Capital One 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 20

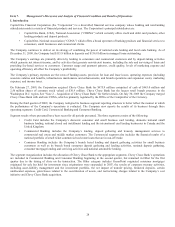

We May Experience Increased Losses Associated with Mortgage Repurchases and Indemnification Obligations

Certain of our subsidiaries, including GreenPoint and CONA, as successor to Chevy Chase Bank, may be required to repurchase

mortgage loans that have been sold to investors in the event there are certain breaches of certain representations and warranties

contained within the sales agreements. We may be required to repurchase mortgage loans that we sell to investors in the event that

there was improper underwriting or fraud, or in the event that the loans become delinquent shortly after they are originated. These

subsidiaries also may be required to indemnify certain purchasers and others against losses they incur in the event of breaches of

representations and warranties and in various other circumstances, and the amount of such losses could exceed the repurchase amount

of the related loans. Consequently, we may be exposed to credit risk associated with sold loans. We have established a reserve in the

consolidated financial statements for potential losses that are considered to be both probable and reasonably estimable related to the

mortgage loans sold by our originating subsidiaries. The adequacy of the reserve and the ultimate amount of losses incurred will

depend on, among other things, the actual future mortgage loan performance, the actual level of future repurchase and indemnification

requests, the actual success rate of claimants, developments in Company and industry litigation, actual recoveries on the collateral, and

macroeconomic conditions (including unemployment levels and housing prices). Due to uncertainties relating to these factors, we

cannot reasonably estimate the total amount of losses that will actually be incurred as a result of our subsidiaries’ repurchase and

indemnification obligations, and there can be no assurance that our reserves will be adequate or that the total amount of losses incurred

will not have a material adverse effect upon the Company’s financial condition or results of operations. For additional information

related to the Company’s mortgage loan operations, mortgage loan repurchase and indemnification obligations and related reserves,

see Item 7 “Management Discussion and Analysis of Financial Conditions and Results of Operations – Valuation of Representation

and Warranty Reserve”.

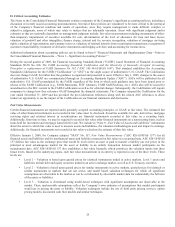

We may not be able to maintain adequate capital levels, which could have a negative impact on our business results

As a result of recent economic and market developments, financial institutions may become subject to new and increased capital

requirements. While it is not clear what form these requirements might take or whether they will apply to the Company, it is possible

that we could be required to increase our capital buffers more quickly than we can generate additional capital. Thus, such new

requirements could have a negative impact on our ability to lend, to grow deposit balances and/or on our returns.

Among the proposals under consideration:

• Under the Wall Street Reform and Consumer Protection Act as passed by the House in December 2009, financial holding

companies that are deemed to pose systemic risks would be subject to heightened oversight and scrutiny, including

increased risk-based capital requirements and leverage limits under regulations to be promulgated by the Federal Reserve.

The legislation also would require the Federal Reserve to take prompt corrective action with respect to systemically

important firms that do not meet minimum capital requirements and authorizes the Federal Reserve to require systemically

important firms to maintain a minimum amount of long-term hybrid debt that would be convertible to equity under certain

circumstances. No companion bill for to the Wall Street Reform Act has yet been introduced in the Senate.

• In December 2009, the Basel Committee on Banking Supervision released for comment a proposal to strengthen global

capital regulations. The key elements of the proposal include raising the quality, consistency and transparency of the

capital base, strengthening the risk coverage of the capital framework, introducing a leverage ratio that is different from

the U.S. leverage ratio measures and promoting the build-up of capital buffers. The U.S. banking agencies are expected to

issue a similar version of the proposal later this year. Although any U.S. proposal would apply to banking organizations

subject to the Basel II regime to which the Company is not currently subject, the proposal might also impact the Company

and other banking organizations.

• In January 2010, the OCC and the Federal Reserve announced a final rule regarding capital requirements related to the

adoption of ASC 860/SFAS 166 and ASC 810/SFAS 167. Under the final rule, the Company and its subsidiary banks will

be required to hold capital against those risk-weighted assets consolidated as a result of the application of ASC 860/SFAS

166 and ASC 810/SFAS 167.

• We maintain a substantial deferred tax asset on our balance sheet, and we include this asset when calculating our

regulatory capital levels. However, for regulatory capital purposes, deferred tax assets that are dependent on future taxable

income are limited to the lesser of: (i) the amount of deferred tax assets we expect to realize within one year of the

calendar quarter-end date, based on our projected future taxable income for that year; or (ii) 10% of the amount of our

Tier 1 capital. In addition, the Basel Committee’s capital proposal would require a reduction from capital for any deferred

tax assets that are dependent on future earnings. As a result, we may not be able to consider the full value of the deferred

tax asset when calculating our regulatory capital levels.