Capital One 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 111

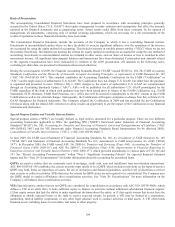

Credit card loan balances that are expected to be securitized in the next three months are accounted for as held for sale. The loans that

have been identified as held for sale are carried at the lower of aggregate cost or fair value and an allowance for loan losses is not

provided for these loans. Management believes its ability to reasonably forecast the amount of existing credit card loans that should be

accounted for as held for sale is limited to three months from the balance sheet date because of the short-term nature of the assets, the

revolving nature of the securitization structures and the fact that securitizations that occur beyond three months will involve a

significant proportion of credit card loans that have not yet been originated. The Company continues to include these loans in loans

held for investment because separate classification in the Reported Consolidated Balance Sheets and related impacts to the Reported

Consolidated Statements of Income is considered immaterial to the Company’s financial statements. Cash flows associated with loans

that are originated with the intent to hold for investment are classified as investing cash flow, regardless of a subsequent change of

intent. Certain mortgage loans associated with the GreenPoint shut down, which were previously categorized as held for sale and

marked at the lower of aggregate cost or fair value, were transferred to held for investment at December 31, 2007. Cash flows

associated with these loans were included in operating cash flows.

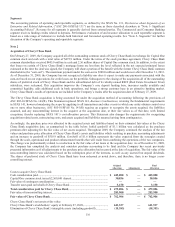

Loans Acquired

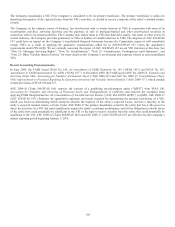

Loans acquired in connection with acquisitions are accounted for under ASC 805-10/SFAS 141(R) and Statement of Position 03-3,

Accounting for Certain Loans or Debt Securities Acquired in a Transfer (“ASC 310-10/SOP 03-3”) if at acquisition the loans have

evidence of credit quality deterioration since origination and it is probable that all contractually required payments will not be

collected. Under both statements, acquired loans are recorded at fair value and the carry-over of the related allowance for loan and

lease losses is prohibited. Determining fair value of the loans involves estimating the principal and interest cash flows expected to be

collected on the loans and discounting those cash flows at a market rate of interest. During the evaluation of whether a loan was

considered impaired under ASC 310-10/SOP 03-3 or performing under ASC 805-10/SFAS 141(R), the Company considered a number

of factors, including the delinquency status of the loan, payment options and other loan features (i.e. reduced documentation or stated

income loans, interest only payments, or negative amortization features), the geographic location of the borrower or collateral, the

loan-to-value ratio and the risk rating assigned to the loans. Based on these criteria, the Company considered the entire Chevy Chase

Bank option arm portfolio to be impaired and accounted for under ASC 310-10/SOP 03-3. Portions of the Chevy Chase Bank

commercial loan portfolio, HELOC portfolio and the fixed mortgage portfolio were also considered impaired.

The excess of cash flows expected at acquisition over the estimated fair value is referred to as the accretable yield and is recognized

into interest income over the remaining life of the loan. The difference between contractually required payments at acquisition and the

cash flows expected to be collected at acquisition, considering the impact of prepayments, is referred to as the nonaccretable

difference. The nonaccretable difference includes estimated future credit losses expected to be incurred over the life of the loan. Net

charge-offs on such loans are applied to the nonaccretable difference recorded at acquisition for the estimated future credit losses.

Subsequent decreases to the expected cash flows will require the Company to consider such loans impaired and establish an

appropriate allowance for loan loss. If actual cash flows are significantly greater than previously expected or it is probable that there is

a significant increase in expected cash flows, then the Company will reduce any remaining allowance established after loan

acquisition and adjust the amount of accretable yield through reclassification from the nonaccretable difference. Prospectively, this

new balance of accretable yield is recognized in interest income over the remaining life of the loan.

The income recognition method described above is dependent on the Company having a reasonable expectation of the amount and

timing of cash flows expected to be collected on the acquired loans. The Company expects to fully collect the new carrying amount of

the acquired Chevy Chase Bank loans and believes that it has a reasonable expectation of the amount and timing of cash flows. As

such, the Company considers the loans to be performing even if customers are contractually delinquent or the loans had been

considered nonperforming or nonaccrual by Chevy Chase Bank. Refer to “Note 3- Loans Acquired in a Transfer” for additional

discussion.

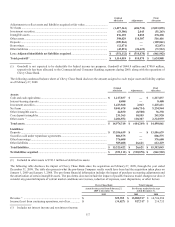

Nonperforming Assets

Nonperforming assets include nonaccrual loans, impaired loans, certain restructured loans on which interest rates or terms of

repayment have been materially revised, foreclosed and repossessed assets.

Commercial loans, mortgage and auto loans are placed in nonaccrual status at 90 days past due or sooner if, in management’s opinion,

there is doubt concerning full collectibility of both principal and interest. All other consumer loans and small business credit card

loans are not placed in nonaccrual status prior to charge-off; however management does assess collectibility of finance charge and fees

and does not accrue the estimated uncollectible portion of finance charges and fees as income (the “suppression amount”). See

“Revenue Recognition” within “Note 1- Significant Accounting Policies” for more information on the calculation of the suppression

amount.