Capital One 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 30

ASC 820-10/SFAS 157 requires that valuation techniques maximize the use of observable inputs and minimize the use of

unobservable inputs. When available, we use quoted market prices to measure fair value. If market prices are not available, fair value

measurement is based upon models that use primarily market-based or independently-sourced market parameters, including interest

rate yield curves, prepayment speeds, option volatilities and currency rates. When market observable inputs for model-based valuation

techniques may not be readily available, we are required to make judgments about assumptions market participants would use in

estimating the fair value of the financial instrument.

The extent of management judgment involved in measuring the fair value of financial instruments is dependent upon the availability

of quoted prices or observable market data. For financial instruments that have quoted prices in active markets or whose fair value is

measured using data observable in the market, there is minimal management judgment involved in measuring fair value. When quoted

prices or observable market data is not fully available, management judgment is necessary to estimate fair value. In addition, changes

in market conditions may reduce the availability of quoted prices or observable market data. For example, an increase in dislocation

and corresponding decrease in new issuance and trading volumes could result in observable market data becoming unavailable. When

market data is not available, we use valuation techniques with assumptions that management believes other market participants would

also use to estimate fair value.

Effective January 1, 2008, the Company adopted SFAS No. 159, The Fair Value Option for Financial Assets and Liabilities (“ASC

825-10/SFAS 159”). ASC 825-10/SFAS 159 permits entities to choose to measure many financial instruments and certain other items

at fair value with changes in fair value included in current earnings. The election is made on specified election dates, can be made on

an instrument by instrument basis, and is irrevocable. The initial adoption of ASC 825-10/SFAS 159 did not have a material impact on

the consolidated earnings and financial position of the Company.

The acquisition of Chevy Chase Bank is accounted for under the acquisition method of accounting following the provisions of ASC

805-10/SFAS No. 141(R), which requires an acquirer to recognize the assets acquired, the liabilities assumed, and any noncontrolling

interest in the acquiree at the acquisition date, at their fair values as of that date, with limited exceptions, thereby replacing SFAS

141’s cost-allocation process. See “Note 2 – Acquisition of Chevy Chase Bank” for further discussion of this acquisition.

Impairment for Securities Available for Sale

The Company performs an other-than-temporary impairment analysis to determine whether it should recognize a loss in earnings

when investments in its available for sale securities are impaired, which occurs when the fair value of an investment is less than its

amortized cost basis. The Company selects securities for its analysis based on the period of time a security has been in an unrealized

loss position, the credit rating of the security, the extent to which amortized cost exceeds fair value, and current market conditions,

among other considerations. The Company also considers any intent to sell a security in an unrealized loss position and the likelihood

it will be required to sell a security before its anticipated recovery. In the analysis of the selected securities, the Company determines

its best estimate of the present value of cash flows expected to be collected for each security. If that value is less than the amortized

cost basis of the security, a loss exists and an other than temporary impairment is considered to have occurred. Credit related

impairment is recognized in earnings and impairment due to all other factors is recognized in other comprehensive income.

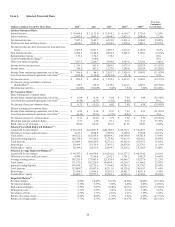

Determination of Allowance for Loan and Lease Losses

The allowance for loan and lease losses is maintained at an amount estimated to be sufficient to absorb losses, net of principal

recoveries (including recovery of collateral), inherent in the existing reported loan portfolios. The provision for loan and lease losses is

the periodic cost of maintaining an adequate allowance.

The amount of allowance necessary is based on distinct allowance methodologies depending on the type of loan. Allowance

methodologies for consumer loans such as credit card, automobile loans and mortgages are primarily based upon delinquency

migration analysis, forecasted forward loss curves and historical loss trends. The methodology for credit cards includes estimated

recoveries, while methodologies for automobile loans and mortgages consider estimated collateral values. Allowance methodologies

for commercial loans are largely based upon specifically identified criticized loans, trends in criticized loans, estimated collateral

values, and recent historical loss trends.

In evaluating the sufficiency of the allowance for loan and lease losses, management takes into consideration many factors including,

but not limited to, recent trends in delinquencies and charge-offs including bankruptcy, deceased and recovered amounts, economic

conditions, the value of collateral securing the loans, legal and regulatory guidance, credit evaluation and underwriting policies,

seasonality, the degree of assumed risk inherent in the portfolio, and uncertainties in the Company’s forecasting and modeling. In

particular, unemployment rates, housing prices and the valuation of commercial properties, consumer real estate, and automobiles are

factors which significantly impact the allowance for loan and lease losses. Management examines a variety of externally available data

as well as the Company’s recent experience in the consideration of these factors. See “Table 17—Summary of Allowance for Loan

and Lease Losses” for additional detail on activity in the allowance.