Capital One 2009 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135

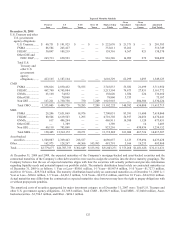

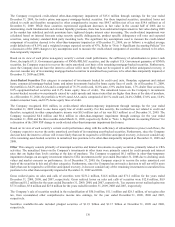

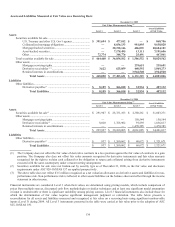

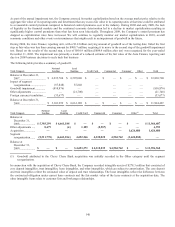

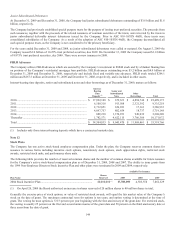

Level 3 Instruments Only

For the Year Ended December 31, 2009

Securities

Available for

Sale

Mortgage

Servicing

Rights(1) Derivative

Receivables(2)

Retained

Interests in

Securitizations(3)

Derivative

Payables(2)

Balance, January 1, 2009 $ 2,380,261 $ 150,544 $ 59,895 $ 1,470,385 $ 60,672

Total realized and unrealized gains

(losses): ...............................................

.

Included in earnings .......................

.

99 (5,505) (213,965) (131,411) (27,574)

Included in other comprehensive

income .......................................

.

(168,380) — — 114,228 —

Purchases, issuances and

settlements, net ...................................

.

(114,008) 94,612 37,870 2,491,338 3,804

Transfers in/(out) of Level 3....................

.

(591,440) — 556,792 — (3,968)

Balance, December 31, 2009 $ 1,506,532 $ 239,651 $ 440,592 $ 3,944,540 $ 32,934

Change in unrealized gains (losses) included in

earnings related to financial instruments

held at December 31, 2009 ...........................

.

$ 99 $ (5,505) $ (213,965) $ 70,749 $ (27,574)

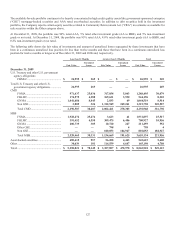

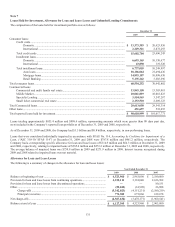

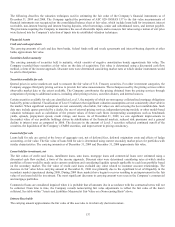

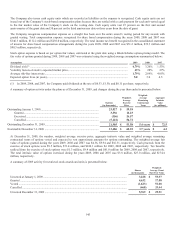

For the Year Ended December 31, 2009

Securities Available for Sale

U.S. Treasury

& other U.S.

Gov’t agency

Collateralized

mortgage

obligations

Mortgage-

backed

securities

Asset-

backed

securities

Other

Total

Balance, January 1, 2009 $ — $ 1,579,909 $ 773,200 $ — $ 27,152 $ 2,380,261

Total realized and unrealized gains

(losses): ........................................

Included in earnings ................ — 213 — (114) — 99

Included in other

comprehensive income ....... — (175,032) 6,652 — — (168,380)

Purchases, issuances and

settlements, net ............................ — (234,768) 48,220 74,201 (1,661) (114,008)

Transfers in/(out) of Level 3............. — (188,427) (342,037) (60,976) — (591,440)

Balance, December 31, 2009 $ — $ 981,895 $ 486,035 $ 13,111 $ 25,491 $ 1,506,532

Change in unrealized gains (losses)

