Capital One 2009 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

133

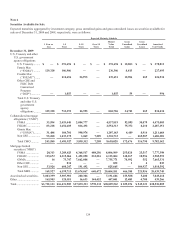

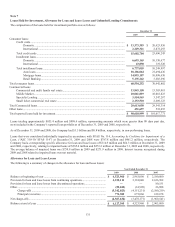

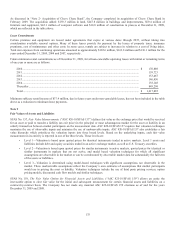

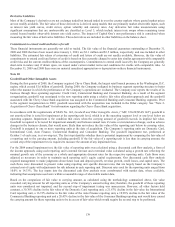

As discussed in “Note 2- Acquisition of Chevy Chase Bank”, the Company completed its acquisition of Chevy Chase Bank in

February 2009. The acquisition added: $159.3 million in land, $247.8 million in buildings and improvements, $69.4 million of

furniture and equipment, $42.1 million of computer software and $10.8 million of construction in process at December 31, 2009,

which are reflected in the table above.

Lease Commitments

Certain premises and equipment are leased under agreements that expire at various dates through 2035, without taking into

consideration available renewal options. Many of these leases provide for payment by the lessee of property taxes, insurance

premiums, cost of maintenance and other costs. In some cases, rentals are subject to increases in relation to a cost of living index.

Total rent expenses from continuing operations amounted to approximately $182.6 million, $163.8 million and $136.1 million for the

years ended December 31, 2009, 2008 and 2007, respectively.

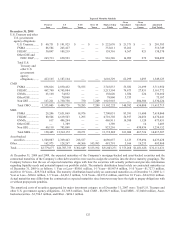

Future minimum rental commitments as of December 31, 2009, for all non-cancelable operating leases with initial or remaining terms

of one year or more are as follows:

2010 .................................................................................................................................................................

.

$ 170,889

2011 .................................................................................................................................................................

.

159,723

2012 .................................................................................................................................................................

.

153,467

2013 .................................................................................................................................................................

.

146,450

2014 .................................................................................................................................................................

.

138,148

Thereafter ........................................................................................................................................................

.

849,208

Total ................................................................................................................................................................

.

$ 1,617,885

Minimum sublease rental income of $37.4 million, due in future years under non-cancelable leases, has not been included in the table

above as a reduction to minimum lease payments.

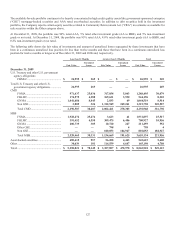

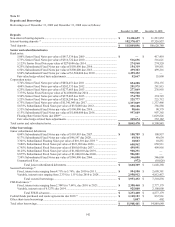

Note 9

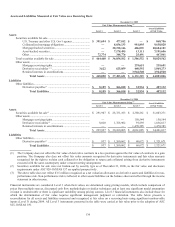

Fair Values of Assets and Liabilities

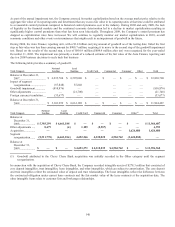

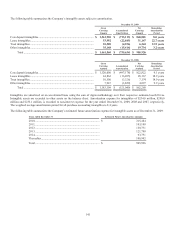

SFAS No. 157, Fair Value Measurements, (“ASC 820-10/SFAS 157”) defines fair value as the exchange price that would be received

for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an

orderly transaction between market participants on the measurement date. ASC 820-10/SFAS 157 requires that valuation techniques

maximize the use of observable inputs and minimize the use of unobservable inputs. ASC 820-10/SFAS 157 also establishes a fair

value hierarchy which prioritizes the valuation inputs into three broad levels. Based on the underlying inputs, each fair value

measurement in its entirety is reported in one of the three levels. These levels are:

• Level 1—Valuation is based upon quoted prices for identical instruments traded in active markets. Level 1 assets and

liabilities include debt and equity securities traded in an active exchange market, as well as U.S. Treasury securities.

• Level 2—Valuation is based upon quoted prices for similar instruments in active markets, quoted prices for identical or

similar instruments in markets that are not active, and model based valuation techniques for which all significant

assumptions are observable in the market or can be corroborated by observable market data for substantially the full term

of the assets or liabilities.

• Level 3—Valuation is determined using model-based techniques with significant assumptions not observable in the

market. These unobservable assumptions reflect the Company’s own estimates of assumptions that market participants

would use in pricing the asset or liability. Valuation techniques include the use of third party pricing services, option

pricing models, discounted cash flow models and similar techniques.

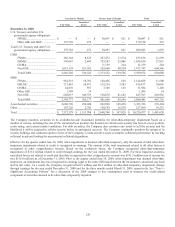

SFAS No. 159, The Fair Value Option for Financial Assets and Liabilities, (“ASC 825-10/SFAS 159”) allows an entity the

irrevocable option to elect fair value for the initial and subsequent measurement for certain financial assets and liabilities on a

contract-by-contract basis. The Company has not made any material ASC 825-10/SFAS 159 elections as of and for the years

December 31, 2009 and 2008.