Capital One 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 108

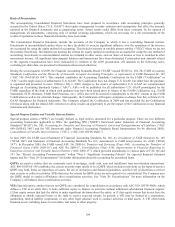

On April 9, 2009, the FASB issued FSP No. FAS 115-2 and FAS 124-2, Recognition and Presentation of Other-Than-Temporary

Impairment (“ASC 320-10-65/FSP 115-2 and FAS 124-2”), which eliminates the Company’s requirement to assert its intent and

ability to hold an investment until its forecasted recovery to avoid recognizing an impairment loss. The FSP requires the Company to

recognize an other-than-temporary impairment when the Company intends to sell the security or it is more likely than not that it will

be required to sell the security before recovery. Credit-related impairments are recorded in income while other impairments are

recorded in other comprehensive income. ASC 320-10-65/FSP 115-2 and FAS 124-2 are effective for interim and annual reporting

periods ending after June 15, 2009. The adoption of ASC 320-10-65/FSP 115-2 and FAS 124-2 occurred during the second quarter of

2009. See “Note 6- Securities Available for Sale” for additional detail.

On April 9, 2009, the FASB issued FSP No. FAS 107-1 and APB 28-1, Interim Disclosures about Fair Value of Financial

Instruments (“ASC 825-10-65/FSP 107-1 and APB 28-1”), which will require the Company to include fair value disclosures of

financial instruments for each interim and annual period that financial statements are prepared. ASC 825-10-65/FSP 107-1 and APB

28-1 is effective for interim and annual reporting periods ending after June 15, 2009. The adoption of ASC 825-10-65/FSP 107-1 and

APB 28-1 occurred during the second quarter of 2009, and did not have a material effect on the consolidated earnings and financial

position of the Company because it only amends the disclosure requirements. See “Note 9- Fair Values of Assets and Liabilities” for

additional details.

In January 2009, the FASB issued FASB Staff Position No. EITF 99-20-1, “Recognition of Interest Income and Impairment on

Purchased Beneficial Interests and Beneficial Interests That Continue to Be Held by a Transferor in Securitized Financial Assets”

(“ASC 325-40-65/FSP EITF 99-20”). The FSP was issued to achieve more consistent determination of whether an other-than-

temporary impairment has occurred. The FSP also retains and emphasizes the objective of an other-than-temporary impairment

assessment and the related disclosure requirements in SFAS No. 115, “Accounting for Certain Investments in Debt and Equity

Securities,” (“ASC 320-10/SFAS 115”) and other related guidance. ASC 325-40-65/FSP EITF 99-20 emphasizes that any other-than-

temporary impairment resulting from the application of ASC 320-10/SFAS 115 or ASC 325-40-65/FSP EITF 99-20 shall be

recognized in earnings equal to the entire difference between the investment’s cost and its fair value at the balance sheet date of the

reporting period for which the assessment is made. ASC 325-40-65/FSP EITF 99-20 is effective for interim and annual reporting

periods ending after December 15, 2008, and shall be applied prospectively. Retrospective application to a prior interim or annual

reporting period is not permitted. The adoption of ASC 325-40-65/FSP EITF 99-20 did not have impact on consolidated earnings or

financial position of the Company.

In December 2008, the FASB issued FSP No. FAS 132(R)-1, “Employer’s Disclosures about Postretirement Benefit Plan Assets”

(“ASC 715-20-65/FSP 132(R)-1”). ASC 715-20-65/FSP 132(R)-1 requires enhanced disclosures about the fair value of the

Company’s plan assets in a similar fashion as our disclosures required by ASC 820-10/SFAS 157. The FSP is effective for financial

statements issued for reporting periods ending after December 15, 2009. The initial adoption of ASC 715-20-65/FSP 132(R) did not

have a material impact on the consolidated earnings and financial position of the Company because it only amends the disclosure

requirements. See “Note 14- Retirement Plans” for additional details.

In June 2008, the FASB issued FSP EITF 03-6-1, “Determining Whether Instruments Granted in Share-Based Payment Transactions

Are Participating Securities” (“ASC 260-10-65/FSP EITF 03-6-1”) The FSP addresses whether instruments granted in share-based

payment transactions are participating securities prior to vesting and therefore need to be included in the earnings allocation in

calculating earnings per share under the two-class method described in SFAS No. 128, “Earnings per Share” (“ASC 260-10/SFAS

128”). The FSP requires companies to treat unvested share-based payment awards that have non-forfeitable rights to dividend or

dividend equivalents as a separate class of securities in calculating earnings per share. The FSP is effective for fiscal years beginning

after December 15, 2008; earlier application is not permitted. The adoption of ASC 260-10-65/FSP EITF 03-6-1 did not have a

material effect on our results of operations or earnings per share.

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging Activities-an amendment of

FASB Statement No. 133, (“ASC 815-10-65/SFAS 161”). This Statement changes the disclosure requirements for derivative and

hedging activities. Entities are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments,

(b) how derivative instruments and related hedged items are accounted for under ASC 815-10-65/SFAS 161 and its related

interpretations, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial

performance, and cash flows. This Statement is effective for fiscal years, and interim periods within those fiscal years, beginning after

November 15, 2008. The adoption of ASC 815-10-65/SFAS 161 did not have an impact on the consolidated earnings or financial

position of the Company because it only amends the disclosure requirements for derivatives and hedged items. See “Note 19-

Derivative Instruments and Hedging Activities” for derivatives disclosures under ASC 815-10-65/SFAS 161.