Capital One 2009 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

168

Company. The expected amortization period of this trust is fourteen months, which is consistent with the expected amortization period

prior to hitting the trigger. No early amortization events related to the Company’s off-balance sheet securitizations have occurred for

the years ended December 31, 2009, 2008 or 2007 with the exception of that described above.

Collections of interest and fees received on securitized receivables are used to pay interest to investors, servicing and other fees, and

are available to absorb the investors’ share of credit losses. Amounts collected in excess of that needed to pay the above amounts are

remitted, in general, to the Company. Under certain conditions, some of the cash collected may be retained to ensure future payments

to investors.

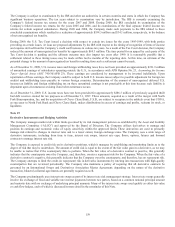

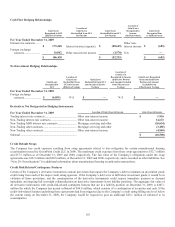

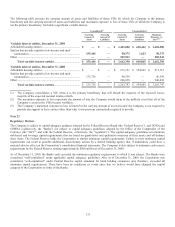

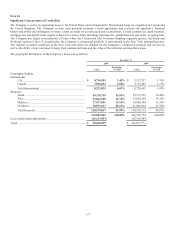

The following provides the details of the cash flow related to securitization transactions for the years ended December 31, 2009 and

2008:

Year Ended December 31

2009

2008

Proceeds from new securitizations ........................................................................................................

.

$ 12,068,309 $ 10,046,699

Collections reinvested in revolving securitizations ...............................................................................

.

70,895,890 85,351,341

Repurchases of accounts from the trust ................................................................................................

.

9,210 251,776

Servicing fees received .........................................................................................................................

.

879,271 956,163

Cash flows received on retained interests (1) .........................................................................................

.

$ 5,252,263 $ 6,374,957

(1) Includes all cash receipts of excess spread and other payments (excluding servicing fees) from the trust to the Company.

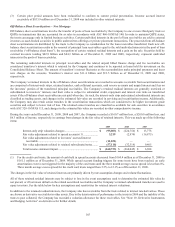

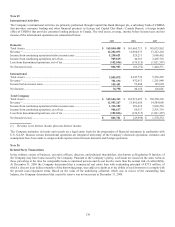

For the year ended December 31, 2009 the Company recognized gross gains of $40.6 million on both the public and private sale of

$12.1 billion of loan principal receivables compared to gross gains of $58.4 million on the sale of $10.0 billion of loan principal

receivables for the year ended December 31, 2008 and gross gains of $63.8 million on the sale of $12.6 billion of loans for the year

ended December 31, 2007. These gross gains are included in servicing and securitizations income. In addition, the Company

recognized, as a reduction to servicing and securitizations income, upfront securitization transaction costs and recurring credit facility

commitment fees of $48.9 million, $43.9 million, and $45.0 million for the years ended December 31, 2009, 2008, and 2007

respectively. The remainder of servicing and securitizations income represents servicing income and excess interest and non-interest

income generated by the transferred receivables, less the related net losses on the transferred receivables and interest expense related

to the securitization debt.

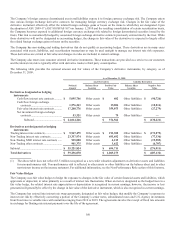

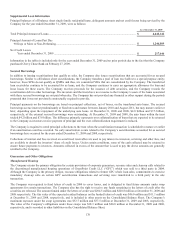

Supplemental Loan Information

Loans included in securitization transactions which qualify as sales under U.S. GAAP have been removed from the Company’s

“reported” balance sheet, but are included within the “managed” financial information, as shown in the table below.

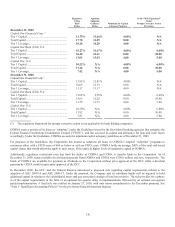

Year Ended December 31

2009 2008

Loans

Outstanding Loans

Delinquent Loans

Outstanding

Loans

Delinquent

Managed loans ..................................................................... $ 136,802,902 $ 6,465,158 $ 146,936,754 $ 6,596,223

Securitization adjustments ................................................... (46,183,903) (2,718,894) (45,918,983) (2,178,400)

Reported loans ..................................................................... $ 90,618,999 $ 3,746,264 $ 101,017,771 $ 4,417,823

Average Loans Net Charge-Offs Average Loans

Net Charge-Offs

Managed loans ..................................................................... $ 143,514,416 $ 8,420,634 $ 147,812,266 $ 6,424,937

Securitization adjustments ................................................... (43,727,131) (3,853,000) (48,841,363) (2,946,766)

Reported loans ..................................................................... $ 99,787,285 $ 4,567,634 $ 98,970,903 $ 3,478,171

Off-Balance Sheet Securitizations –Mortgage

The Company periodically sells various loan receivables through asset-backed securitizations, in which receivables which are

transferred to trusts and certificates are sold to investors. The outstanding trust certificate balance at December 31, 2009 was $4.6

billion. There were no loans sold into new trusts during the period and no gains recognized during the period.

The Company continues to service and receive servicing fees on the outstanding balance of securitized receivables. The Company also

retains rights, which may be subordinated, to future cash flows arising from the receivables. The Company generally estimates the fair

value of these retained interests based on the estimated present value of expected future cash flows from securitized and sold