Capital One 2009 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

155

Note 16

Restructuring

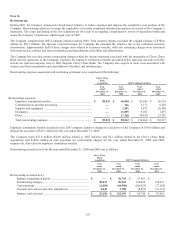

During 2007, the Company announced a broad-based initiative to reduce expenses and improve the competitive cost position of the

Company. Restructuring initiatives leverage the capabilities of recently completed infrastructure projects in several of the Company’s

businesses. The scope and timing of the cost reductions are the result of an ongoing, comprehensive review of operations within and

across the Company’s businesses, which began early in 2007.

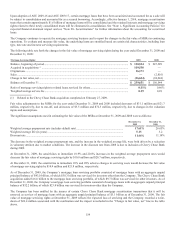

The Company completed the 2007 Company initiative during 2009. Total incurred charges exceeded the original estimate of $300.0

million by $63.3 million. The increase occurred because the Company has extended the initiative due to the continued economic

deterioration. Approximately half of these charges were related to severance benefits, while the remaining charges were associated

with items such as contract and lease terminations and consolidation of facilities and infrastructure.

The Company has recorded certain restructuring charges within the income statement associated with the integration of Chevy Chase

Bank into the operations of the Company. Expenses for employee termination benefits presented below represent one-time activities

and do not represent ongoing costs to fully integrate Chevy Chase Bank. The Company also expects to incur costs associated with

contract and lease terminations and consolidation of facilities and infrastructure.

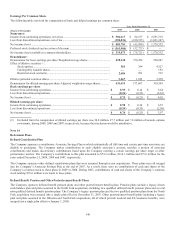

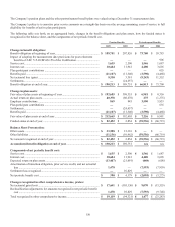

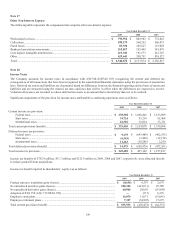

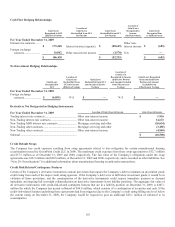

Restructuring expenses associated with continuing operations were comprised of the following:

Chevy Chase

Bank

Acquisition 2007 Company Initiative

Year

ended

December 31,

2009

Year

ended

December 31,

2009

Year

ended

December 31,

2008

Year

ended

December 31,

2007

Restructuring expenses:

Employee termination benefits ........................................................

.

$ 28,833 $ 46,940 $ 85,949 $ 86,714

Communication and data processing ...............................................

.

— 766 2,171 6,628

Supplies and equipment ...................................................................

.

— 3,201 2,473 20,246

Occupancy .......................................................................................

.

— 21,895 9,052 1,057

Other ................................................................................................

.

— 17,760 34,819 23,592

Total restructuring expenses ............................................................

.

$ 28,833 $ 90,562 $ 134,464 $ 138,237

Employee termination benefits included for the 2007 company initiative charges for executives of the Company of $10.8 million and

charges for associates of $36.1 million for the year ended December 31, 2009.

The Company made $71.0 million ($64.9 million related to 2007 initiative and $6.1 million related to the Chevy Chase Bank

acquisition) and $100.8 million in cash payments for restructuring charges for the year ended December 31, 2009 and 2008,

respectively, that related to employee termination benefits.

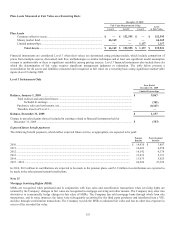

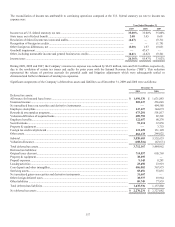

Restructuring accrual activity for the year ended December 31, 2009 and 2008 was as follows:

Chevy Chase

Bank

Acquisition 2007 Company Initiative

Year

ended

December 31,

2009

Year

ended

December 31,

2009

Year

ended

December 31,

2008

Year

ended

December 31,

2007

Restructuring accrual activity:

Balance, beginning of period .....................................................

.

$ — $ 92,749 $ 67,961 $ —

Restructuring charges ................................................................

.

28,833 90,562 134,464 138,237

Cash payments ...........................................................................

.

(6,083) (64,900) (100,823) (37,165)

Noncash write-downs and other adjustments .............................

.

2,440 3,788 (8,853) (33,111)

Balance, end of period ...............................................................

.

$ 25,190 $ 122,199 $ 92,749 $ 67,961