Capital One 2009 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

165

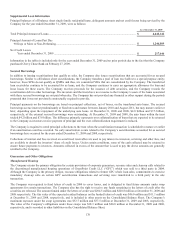

(3) Certain prior period amounts have been reclassified to conform to current period presentation. Investor accrued interest

receivable of $833.9 million as of December 31, 2008 was included in other retained interests.

Off-Balance Sheet Securitizations – Non Mortgage

Off-balance sheet securitizations involve the transfer of pools of loan receivables by the Company to one or more third-party trusts or

QSPEs in transactions that are accounted for as sales in accordance with ASC 860-10/SFAS 140. In order to maintain QSPE status,

the trusts can engage only in limited business activities. Certain undivided interests in the pool of loan receivables are sold to external

investors as asset-backed securities in public underwritten offerings or private placement transactions. The proceeds from off-balance

sheet securitizations are distributed by the trusts to the Company as consideration for the loan receivables transferred. Each new off-

balance sheet securitization results in the removal of principal loan receivables equal to the sold undivided interests in the pool of loan

receivables (“off-balance sheet loans”), the recognition of certain retained residual interests and a gain on the sale. Securities held by

external investors totaling $42.8 billion and $44.3 billion as of December 31, 2009 and 2008, respectively, represent undivided

interests in the pools of loan receivables.

The remaining undivided interests in principal receivables and the related unpaid billed finance charge and fee receivables are

considered transferor’s interest which is retained by the Company and continues to be reported as loans held for investment on the

Consolidated Balance Sheet. The amount of transferor’s interest fluctuates as the accountholders make principal payments and incur

new charges on the accounts. Transferor’s interest was $11.4 billion and $13.5 billion as of December 31, 2009 and 2008,

respectively.

The Company’s retained interests in the off-balance sheet securitizations are recorded in accounts receivable from securitizations and

are comprised of interest-only strips, retained tranches, cash collateral accounts, cash reserve accounts and unpaid interest and fees on

the investors’ portion of the transferred principal receivables. The Company’s retained residual interests are generally restricted or

subordinated to investors’ interests and their value is subject to substantial credit, repayment and interest rate risks on transferred

assets if the off-balance sheet receivables are not paid when due. As such, the interest-only strip and retained subordinated interests are

classified as trading assets, and changes in the estimated fair value are recorded in servicing and securitization income. Additionally,

the Company may also retain senior tranches in the securitization transactions which are considered to be higher investment grade

securities and subject to lower risk of loss. The retained senior tranches are classified as available for sale securities in accordance

with ASC 320-10/SFAS 115, and changes in the estimated fair value are recorded in other comprehensive income.

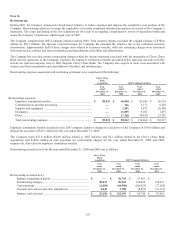

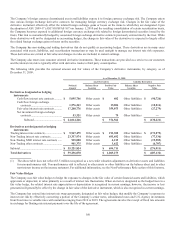

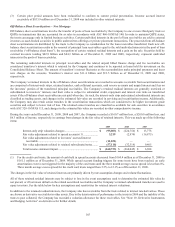

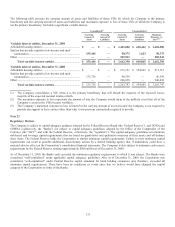

During the years ended December 31, 2009, 2008 and 2007, the Company recorded a $160.7 million loss, a $260.0 million loss, and

$6.3 million of income, respectively in earnings from changes in the fair value of retained interests. This was made up of the following

items:

2009 2008

2007

Interest-only strip valuation changes .............................................

.

$ (95,803) $ (224,756) $ 13,778

Fair value adjustments related to spread accounts (1) ...................

.

3,219 (2,970) (16,875)

Fair value adjustments related to investors’ accrued interest

receivable ..................................................................................

.

(11,031) — —

Fair value adjustments related to retained subordinated notes .......

.

(57,118) (32,319) 9,405

Total income statement impact ......................................................

.

$ (160,733) $ (260,045) $ 6,308

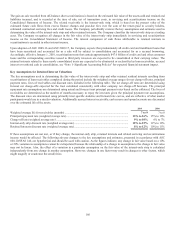

(1) For the credit card trusts, the amount of cash held in spread accounts decreased from $164.4 million as of December 31, 2008 to

$161.1 million as of December 31, 2009. While spread account funding triggers for some trusts have been reached, an early

amortization event is not triggered for the majority of the card trusts until the three month average excess spread is less than 0%.

Three month average excess spread for the credit card trusts ranged from 5.5% to 12.1% as of December 31, 2009.

The changes in the fair value of retained interests are primarily driven by rate assumption changes and volume fluctuations.

All of these retained residual interests may be subject to loss in the event assumptions used to determine the estimated fair value do

not prevail, or if borrowers default on the related securitized receivables and the Company’s retained subordinated tranches are used to

repay investors. See the table below for key assumptions and sensitivities for retained interest valuations.

In addition to the retained residual interests, the Company also has receivables from the trusts related to interest rate derivatives. These

are shown as derivative receivables in other assets. Due to the deterioration of performance in the trusts in 2009 and the inability of the

trusts to post collateral, the Company has recorded a valuation allowance for these receivables. See “Note 19- Derivative Instruments

and Hedging Activities” on derivatives for further details.