Capital One 2009 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

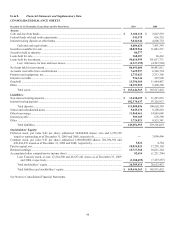

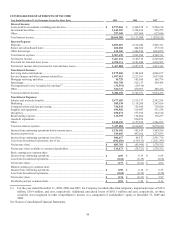

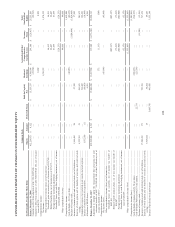

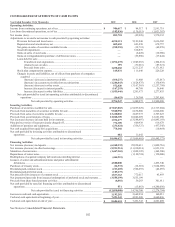

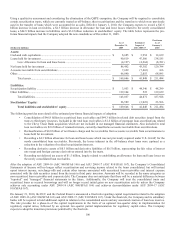

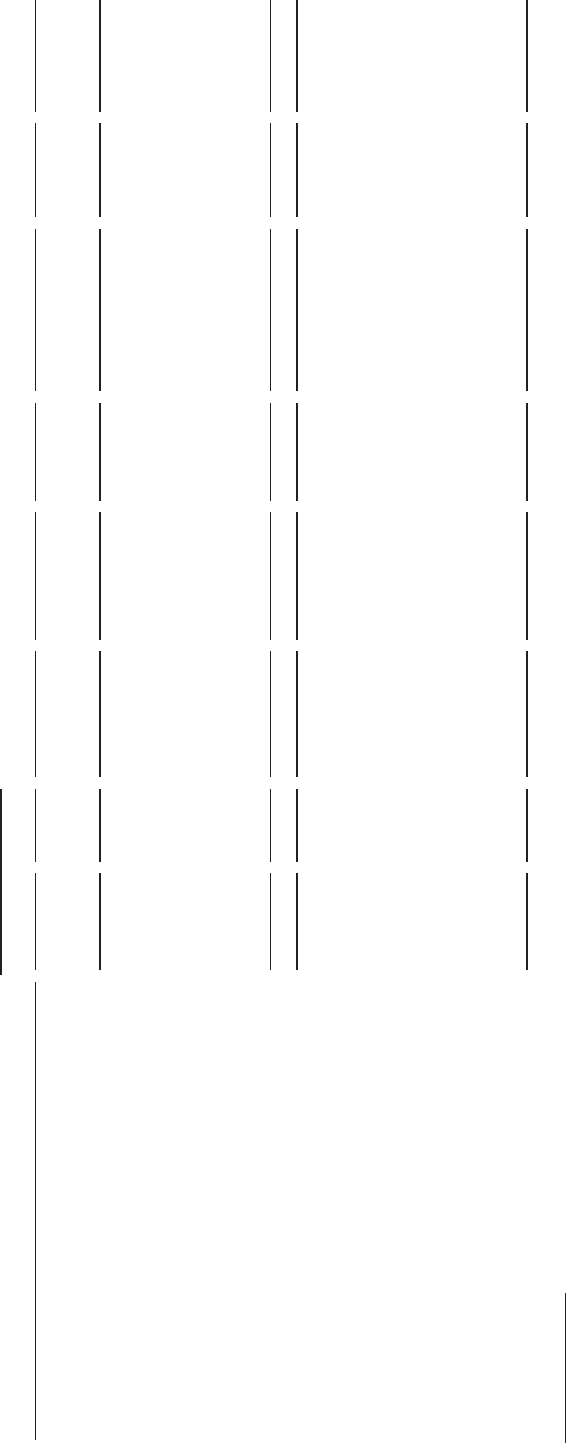

101

Common Stock

Preferred Stock

Paid-In Capital,

Net

Retained

Earnings

Accumulated Other

Comprehensive

Income (Loss) Treasury

Stock

Total

Stockholders’

Equity

(In Thousands, Except Per Share Data)

Shares Amount

Accretion of preferred stock discount ..............................................................

.

— — 10,009 — (10,009) — — —

Compensation expense for restricted stock awards and stock options ............

.

— — — 95,048 — — — 95,048

Allocation of ESOP shares ...............................................................................

.

— — — 4,678 — — — 4,678

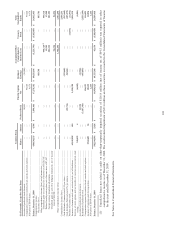

Balance, December 31, 2008 438,434,235 $ 4,384 $ 3,096,466 $ 17,278,102 $ 10,621,164 $ (1,221,796) $ (3,165,887) $ 26,612,433

Comprehensive income:

Net income (loss) .......................................................................................

.

— — — — 883,781 — — 883,781

Other comprehensive income (loss), net of income tax: ...........................

.

Unrealized gains on securities, net of income tax of $520,302 ..........

.

— — — — — 995,715 (1) — 995,715

Defined benefit pension plans, net of income taxes of $7,307 ...........

.

— — — — — 13,289 — 13,289

Foreign currency translation adjustments ...........................................

.

— — — — — 201,252 — 201,252

Unrealized gains in cash flow hedging instruments, net of income

taxes of $60,904 ............................................................................

.

— — — — — 94,194 — 94,194

Other comprehensive income (loss) ..........................................................

.

— — — — — 1,304,450 — 1,304,450

Comprehensive income (loss) ..........................................................................

.

2,188,231

Cash dividends-Common stock $.53 per share ................................................

.

— — — — (213,669) — — (213,669)

Cash dividends-Preferred stock 5% per annum ...............................................

.

— — (22,714) — (82,461) — — (105,175)

Purchase of treasury stock ................................................................................

.

— — — — — — (14,572) (14,572)

Issuances of common stock and restricted stock, net of forfeitures ................

.

61,041,008 610 — 1,535,520 — — — 1,536,130

Exercise of stock options and tax benefits of exercises and restricted stoc

k

vesting ........................................................................................................

.

358,552 4 — (6,885) — — — (6,881)

Accretion of preferred stock discount ..............................................................

.

— — 33,554 — (33,554) — — —

Redemption of preferred stock .........................................................................

.

— — (3,107,306) — (447,893) — — (3,555,199)

Compensation expense for restricted stock awards and stock options ............

.

— — — 116,023 — — — 116,023

Issuance of common stock for acquisition .......................................................

.

2,560,601 26 — 30,830 — — — 30,856

Allocation of ESOP shares ...............................................................................

.

— — — 1,233 — — — 1,233

Balance, December 31, 2009 502,394,396 $ 5,024 $ — $ 18,954,823 $ 10,727,368 $ 82,654 $ (3,180,459) $ 26,589,410

(1) Unrealized losses not related to credit on other-than-temporarily impaired securities of $116.8 million (net of income tax of $64.5 million) was reported in other

comprehensive income as of December 31, 2009. The credit-related impairment of $31.6 million on these securities is recorded in the Consolidated Statements of Income

for the year ended December 31, 2009.

See Notes to Consolidated Financial Statements.