Capital One 2009 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148

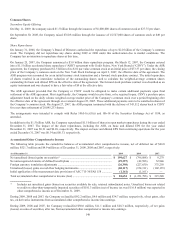

Common Shares

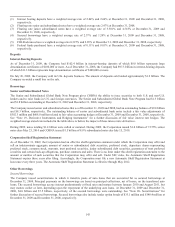

Secondary Equity Offering

On May 11, 2009, the company raised $1.5 billion through the issuance of 56,000,000 shares of common stock at $27.75 per share.

On September 30, 2008, the Company raised $760.8 million through the issuance of 15,527,000 shares of common stock at $49 per

share.

Share Repurchases

On January 31, 2008, the Company’s Board of Directors authorized the repurchase of up to $2.0 billion of the Company’s common

stock. The Company did not repurchase any shares during 2009 or 2008 under this authorization due to market conditions. The

Company has no intention to repurchase shares at this time.

On January 25, 2007, the Company announced a $3.0 billion share repurchase program. On March 12, 2007, the Company entered

into a $1.5 billion accelerated share repurchase (“ASR”) agreement with Credit Suisse, New York Branch (“CSNY”). Under the ASR

agreement, the Company purchased $1.5 billion of its $.01 par value common stock at an initial price of $73.57 per share, the closing

price of the Company’s common stock on the New York Stock Exchange on April 2, 2007, the effective date of the agreement. The

ASR program was accounted for as an initial treasury stock transaction and a forward stock purchase contract. The initial repurchase

of shares resulted in an immediate reduction of the outstanding shares used to calculate the weighted-average common shares

outstanding for basic and diluted EPS on the effective date of the agreement. The forward stock purchase contract was classified as an

equity instrument and was deemed to have a fair value of $0 at the effective date.

The ASR agreement provided that the Company or CSNY would be obligated to make certain additional payments upon final

settlement of the ASR agreement. Most significantly, the Company would receive from, or be required to pay, CSNY a purchase price

adjustment based on the daily volume weighted average market price of the Company’s common stock over a period beginning after

the effective date of the agreement through on or around August 22, 2007. These additional payments were to be satisfied in shares of

the Company’s common stock. On August 27, 2007, the ASR program terminated with the delivery of 343,512 shares back to CSNY

for a net share retirement of 20,045,233 shares.

The arrangements were intended to comply with Rules 10b5-1(c)(1)(i) and 10b-18 of the Securities Exchange Act of 1934, as

amended.

In addition to the $1.5 billion ASR, the Company repurchased $1.5 billion of shares in open market repurchases during the year ended

December 31, 2007. The impact of the share repurchases, including the ASR, on basic and diluted EPS for the year ended

December 31, 2007 was $0.21 and $0.20, respectively. The impact on basic and diluted EPS from continuing operations for the year

ended December 31, 2007 was $0.34 and $0.33, respectively.

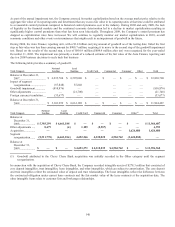

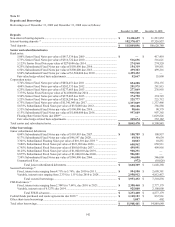

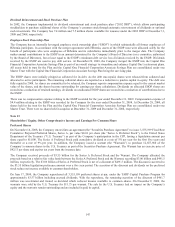

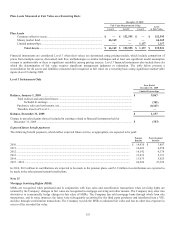

Accumulated Other Comprehensive Income

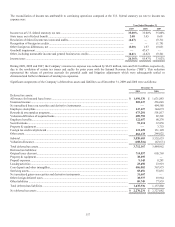

The following table presents the cumulative balances of accumulated other comprehensive income, net of deferred tax of $66.8

million, $521.7 million and $4.9 million as of December 31, 2009, 2008 and 2007, respectively:

As of December 31

2009 2008

2007

N

et unrealized (losses) gains on securities(1) .....................................................................

.

$ 199,627 $ (796,088) $ 9,279

N

et unrecognized elements of defined benefit plans .........................................................

.

(29,297) (42,586) 32,846

Foreign currency translation adjustments ..........................................................................

.

(26,398) (227,650) 375,258

Unrealized (losses) gains on cash flow hedging instruments .............................................

.

(60,117) (154,311) (102,135)

Initial application of the measurement date provisions of ASC 715-30/FAS 158 .............

.

(1,161) (1,161) —

Total accumulated other comprehensive income (loss) .....................................................

.

$ 82,654 $ (1,221,796) $ 315,248

(1) Includes net unrealized gains (losses) on securities available for sale, retained subordinated notes. Unrealized losses not related

to credit on other-than-temporarily impaired securities of $181.3 million (net of income tax was $116.8 million) was reported in

other comprehensive income as of December 31, 2009.

During 2009, 2008 and 2007, the Company reclassified $92.2 million, $9.0 million and $34.7 million, respectively, of net gains, after

tax, on derivative instruments from accumulated other comprehensive income into earnings.

During 2009, 2008 and 2007, the Company reclassified $50.0 million, $11.1 million and $28.3 million, respectively, of net gains

(losses) on sales of securities, after tax, from accumulated other comprehensive income into earnings.