Chevy Chase Bank acquisition are initially recorded at fair value and no separate allowance

for loan and lease losses is recorded for these loans as long as the loans perform as initially expected. Charge-offs of $373.8 million

were applied against the non-accretable difference established at acquisition. See “Note 3- Loans Acquired in a Transfer” for a more

detailed discussion.

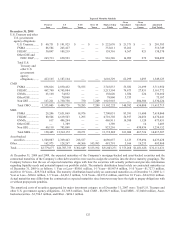

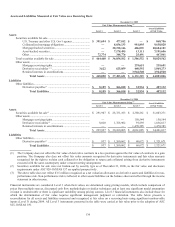

Unfunded Lending Commitments

We manage the potential risk in credit commitments by limiting the total amount of arrangements, both by individual customer and in

total, by monitoring the size and maturity structure of these portfolios and by applying the same credit standards for all of our credit

activities.

As of December 31, 2009 and 2008, the Company had $154.9 billion and $171.1 billion, respectively, of unused credit card lines.

While this amount represented the total unused available credit card lines, the Company has not experienced, and does not anticipate,

that all of its customers will exercise their entire available line at any given point in time.

In addition to available unused credit card lines, the Company enters into commitments to extend credit that are legally binding

conditional agreements having fixed expirations or termination dates and specified interest rates and purposes. These commitments

generally require customers to maintain certain credit standards. Collateral requirements and loan-to-value ratios are the same as those

for funded transactions and are established based on management’s credit assessment of the customer. Commitments may expire

without being drawn upon. Therefore, the total commitment amount does not necessarily represent future requirements. The Company

maintains a reserve for unfunded loan commitments and letters of credit to absorb estimated probable losses related to these unfunded

credit facilities in other liabilities. The outstanding unfunded commitments to extend credit other than credit card lines were

approximately $12.0 billion and $10.0 billion as of December 31, 2009 and 2008, respectively. A reserve of $118.6 million and $26.0

million has been established as of December 31, 2009 and 2008, respectively.

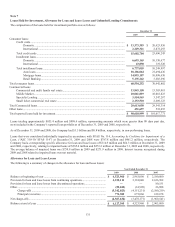

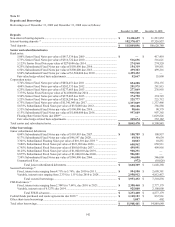

Note 8

Premises, Equipment & Lease Commitments

Premises and Equipment

Premises and equipment are stated at cost less accumulated depreciation and amortization. The Company capitalizes direct costs

(including external costs for purchased software, contractors, consultants and internal staff costs) for internally developed software

projects that have been identified as being in the application development stage. Depreciation and amortization expenses are computed

generally by the straight-line method over the estimated useful lives of the assets. Useful lives for premises and equipment are as

follows:

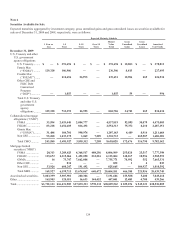

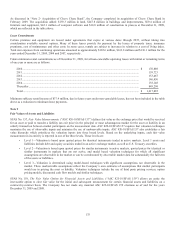

Premises & Equipment

Useful Lives

Buildings and improvement 5-39 years

Furniture and equipment 3-10 years

Computers and software 3-7 years

Premises and equipment were as follows:

December 31

2009

2008

Land ..........................................................................................................................................................

.

$ 582,685 $ 424,409

Buildings and improvements ....................................................................................................................

.

1,836,218 1,529,827

Furniture and equipment ...........................................................................................................................

.

1,237,315 1,144,606

Computer software ....................................................................................................................................

.

922,143 836,465

In process ..................................................................................................................................................

.

239,217 257,333

4,817,578 4,192,640

Less: Accumulated depreciation and amortization ...................................................................................

.

(2,081,955 (1,879,534

)

Total premises and equipment, net ...........................................................................................................

.

$ 2,735,623 $ 2,313,106

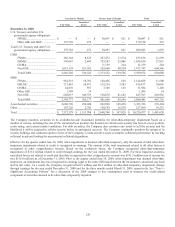

Depreciation and amortization expense from continuing operations was $327.1 million, $331.2 million, and $308.8 million, for the

years ended December 31, 2009, 2008 and 2007, respectively.