Capital One 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 105

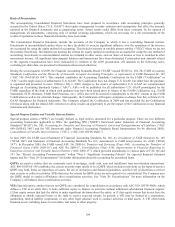

The Company consolidates a VIE if the Company is considered to be its primary beneficiary. The primary beneficiary is subject to

absorbing the majority of the expected losses from the VIE’s activities, is entitled to receive a majority of the entity’s residual returns,

or both.

The Company, in the ordinary course of business, has involvement with or retains interests in VIEs in connection with some of its

securitization activities, servicing activities and the purchase or sale of mortgage-backed and other asset-backed securities in

connection with its investment portfolio. The Company also makes loans to VIEs that hold debt, equity, real estate or other assets. In

certain instances, the Company provides guarantees to VIEs or holders of variable interests in VIEs. The adoption of ASC 810/SFAS

167 could have an impact on the Company’s consolidated financial statements because the Corporation expects it will consolidate

certain VIE’s as a result of applying the qualitative considerations called for in ASC810/SFAS 167 versus the quantitative

requirements under FIN 46(R). We are currently assessing the impact of ASC 810/SFAS 167 on our VIE structures at this time. See

“Note 15- Mortgage Servicing Rights”, “Note 20- Securitizations”, “Note 21- Commitments, Contingencies and Guarantees”, and

“Note 22- Other Variable Interest Entities” for more detail on the Company’s involvement and exposure related to non-consolidated

VIEs.

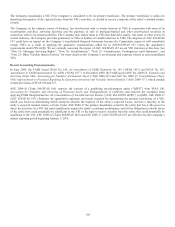

Recent Accounting Pronouncements

In June 2009, the FASB issued SFAS No. 166, An Amendment of FASB Statement No. 140 (“SFAS 166”) and SFAS No. 167,

Amendments to FASB Interpretation No. 46(R) (“SFAS 167”). In December 2009, the FASB issued ASU No. 2009-16, Transfers and

Servicing (Topic 860): Accounting for Transfers of Financial Assets (“ASU 2009-16”) and ASU No. 2009-17, Consolidations (Topic

810): Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities (“ASU 2009-17”), which amends

certain provisions of SFAS 166 and 167.

ASU 2009-16 (Topic 860/SFAS 166) removes the concept of a qualifying special-purpose entity (“QSPE”) from SFAS 140,

Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities and removes the exception from

applying FASB Interpretation No. 46, Consolidation of Variable Interest Entities (“ASC 810-10/FIN 46(R)”), to QSPE. ASU 2009-17

(ASC 810/SFAS 167) eliminates the quantitative approach previously required for determining the primary beneficiary of a VIE,

which was based on determining which enterprise absorbs the majority of the entity’s expected losses, receives a majority of the

entity’s expected residual returns, or both. Under ASU 2009-17 the primary beneficiary would be the entity that has (i) the power to

direct the activities of a VIE that most significantly impact the entity’s economic performance and (ii) the obligation to absorb losses

of the entity that could potentially be significant to the VIE or the right to receive benefits from the entity that could potentially be

significant to the VIE. ASU 2009-16 (Topic 860/SFAS 166) and ASU 2009-17 (ASC 810/SFAS 167) are effective for the Company’s

annual reporting period beginning January 1, 2010.