Capital One 2009 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

154

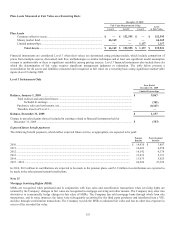

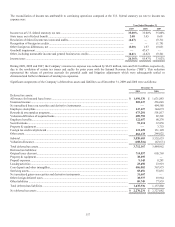

Upon adoption of ASU 2009-16 and ASU 2009-17, certain mortgage loans that have been securitized and accounted for as a sale will

be subject to consolidation and accounted for as a secured borrowing. Accordingly, effective January 1, 2010, mortgage securitization

trusts that contain approximately $1.6 billion of mortgage loans will be consolidated and the retained interests and mortgage servicing

rights related to these newly consolidated trusts will be eliminated in consolidation. See “Note 1- Significant Accounting Policies” for

expected financial statement impact and see “Note 20- Securitizations” for further information about the accounting for securitized

loans.

The Company continues to operate the mortgage servicing business and to report the changes in the fair value of MSRs in continuing

operations. To evaluate and measure fair value, the underlying loans are stratified based on certain risk characteristics, including loan

type, note rate and investor servicing requirements.

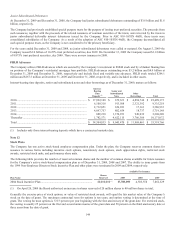

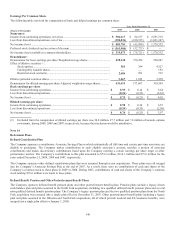

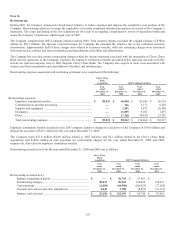

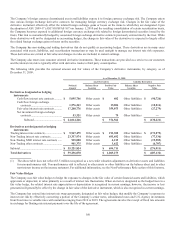

The following table sets forth the changes in the fair value of mortgage servicing rights during the year ended December 31, 2009 and

December 31, 2008:

Mortgage Servicing Rights:

2009

2008

Balance, beginning of period ..................................................................................................................... $ 150,544 $ 247,589

Acquired in acquisitions (1) ........................................................................................................................ 109,538 —

Originations ............................................................................................................................................... 16,173 —

Sales .......................................................................................................................................................... — (2,801)

Change in fair value, net ............................................................................................................................ (36,604) (94,244)

Balance at December 31 ............................................................................................................................ $ 239,651 $ 150,544

Ratio of mortgage servicing rights to related loans serviced for others ..................................................... 0.81% 0.66%

Weighted average service fee .................................................................................................................... 0.29 0.28

(1) Related to the Chevy Chase Bank acquisition completed on February 27, 2009.

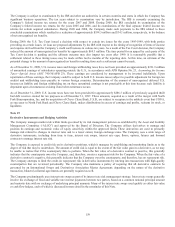

Fair value adjustments to the MSRs for the year ended December 31, 2009 and 2008 included decreases of $31.1 million and $21.7

million, respectively, due to run-off, and decreases of $5.5 million and $72.5 million, respectively, due to changes in the valuation

inputs and assumptions.

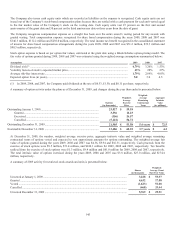

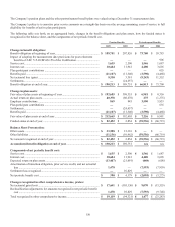

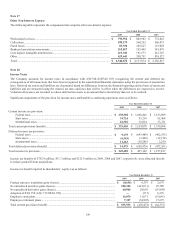

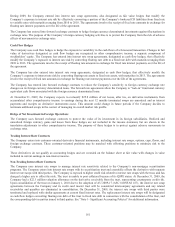

The significant assumptions used in estimating the fair value of the MSRs at December 31, 2009 and 2008 were as follows:

December 31,

2009

December 31,

2008

Weighted average prepayment rate (includes default rate) ................................................................. 17.61% 26.65%

Weighted average life (in years) ......................................................................................................... 5.15 3.2

Discount rate ....................................................................................................................................... 11.46% 11.14%

The decrease in the weighted average prepayment rate, and the increase in the weighted average life, were both driven by a reduction

in voluntary attrition due to market conditions. The increase in the discount rate from 2008 is due to inclusion of Chevy Chase Bank

during 2009.

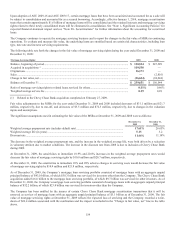

At December 31, 2009, the sensitivities to immediate 10.9% and 20.8% increases in the weighted average prepayment rates would

decrease the fair value of mortgage servicing rights by $10.8 million and $20.7 million, respectively.

At December 31, 2009, the sensitivities to immediate 10% and 20% adverse changes in servicing costs would decrease the fair value

of mortgage servicing rights by $10.9 million and $21.8 million, respectively.

As of December 31, 2009, the Company’s mortgage loan servicing portfolio consisted of mortgage loans with an aggregate unpaid

principal balance of $43.0 billion, of which $30.3 billion was serviced for investors other than the Company. The Chevy Chase Bank

acquisition added $16.8 billion to the mortgage loan servicing portfolio, of which $9.7 billion was serviced for other investors. As of

December 31, 2008, the Company’s mortgage loan servicing portfolio consisted of mortgage loans with an aggregate unpaid principal

balance of $32.2 billion, of which $23.0 billion was serviced for investors other than the Company.

The Company has been notified by the insurer of certain Chevy Chase Bank mortgage securitization transactions that it will be

removed as servicer of mortgage loans with an aggregate unpaid principal balance of $3.1 billion as of December 31, 2009. The fair

value of mortgage servicing rights at December 31, 2009 reflects the expected loss of servicing and the Company recorded a write-

down of $26.4 million associated with the notification and the impact is included in the “Change in fair value, net” line in the table

above.