Capital One 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

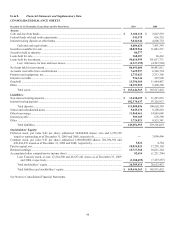

Item 8. Financial Statements and Supplementary Data

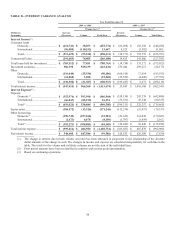

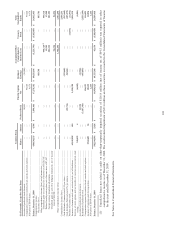

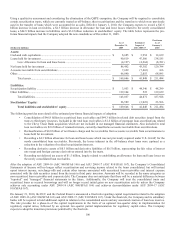

CONSOLIDATED BALANCE SHEETS

December 31 (In Thousands, Except Share and Per Share Data)

2009

2008

Assets:

Cash and due from banks .................................................................................................................

.

$ 3,100,110 $ 2,047,839

Federal funds sold and resale agreements ........................................................................................

.

541,570 636,752

Interest bearing deposits at other banks ...........................................................................................

.

5,042,944 4,806,752

Cash and cash equivalents ......................................................................................................

.

8,684,624 7,491,343

Securities available for sale .............................................................................................................

.

38,829,562 31,003,271

Securities held to maturity ...............................................................................................................

.

80,577 —

Loans held for sale ...........................................................................................................................

.

268,307 68,462

Loans held for investment ................................................................................................................

.

90,618,999 101,017,771

Less: Allowance for loan and lease losses ..............................................................................

.

(4,127,395) (4,523,960)

N

et loans held for investment ..........................................................................................................

.

86,491,604 96,493,811

Accounts receivable from securitizations ........................................................................................

.

7,629,597 6,342,754

Premises and equipment, net ............................................................................................................

.

2,735,623 2,313,106

Interest receivable ............................................................................................................................

.

936,146 827,909

Goodwill ..........................................................................................................................................

.

13,596,368 11,964,487

Other ................................................................................................................................................

.

10,393,955 9,408,309

Total assets .............................................................................................................................

.

$ 169,646,363 $ 165,913,452

Liabilities:

N

on-interest bearing deposits...........................................................................................................

.

$ 13,438,659 $ 11,293,852

Interest bearing deposits ..................................................................................................................

.

102,370,437 97,326,937

Total deposits .........................................................................................................................

.

115,809,096 108,620,789

Senior and subordinated notes .........................................................................................................

.

9,045,470 8,308,843

Other borrowings .............................................................................................................................

.

11,968,461 14,869,648

Interest payable ................................................................................................................................

.

509,105 676,398

Other ................................................................................................................................................

.

5,724,821 6,825,341

Total liabilities ........................................................................................................................

.

143,056,953 139,301,019

Stockholders’ Equity:

Preferred stock, par value $.01 per share; authorized 50,000,000 shares; zero and 3,555,199

issued or outstanding as of December 31, 2009 and 2008, respectively .....................................

.

— 3,096,466

Common stock, par value $.01 per share; authorized 1,000,000,000 shares; 502,394,396 and

438,434,235 issued as of December 31, 2009 and 2008, respectively ........................................

.

5,024 4,384

Paid-in capital, net ...........................................................................................................................

.

18,954,823 17,278,102

Retained earnings .............................................................................................................................

.

10,727,368 10,621,164

Accumulated other comprehensive income (loss) ...........................................................................

.

82,654 (1,221,796)

Less: Treasury stock, at cost; 47,224,200 and 46,637,241 shares as of December 31, 2009

and 2008, respectively .......................................................................................................

.

(3,180,459) (3,165,887)

Total stockholders’ equity ......................................................................................................

.

26,589,410 26,612,433

Total liabilities and stockholders’ equity ................................................................................

.

$ 169,646,363 $ 165,913,452

See Notes to Consolidated Financial Statements.