Capital One 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

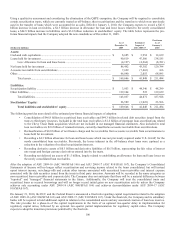

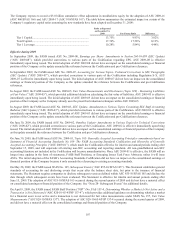

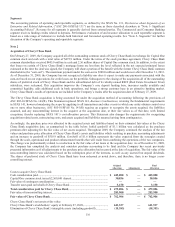

Using a qualitative assessment and considering the elimination of the QSPE exemption, the Company will be required to consolidate

certain securitization trusts, which are currently treated as off-balance sheet securitizations and the transfers to which were previously

used in the transfer of loans which were accounted for as sales. Effective January 1, 2010, the Company expects to record a $47.6

billion increase in loan receivables, a $4.3 billion increase in allowance for loan and lease losses related to the newly consolidated

loans, a $44.9 billion increase in liabilities and a $3.0 billion reduction in stockholders’ equity. The table below represents the pro-

forma financial impacts had the Company adopted the new standards as of December 31, 2009.

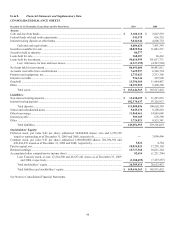

(Dollars in millions)

As of

December 31,

2009

Estimated

Impact of

ASU 2009-17

Pro-forma

As of

January 1,

2010

Assets:

Cash and cash equivalents ................................................................................................

.

$ 8,685 $ 3,954 $ 12,639

Loans held for investment ................................................................................................

.

90,619 47,566 138,185

Less: Allowance for loan and lease losses ..............................................................

.

(4,127) (4,264) (8,391)

N

et loans held for investmen

t

...........................................................................................

.

86,492 43,302 129,794

Accounts receivable from securitizations .........................................................................

.

7,629 (7,463) 166

Other .................................................................................................................................

.

66,840 2,055 68,895

Total assets ..............................................................................................................

.

$ 169,646 $ 41,848 $ 211,494

Liabilities:

Securitization liability ......................................................................................................

.

$ 3,953 $ 44,346 $ 48,299

Other liabilities .................................................................................................................

.

139,104 525 139,629

Total liabilities ........................................................................................................

.

143,057 44,871 187,928

Stockholders’ Equity: 26,589 (3,023) 23,566

Total liabilities and stockholders’ equity ............................................................

.

$ 169,646 $ 41,848 $ 211,494

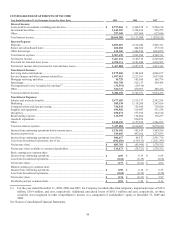

The following provides more detail of the estimated pro-forma financial impacts of adoption:

• Consolidation of $46.8 billion in securitized loan receivables and $44.3 billion in related debt securities issued from the

trusts to third party investors. Included in the total loan receivables is $1.6 billion of mortgage loan securitizations related

to the Chevy Chase Bank acquisition which are not included in our managed financial statements. Also included in total

loan receivables are $2.6 billion of retained interests, currently classified as accounts receivable from securitizations.

• Reclassification of $0.8 billion of net finance charge and fee receivables from accounts receivable from securitizations to

loans held for investment.

• Recording a $4.3 billion allowance for loan and lease losses which was not previously required under U.S. GAAP, for the

newly consolidated loan receivables. Previously, the losses inherent in the off-balance sheet loans were captured as a

reduction in the valuation of residual securitization interests.

• Recording derivative assets of $0.3 billion and derivative liabilities of $0.5 billion, representing the fair value of interest

rate swaps and foreign currency derivatives entered into by the trusts.

• Recording net deferred tax assets of $1.5 billion, largely related to establishing an allowance for loan and lease losses on

the newly consolidated loan receivables.

After the adoption of ASU 2009-16 (ASC 860/SFAS 166) and ASU 2009-17 (ASC 810/SFAS 167), the Company’s Consolidated

Statements of Income will no longer reflect securitization and servicing income related to the loans consolidated, but will instead

report interest income, net-charge-offs and certain other income associated with securitized loan receivables and interest expense

associated with the debt securities issued from the trusts to third party investors. Amounts will be recorded in the same categories as

non-securitized loan receivables and corporate debt. The Company does not anticipate that there will be a material difference between

“reported” and “managed” financial statements in the future. Additionally, the Company will treat the consolidated trusts and

securitized loans as secured borrowings and will no longer record initial gains on new securitization activity unless the Company

achieves sale accounting under ASU 2009-16 (ASC 860/SFAS 166) and achieves deconsolidation under ASU 2009-17 (ASC

810/SFAS 167).

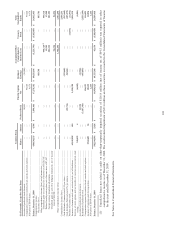

On January 21, 2010, the OCC and the Federal Reserve announced a final rule regarding capital requirements related to the adoption

of ASU 2009-16 (ASC 860/SFAS 166) and ASU 2009-17 (ASC 810/SFAS 167). Under the final rule, the Company and its subsidiary

banks will be required to hold additional capital in relation to the consolidated assets and any associated creation of loan loss reserves.

The rule provides for a phase-in of the capital requirements in the form of an optional two-quarter delay in implementation for

regulatory capital ratios, followed by an optional two-quarter partial implementation for regulatory capital ratios. The Company

expects to adopt the transition provisions permitted by the final rule.