Capital One 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 46

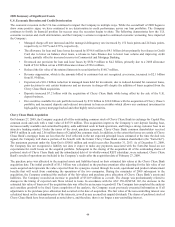

2008 Summary of Significant Events

U.S. Economic Recession and Credit Deterioration

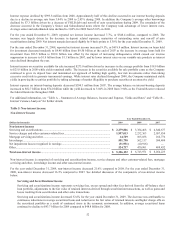

The U.S. economic recession has impacted the Company in multiple ways during the year. Most notably we have seen significant

deterioration in credit performance. As the recession deepened, the Company responded by fortifying its balance sheet, exiting the

riskiest areas we operated in and reducing costs as appropriate. The following demonstrates how the U.S. economic recession and

credit deterioration, and the Company’s actions to anticipate and respond to economic worsening, have impacted the Company:

• Increased managed charge-off rate and managed delinquency rate by 147 basis points and 62 basis points, respectively, to

4.35% and 4.49%, respectively,

• Increased the allowance for loan and lease losses by $1.6 billion to $4.5 billion, increasing the coverage ratio of allowance

as a percentage of loans held for investment by 157 basis points to 4.48%,

• Increased our provision for loan and lease losses by $2.5 billion to $5.1 billion,

• Reduced the fair value of the interest-only strips and other retained interests by $224.8 million,

• Revenue suppression, which is the amounts billed to customers but not recognized as revenue, increased to $1.9 billion

from $1.1 billion,

• Experienced a $4.4 billion reduction in managed loans held for investment, due to weaker spending and loan demand from

credit-worthy customers, tightening underwriting, an exit from lending activities not resilient to the economic downturn

and an increase in charge-offs,

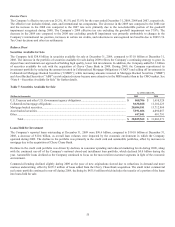

• Deposit growth was primarily invested in high-quality agency mortgage backed securities and AAA-rated securities

backed by consumer loans. Increasing our securities available for sale by $11.2 billion to $31.0 billion.

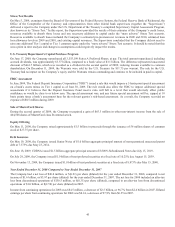

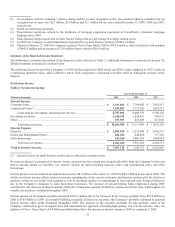

U.S. Treasury Department’s Capital Purchase Program Participation

On November 14, 2008 the Company entered into an agreement (the “Securities Purchase Agreement”) to issue 3,555,199 Fixed Rate

Cumulative Perpetual Preferred Shares, Series A, par value $0.01 per share (the “Series A Preferred Stock”), to the United States

Department of the Treasury (“U.S. Treasury”) as part of the Company’s participation in the U.S. Treasury’s Troubled Asset Relief

Program Capital Purchase Program (“CPP”), having a liquidation amount per share equal to $1,000. The Series A Preferred Stock

pays cumulative dividends at a rate of 5% per year for the first five years and thereafter at a rate of 9% per year. As noted above, the

Company redeemed the Series A Preferred Stock in June 2009 at the liquidation amount per share.

In addition, the Company issued Warrants to purchase 12,657,960 of the Company’s common shares to the U.S. Treasury as part of

the Securities Purchase Agreement. The Warrants have an exercise price of $42.13 per share. The Warrants expire ten years from the

issuance date. As noted above, the U.S. Treasury sold the Warrants on December 9, 2009 for $11.75 per warrant.

The Company received proceeds of $3.55 billion for the Series A Preferred Stock and the Warrants. The Company allocated the

proceeds based on a relative fair value basis between the Series A Preferred Stock and the Warrants, recording $3.06 billion and

$491.5 million, respectively. The fair value of the preferred stock was estimated using independent quotes from third party sources

who considered the structure, subordination and size of the preferred stock issuance in comparison to the trust preferred securities

issued by special purpose trusts established by the Company. Fair value of the stock warrants was estimated using a pricing model

with the most significant assumptions being the forward dividend yield and implied volatility of the Company’s stock price. The $3.06

billion of Series A Preferred Stock is net of a discount of $491.5 million. The discount will be accreted to the $3.55 billion liquidation

preference amount over a five year period. The accretion of the discount and dividends on the preferred stock reduce net income

available to common shareholders.

OCC Minimum Payment Rules

In March 2008, COBNA converted from a Virginia state-chartered bank to a national association, which is regulated by the OCC. The

OCC has minimum payment policies for the credit card industry designed to force modest positive amortization for all card accounts.

Under the new policy, the monthly minimum payment is set at 1% of principal balance, plus all interest assessed in the prior cycle,

plus any past due fees and certain other fees assessed in the prior cycle. This compares to the Company’s previous policy, which for

most accounts was a flat 3% of principal balance. This will have the effect of increasing the minimum payment for delinquent

customers, while lowering it for many customers who are current.

The Company has converted substantially all accounts to comply with OCC minimum payment policies for the year ended

December 31, 2009.