Capital One 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 104

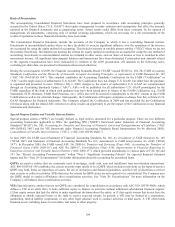

Basis of Presentation

The accompanying Consolidated Financial Statements have been prepared in accordance with accounting principles generally

accepted in the United States (“U.S. GAAP”) that require management to make estimates and assumptions that affect the amounts

reported in the financial statements and accompanying notes. Actual results could differ from these estimates. In the opinion of

management, all adjustments, consisting only of normal recurring adjustments, which are necessary for a fair presentation of the

results of operations in these financial statements, have been made.

The Consolidated Financial Statements include the accounts of the Company in which it has a controlling financial interest.

Investments in unconsolidated entities where we have the ability to exercise significant influence over the operations of the investee

are accounted for using the equity method of accounting. This includes interests in variable interest entities (“VIEs”) where we are not

the primary beneficiary. Investments not meeting the criteria for equity method accounting are accounted for using the cost method of

accounting. Investments in unconsolidated entities are included in other assets, and our share of income or loss is recorded in other

non-interest income. All significant intercompany balances and transactions have been eliminated. Certain prior year amounts related

to the segment reorganization have been reclassified to conform to the 2009 presentation. All amounts in the following notes,

excluding per share data, are presented in thousands unless noted otherwise.

During the second quarter of 2009, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 168, The FASB Accounting

Standards Codification and the Hierarchy of Generally Accepted Accounting Principles—a replacement of FASB Statement No. 162

(“ASC 105-10-65/SFAS 168”). This standard establishes the Accounting Standards Codification for the FASB (“Codification” or

“ASC”) as the single source of authoritative U.S. GAAP. The Codification does not change U.S. GAAP, but rather how the guidance

is organized and presented to users. Effective July 1, 2009, changes to the source of authoritative U.S. GAAP are communicated

through an Accounting Standards Update (“ASU”). ASUs will be published for all authoritative U.S. GAAP promulgated by the

FASB, regardless of the form in which such guidance may have been issued prior to release of the FASB Codification (e.g., FASB

Statements, EITF Abstracts, FASB Staff Positions, etc.). ASUs also will be issued for amendments to the SEC content in the FASB

Codification as well as for editorial changes. Subsequently, the Codification will require companies to change how they reference U.S.

GAAP throughout the financial statements. The Company adopted the Codification in 2009 and has provided the pre-Codification

references along with the related ASC references to allow readers an opportunity to see the impact of the Codification on our financial

statements and disclosures.

Special Purpose Entities and Variable Interest Entities

Special purpose entities (“SPEs”) are broadly defined as legal entities structured for a particular purpose. There are two different

accounting frameworks applicable to SPEs: the qualifying SPE (“QSPE”) framework under Statement of Financial Accounting

Standard (“SFAS”) No. 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities (“ASC

860-10/SFAS 140”) and the VIE framework under Financial Accounting Standards Board Interpretation No. 46 (Revised 2003),

Consolidation of Variable Interest Entities (“VIE”), (“ASC 810-10/FIN 46(R)”).

In June 2009, the FASB issued Statement of Financial Accounting Standards No. 166, An Amendment of FASB Statement No. 140

(“SFAS 166”) and Statement of Financial Accounting Standards No. 167, Amendments to FASB Interpretation No. 46(R) (“SFAS

167”). In December 2009, the FASB issued ASU No. 2009-16, Transfers and Servicing (Topic 860): Accounting for Transfers of

Financial Assets (“ASU 2009-16”) and ASU No. 2009-17, Consolidations (Topic 810): Improvements to Financial Reporting by

Enterprises Involved with Variable Interest Entities (“ASU 2009-17”), which provided amendments to various parts of FAS 166 and

167. See “Recent Accounting Pronouncements” within “Note 1- Significant Accounting Policies” for expected financial statement

impact and See “Note 20- Securitizations” for further information about the accounting for securitized loans.

QSPEs are passive entities that are commonly used in mortgage, credit card, auto and installment loan securitization transactions.

ASC 860-10/SFAS 140 establishes the criteria an entity must satisfy to be a QSPE which includes restrictions on the types of assets a

QSPE may hold, limits on repurchase of assets, the use of derivatives and financial guarantees, and the level of discretion a servicer

may exercise to collect receivables. SPEs that meet the criteria for QSPE status are not required to be consolidated. The Company uses

the QSPE model to conduct off-balance sheet securitization activities. See “Note 20- Securitizations” for more information on the

Company’s off-balance sheet securitization activities.

VIEs Special purpose entities that are not QSPEs are considered for consolidation in accordance with ASC 810-10/FIN 46(R), which

defines a VIE as an entity that (1) lacks sufficient equity to finance its activities without additional subordinated financial support;

(2) has equity owners that lack the ability to make significant decisions about the entity; or (3) has equity owners that do not have the

obligation to absorb expected losses or the right to receive expected returns. In general, a VIE may be formed as a corporation,

partnership, limited liability corporation, or any other legal structure used to conduct activities or hold assets. A VIE often holds

financial assets, including loans or receivables, real estate or other property.