included in earnings related to

financial instruments held at

December 31, 2009 ............................... $ — $ 213 $ — $ (114) $ — $ 99

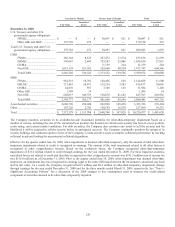

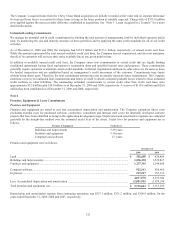

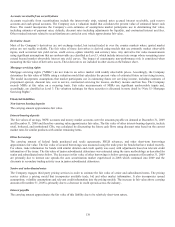

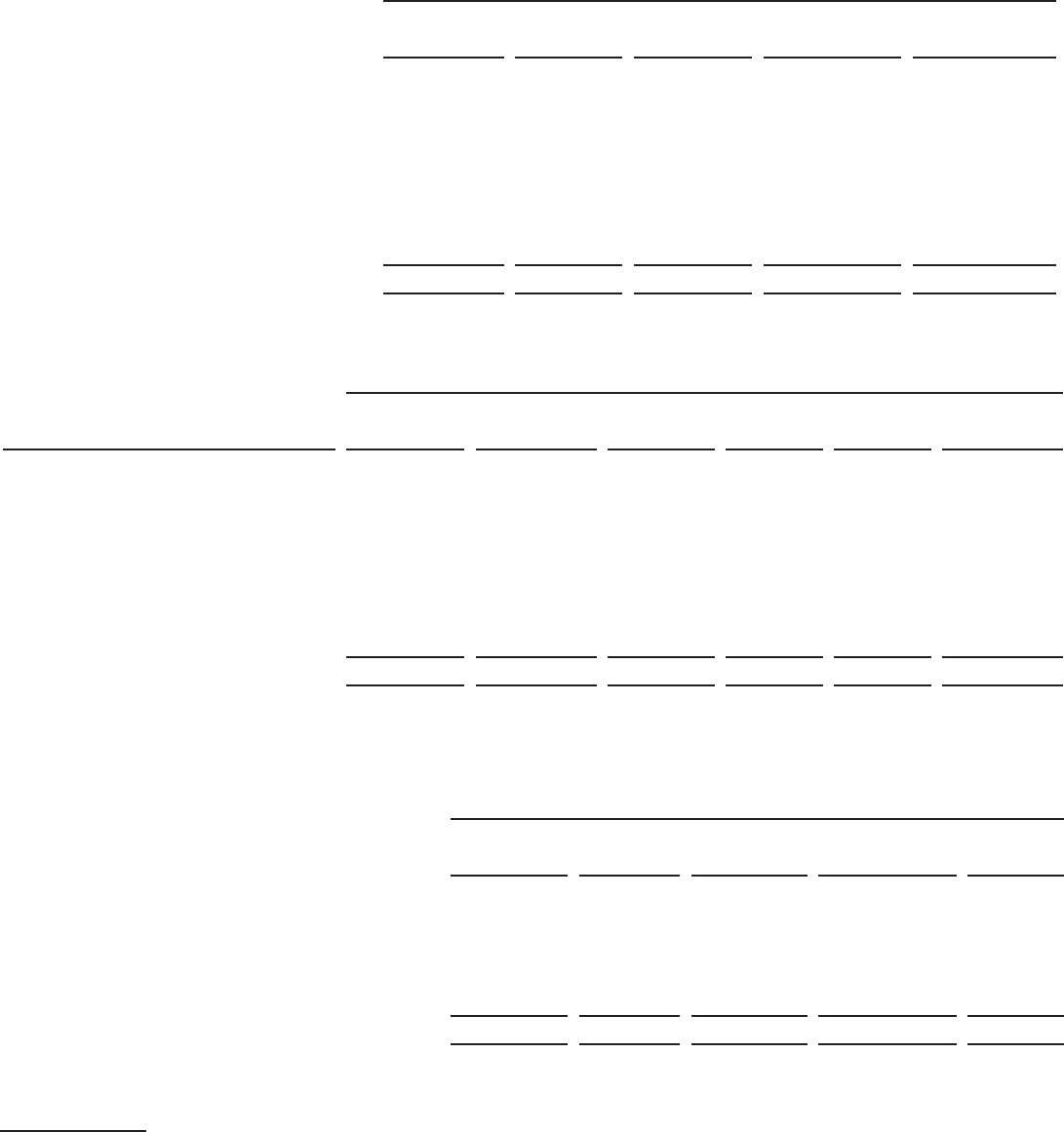

For the Year ended December 31, 2008

Securities

Available for

Sale

Mortgage

Servicing

Rights(1) Derivative

Receivables(2)

Retained

Interests in

Securitizations(3)

Derivative

Payables(2)

Balance, January 1, 2008 .............................................. $ 217,428 $ 247,589 $ 8,962 $ 1,295,498 $ 8,631

Total realized and unrealized gains (losses): .........

Included in earnings ..................................... 18 (72,516) 33,442 (187,934) 34,072

Included in other comprehensive income .... (696,601) — — (57,259) —

Purchases, issuances and settlements .................... 180,631 (24,529) 17,491 420,080 17,969

Transfers into Level 3 ............................................ 2,678,785 — — — —

Balance, December 31, 2008 ......................................... $ 2,380,261 $ 150,544 $ 59,895 $ 1,470,385 $ 60,672

Change in unrealized gains (losses) included in

earnings related to financial instruments held at

December 31, 2008 .................................................... $ — $ (72,516) $ 33,442 $ (41,055) $ 34,072

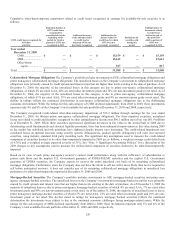

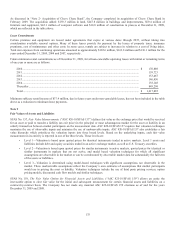

(1) Gains (losses) related to Level 3 mortgage servicing rights are reported in mortgage servicing and other income, which is a

component of non-interest income.

(2) An end of quarter convention is used to measure derivative activity, resulting in end of quarter values being reflected as

purchases, issuances and settlements for derivatives having a zero fair value at inception. Gains (losses) related to Level 3

derivative receivables and derivative payables are reported in other non-interest income, which is a component of non-interest

income.