Capital One 2009 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144

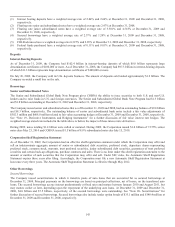

Junior Subordinated Debentures

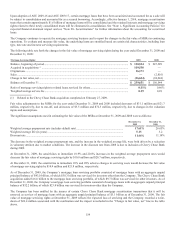

At December 31, 2009 and December 31, 2008, the Company had junior subordinated debentures outstanding of $3.6 billion and $1.6

billion, respectively.

The Company had previously established special purpose trusts for the purpose of issuing trust preferred securities. The proceeds from

such issuances, together with the proceeds of the related issuances of common securities of the trusts, were invested by the trusts in

junior subordinated deferrable interest debentures issued by the Company. Prior to ASC 810-10/FIN 46(R), these trusts were

consolidated subsidiaries of the Company. As a result of the adoption of ASC 810-10/FIN 46(R), the Company deconsolidated all

such special purpose trusts, as the Company is not considered to be the primary beneficiary.

For the years ended December 31, 2009 and 2008, no junior subordinated debentures were called or matured. On August 5, 2009 the

Company issued $1.0 billion of 10.25% trust preferred securities, due 2039. On November 13, 2009 the Company issued $1.0 billion

of 8.875% trust preferred securities, due 2040. There were no new issuances in 2008.

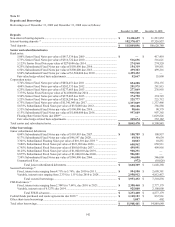

FHLB Advances

The Company utilizes FHLB advances which are secured by the Company’s investment in FHLB stock and by a blanket floating lien

on portions of the Company’s residential mortgage loan portfolio. FHLB advances outstanding were $3.2 billion and $4.9 billion at

December 31, 2009 and December 31, 2008, respectively and include fixed and variable rate advances. FHLB stock totaled $264.1

million and $267.5 million at December 31, 2009 and December 31, 2008, respectively, and is included in other assets.

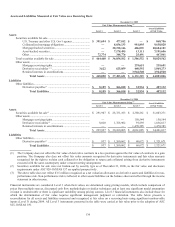

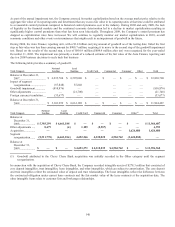

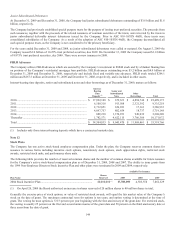

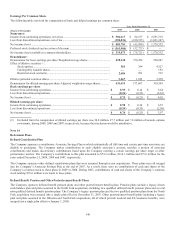

Interest-bearing time deposits, senior and subordinated notes and other borrowings as of December 31, 2009, mature as follows:

Interest-

Bearing

Time

Deposits (1)

Senior and

Subordinated

Notes Other

Borrowings

Total

2010 ................................................................................................. $ 17,922,108 $ 679,321 $ 4,896,744 $ 23,498,173

2011 ................................................................................................. 6,100,318 913,508 2,321,392 9,335,218

2012 ................................................................................................. 2,712,851 656,921 17,163 3,386,935

2013 ................................................................................................. 4,897,757 802,654 18,737 5,719,148

2014 ................................................................................................. 889,230 1,370,951 948,039 3,208,220

Thereafter ........................................................................................ 1,782,571 4,622,115 3,766,386 10,171,072

Total ................................................................................................ $ 34,304,835 $ 9,045,470 $ 11,968,461 $ 55,318,766

(1) Includes only those interest-bearing deposits which have a contractual maturity date.

Note 12

Stock Plans

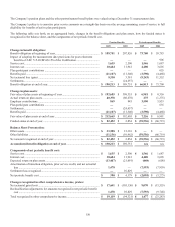

The Company has one active stock-based employee compensation plan. Under the plan, the Company reserves common shares for

issuance in various forms including incentive stock options, nonstatutory stock options, stock appreciation rights, restricted stock

awards, restricted stock units, and performance share units.

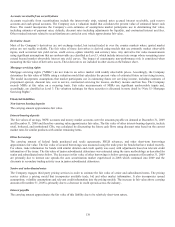

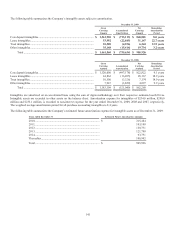

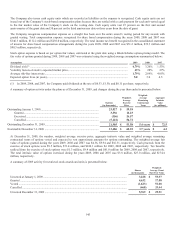

The following table provides the number of reserved common shares and the number of common shares available for future issuance

for the Company’s active stock-based compensation plan as of December 31, 2009, 2008 and 2007. The ability to issue grants from

the 1999 Non-Employee Directors Stock Incentive Plan and other plans were terminated in 2009 and 2004, respectively.

Available For Issuance

Plan Name

Shares

Reserved 2009

2008

2007

2004 Stock Incentive Plan ....................................................................... 40,000,000 (1) 17,789,099 4,505,558 7,862,529

(1) On April 20, 2009 the Board authorized an increase in shares reserved of 20 million shares to 40 million shares in total.

Generally the exercise price of stock options, or value of restricted stock awards, will equal the fair market value of the Company’s

stock on the date of grant. The maximum contractual term for options is ten years, and option vesting is determined at the time of

grant. The vesting for most options is 331/3 percent per year beginning with the first anniversary of the grant date. For restricted stock,

the vesting is usually 25 percent on the first and second anniversaries of the grant date and 50 percent on the third anniversary date or

three years from the date of grant.